Bankers have existed from time immemorial. Modern banking as we know it today emerged in the 20th century. However, we can say that banking goes back many years, even beyond the 15th century, when it gained special relevance because of the boom in trade. Hundreds of years have passed, but its essence remains the same.

Bankers are people who help their clients make the best decisions for their companies. Their knowledge of clients and the sector to which they belong is crucial in advising them at decisive moments in the development of the company: the purchase and/or sale of strategic assets; the purchase, sale or merger of the company itself with others; or decisions as important as a stock market listing. Bankers play a key role in the finance and investment decisions of their clients as they contribute an experience that allows their client to choose the best solutions for their financial needs at each moment of time.

BBVA Group's investment banking area has 165 bankers serving companies and large corporations. They are professionals of up to 30 nationalities, located in 22 countries, who provide their local and global knowledge to execute national and international transactions for the 1,450 clients actively managed by the investment banking area.

Welcome to the world of bankers.

1. Bankers: strategic partners for their clients

Within investment banking, whose main clients are large companies, institutional investors, such as banks, insurance companies, pension funds and public bodies, bankers are the point of contact between the bank and the client: they are the face and eyes of the entity they represent.

The banker's role is key for the bank to become a strategic partner of the client, creating strong and long-term relationships in order to achieve common objectives. The bankers must understand their clients' financial needs, the different markets in which they operate, products and sectors, and also accompany them in their transformation and decision-making process. At the same time, they also get involved in managing the usual day-to-day operational needs and transactions of the companies to establish the strategy of collections, payments, trade and asset management.

For the BBVA banker, the client is the center of his activity. A virtuous circle is built around the client that is generated through anticipation and identification of their needs; transparency in addressing them; an adapted and appropriate set of solutions; and careful information management. Building credibility and trust is the ultimate goal.

We need to strike a balance between responding to the clients' current and future financing and investment needs and ensuring adequate profitability and risk management for the bank. Bankers are the people who satisfy the needs of the clients and manage and coordinate their main tool from the point of view of risk: their financial program. This program is the roadmap that allows the bank to analyze and combine two aspects: the financial needs of the client over the next twelve months and how the bank will participate in the management of them.

These needs and their level of complexity vary depending on the types of clients that investment bankers serve.

-

INSTITUTIONAL CLIENTS

Banks, insurance companies and asset managers.

Their main needs are investment and transactional solutions.

BBVA serves more than 250 groups.

-

GLOBAL CORPORATIONS

Large multinationals from different sectors with sophisticated investment needs.

BBVA serves nearly 1,000 groups.

-

PUBLIC SECTOR

Central banks, sovereign funds and subnational and supranational agencies.

Their needs are similar to those of institutional clients.

BBVA manages more than 100 customers of this type.

-

FINANCIAL SPONSORS

Private equity funds, infrastructure funds, pension funds and sovereign wealth funds that lead the vast majority of investment operations in infrastructure and energy assets.

BBVA manages more than 100 groups.

-

SMALL AND MEDIUM-SIZED ENTERPRISES

and clients who do not belong to wholesale banking industry,

but also have investment banking product needs.

Investment banking clients are generally very sophisticated. Increasingly so. After the latest financial crises, many companies have had to reinvent themselves to the point that their origins are now unrecognizable. Their needs have also evolved, so now there are products that did not exist ten years ago; either because banks have been amending them or because they are newly created products that have emerged to meet new needs.

The bankers, together with the rest of the organization, accompany clients in the transformation that their industries are experiencing, advising them as a financial partner in their decision-making. Some clear examples of how the global agenda marks financial needs and supply are sustainability, digital transformation, and increased financial regulation.

Sustainability is now on the strategic agenda of all CEOs. We are talking about improving the world, achieving positive social and environmental development, and ensuring that companies' profitability today is sustainable tomorrow. Without a doubt, banks have to live up to the needs of their clients if they want to remain relevant to them, and accompany them in the transition to a sustainable future. In this context, BBVA announced in 2018 its 2025 Commitment with which it aims to mobilize 100 billion euros through 2025 to fight climate change. As of December 31, 2019, it already managed to mobilize 30 billion. The bank is a pioneer in sustainable financing and has a broad range of green products for both its wholesale and retail customers.

