Banco Sabadell Shareholders Can Now Join BBVA to Create a European Banking Leader

The Spanish National Securities Market Commission (CNMV) has approved the transaction of BBVA and Banco Sabadell. The take-up period is scheduled to begin on Monday, September 8, 2025 for Banco Sabadell shareholders to accept BBVA’s proposal. It is a very attractive offer, whose current equivalent value represents Banco Sabadell’s best valuation in more than a decade, while incorporating a premium clearly higher than that of recent similar transactions in Europe. As this is a share offer, its attractiveness also stems from BBVA’s current valuation and its upside potential. Following the merger, Banco Sabadell shareholders are set to obtain earnings per share 25¹ percent higher than they would with a standalone Banco Sabadell. “The union of two highly complementary banks at their best moment has an undeniable logic, and is beneficial for shareholders, customers and employees of both entities, and society as a whole. We invite Banco Sabadell shareholders to join this integration project with BBVA, the best possible partner, and a European leader in growth and profitability. Now is the time,” BBVA Chair Carlos Torres Vila said.

- Presentation Analysts (PDF)

- Download Carlos Torres Vila video (WeTransfer)

- Download Carlos Torres Vila video - Webs (WeTransfer)

- Statement from Carlos Torres Vila (Text) (PDF)

- Carlos Torres Vila (Chair), Onur Genç (CEO) y Paula Puyoles (Communications) at the press conference (JPG)

- Onur Genç y Carlos Torres Vila during the event (JPG)

- BBVA Carlos Torres Vila (JPG)

- Ciudad BBVA (JPG)

The offer involves the exchange of one common share in BBVA plus €0.70 in cash for every 5.5483 Banco Sabadell shares, which would give Banco Sabadell shareholders a stake of 13.6 percent² in BBVA, thus benefiting from the value generated by the project.

This is a highly attractive offer for Banco Sabadell shareholders for several reasons:

- Following BBVA’s offer, Banco Sabadell share price stands at its highest level in more than a decade.

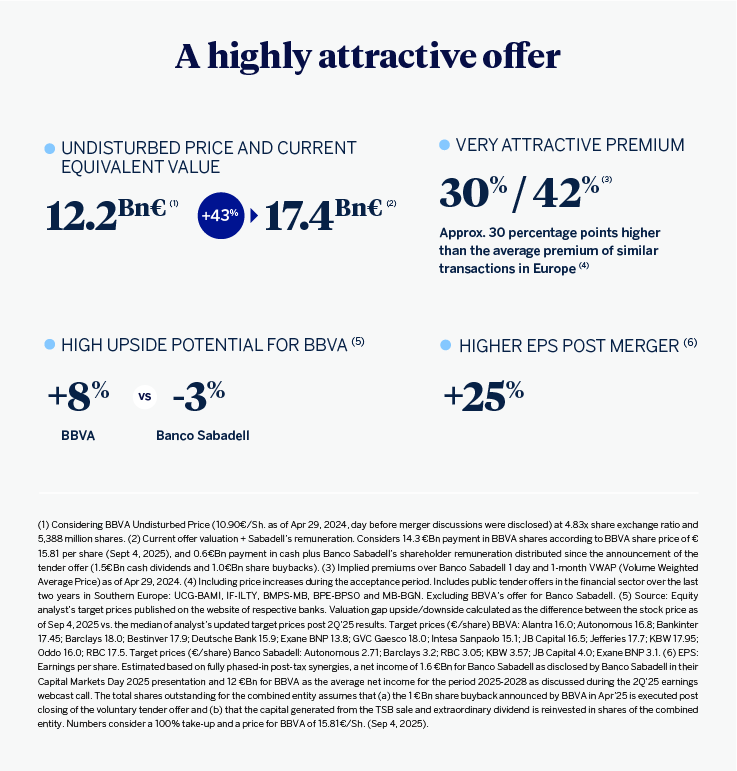

- The current equivalent value of the offer has increased by 43 percent since the day previous to the merger talks being made public, on April 29, 2024, rising from the initial €12.2 billion³ offer to the current €17.4 billion⁴.

- The offer represents a significant premium above Banco Sabadell share price on the day previous to the merger talks being disclosed: 30 percent over the closing price on April 29, 2024; and 42 percent over the weighted average price for the month prior to that date. This premium is well above that of similar transactions in the European banking industry over the past two years (c. 30 percentage points above the average premium of those deals).

- BBVA’s current valuation and its upside potential. Analysts forecast an upside of up to +8 percent for BBVA shares, while Banco Sabadell’s could see a downward correction of around -3 percent⁵.

- While the implementation of total synergies -estimated at €900 million per year following the merger⁶- would be delayed for one year compared to the original scenario (i.e. 2029 instead of 2028) due to the condition imposed by the Spanish Council of Ministers, the preparation for the integration in previous years will enable the full realization of synergies in the first year following the merger.

- The transaction will create significant future value for Banco Sabadell shareholders, who will obtain earnings per share (EPS) 25 percent⁷ higher than what they could with a standalone Sabadell.

For BBVA shareholders, this transaction is also accretive in terms of earnings per share from the first year following the merger, with an improvement of around 5 percent and a high return on investment (incremental ROIC⁸ over 20 percent). All this with a limited impact on the CET1 capital ratio of approximately