Sustainability is now on the strategic agenda of all CEOs

Another important topic is digital transformation. The financial industry has carried out a process of innovation, both in terms of financing products and the digitalization of existing solutions to improve the customer experience. In this way, wholesale banking makes use of the advantages offered by technology and its advances, providing greater agility and transparency for its products.

Another significant change that has conditioned the financial industry has to do with the fact that this sector has undergone a crisis that has led to a tightening of regulations, capital requirements on balance sheets and the process of supervision. Regulation has a clear objective: to strengthen the robustness of the banking system and to reduce systemic financial risk. However, adapting to new regulations, and particularly to those related to market infrastructure, requires time and a lot of effort from financial institutions and also has an impact on their business and corporate strategies. And this certainly adds an additional challenge to the day-to-day life of the banker.

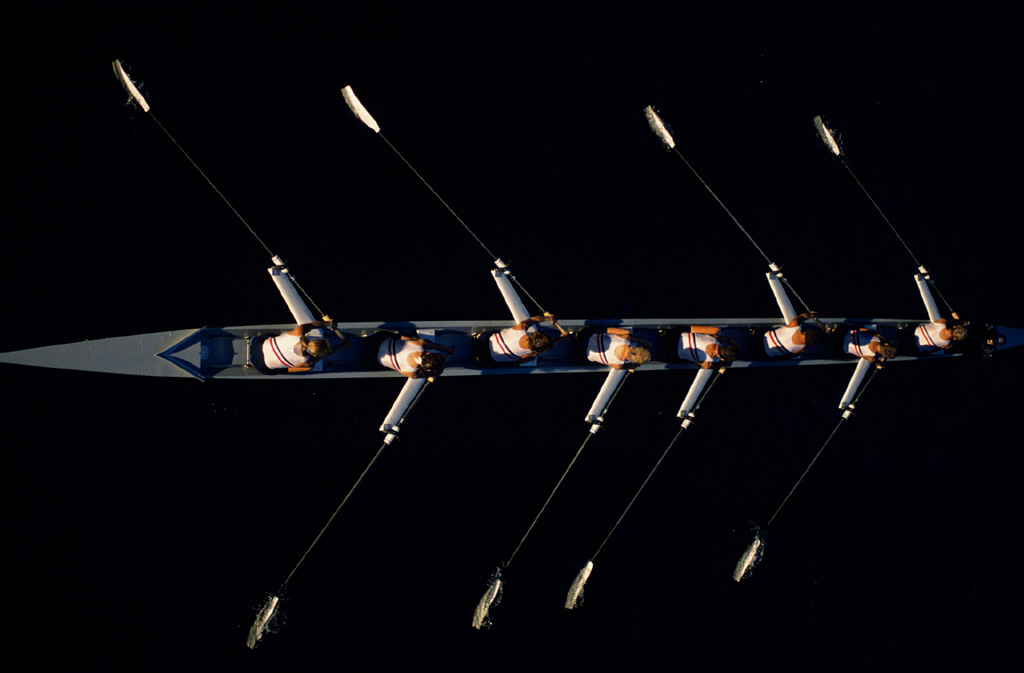

Finally, we must take into account the global transformation that our world is experiencing and how this affects companies and sectors. In order to offer the best solution to the needs of their clients, bankers rely on new ways of working, collective intelligence and the use of data. Their guiding principle is to work much more collaboratively, like the skipper and crew members on a boat. Their values, in line with the purpose of BBVA's corporate culture, are: to work as one team, put the client first and think big.

Bankers work collaboratively, like the skipper and crew members on a boat.

2. A generation of bankers for a new era

In a context as changing and demanding as today, dealing with such sophisticated clients requires a number of key capabilities and tools for bankers to succeed in their work: effective communication, anticipation and negotiation skills.

The capacity to communicate is a must: they need to be direct and concise, but also be able to explain the product offering or details of a particular operation in a clear and simple language. The bankers' high level interaction allows them to relate to senior management, both in the client's sphere and in the bank. Empathy and the ability to interact with people are also essential for effective communication.

In their mission to add value to clients' business, the bankers must be capable of surprising them and anticipating their needs. This requires being curious; finding information beyond the usual tools and sources; talking to the experts (industry, regulatory, analysts, etc.) in order to understand, and then be able to explain their clients the necessary concepts in an understandable way. Adding real value to the strategic dialogue with clients is key to becoming their trusted financial advisor.

Bankers also have to be competent in both inward and outward negotiation, as they act as a client-bank transmission belt. This means that they have two roles within the bank: on one hand, taking care of their clients' interests by negotiating the best solutions and conditions for them, and on the other, ensuring that the clients and the transactions they manage meet the profitability and risk criteria established by the bank. Finding the right balance between these two things is very important when building credibility and trust in these two worlds.

- Holistic view of the client

- Experience accredits capacity and confers reliability to bankers

- Main challenge is to be constantly up-to-date and informed

- Communication skills are a must

- Ability to provide advisory on a wide range of matters

- Ambition, character and 'auctoritas' are determining characteristics of a good banker

- High level of interaction enables them to relate to senior management

In addition, bankers must have a holistic view of clients: they have to know thoroughly their business; their production and business model; who their customers, suppliers and employees are. They must also have a very in-depth knowledge of their clients' products, the platforms on which they operate, the sector they represent and the regulation related to it. This is essential to be able to be close to the client and have a strategic conversation between equals with them. All this while respecting the confidential nature of the information received.

In fact, with regulations, procedures and markets constantly changing, one of the biggest challenges the bankers face, is to be properly updated and informed, and this includes being aware of the economic and geopolitical situation that affects their clients' business. All this information is essential in order to earn credibility with the customer and be considered as a relevant partner in their transformation process.

Experience is undoubtedly a great ally. Experience accredits capacity and confers reliability, which must be transparent, consistent, predictable and coherent. Skills like empathy, interpersonal relationships and the ability to identify what the client really wants are important. The bankers should never be conformist: rather, proactive. They strive to strengthen the relationship with the clients; manage correctly the interests of the bank, so that transactions have a successful close and motivate the teams.

Ambition, character and 'auctoritas' are other determining traits of a good banker. The Romans defined it as a moral quality that is achieved through the adhesion, persuasion and conviction of someone's good example over another. Currently, it can be defined as earned prestige, or capacity of influence. Bankers mobilize many people within the organization. 'Auctoritas' is paramount when it comes to gaining the trust of their teams and clients.

The digital revolution has allowed a systematization of information that used to be much more dispersed

Tools are also important in transforming the role of the banker. The influence of new technologies is beyond doubt in this evolution, as they have led to the systematization of the information that was previously much more dispersed. Customer relationship platforms, which allow clients and their information to be centralized, have improved markedly, facilitating dialogue not only with the customer, but also with product teams and other geographies.

But we cannot ignore that situations such as the COVID-19 crisis pose a major challenge for everyone, including BBVA teams and their customers. In a difficult new situation, such as this one, the bank has been able to adapt in record time to the new environment. Having customer relationship platforms and new technologies in place has allowed for greater anticipation and responsiveness. Through online meetings, bankers have proactively been very close to their clients, demonstrating them the bank's support and commitment, and covering their needs with the best solutions. At the same time, they have maintained a full coordination with product, legal and risk teams in order to prioritize and give a quick response to our clients.

BBVA has long implemented new work forms such as 'agile' methodologies across the whole organization. Bankers pioneered working as multidisciplinary teams, geared to specific projects with delivery dates. Currently, 'agile' sessions are being conducted with product teams and other support areas for monographic studies of the main clients in each segment. In these sessions the teams try to identify possible gaps, areas for improvement, undetected opportunities or, if there are problems, solutions.

In short, multidisciplinary teams consist of product specialists, bankers and geographies, all of which are aligned to pursue the same opportunities, with the same clients and in a systematic way with very specific deadlines. The goal is to apply 'less is more': to make better use of time with clients to give them more added value.

Industry coverage specialist

Luis Enrique Rodríguez

The industry coverage specialist leads the knowledge of a specific sector in different products and geographies.

They are responsible for sharing knowledge in the organization, advising customers, providing a global view of the dynamics and trends in a sector and identifying and generating new business opportunities, focusing on understanding strategic decisions. With their specialization, they guide and support other bankers and areas of the bank in identifying opportunities and maximizing client relationships.

- Sector expert

- Global vision of the sector

- Identifies new business opportunities

- Guides and supports other bankers

Global banker

Olga Eguilior

The global banker manages the relationship with clients on a global level and acts as the link between BBVA and the client.

They work closely with local bankers and product teams with the aim of maximizing business in all geographies through cross-selling and cross-border business. Understanding the needs of clients and their strategic decisions is essential to their role.

- Maximizes business in products and geographies

- Promotes cross-border business

- Focuses on client needs and their strategy

- Ultimately responsible for resource allocation

Transaction banker

Alba Villaverde

The banker specialized in transactional products and services for cash flow management and working capital finance.

Transaction bankers are responsible for domestic and international portfolios of multinational clients, for the sale and after-sales of transactional products and services for managing cash flows and the financing of working capital of investment banking clients. In addition, transaction bankers can play the role of local bankers in some geographies.

- High commercial and advisory capacity

- Focus on recurring revenue generation

- Originator of business opportunities

- Coordination and teamwork

Banker for commercial banking companies

Noelia Hilara

The banker who advises medium-sized companies and corporations on transactions with high strategic value.

They are responsible for advising the segment of medium-sized enterprises and corporations in transactions with high strategic value, through investment banking products that, in most cases, are not part of their recurring activity. The multi-product vision of the banker makes it easier for them to identify opportunities early and thus support the leadership of the operation.

- Multi-product investment banking advice

- Provides market insight

- Facilitator for clients and products

- Boosts cross-selling

3. A day in the life of a banker

Always up-to-date, with a head full of information, a banker's routine is no easy task. Their job is far more complex than sitting in front of a computer and waiting for business opportunities to arrive. It includes a number of tasks that often push them to move out of the office: from customer meetings to notary appointments to formalize transactions. When you add to that numerous daily phone calls and meetings they have, we are faced with the bank's connecting thread, those people who make things happen.

The bankers engage in constant and recurring dialogue with clients and through their proactive attitude they are able to identify business opportunities. To help them in this task, the bankers put together an in-depth analysis of the clients and the market where they operate. This analysis is cross-cutting overview of the clients' business, incorporating inputs from legal and support teams, such as risks, regulation, marketing or communication, as well as from product teams like: bonds, loans, transaction banking, M&A, global markets business, etc.

The information gathered about the clients is reviewed by product teams and different geographies to determine the feasibility of the previously identified opportunities. After evaluating and analyzing the possible options, the bankers propose the solution that best suits the client.

Once this solution has been validated internally by all teams involved, it is time to move on to the preparation of the official client proposal, the 'pitch'. The bank's knowledge of the sector and the client is key in this stage, and an open and recurring dialogue with product teams is a must. As relationship managers, the bankers need to ensure that the client is as satisfied as possible and that the scenario presented to him is the best one.

The next step is to present the proposal to the client, normally in their offices. In order to generate confidence and fluidity in the conversation during the meeting, the banker decides which people should attend the meeting from each party, taking into account their level of contact and relationships. The client proposal is a reflection of the relationship that the bank wants to establish with the client organization; it must be transparent and agnostic. The product or solution that best suits the client should be the one presented.

After receiving the client feedback during the meeting, the team makes the requested adjustments to the initial proposal. After they have been approved internally, the final proposal is prepared, always keeping in mind the profitability for the bank. Now the banker and the product representatives are ready to meet again with the client and submit the final proposal and its conditions.

The responsibility for signing the contract lies with the banker. The signing process depends on the role that the bank has played in the operation, as well as on the type of product or solution in question. Before a contract can be signed, it is shared with the bank's legal teams for their review and feedback.

Although the transaction has now been finalized, the banker's work continues. He stays in constant contact with the client, doing follow-up on the transactions, accompanying the client in his everyday operative and, in a proactive manner, sending him new proposals of improvements for his financial program. As part of the follow-up, the banker works with product teams to recover old proposals which at the time did not flourish, but might interest the client in the future.

“Our goal is to be the bank of reference for our clients by fostering strategic dialogue with them and accompanying them in their transformation towards a more sustainable future.“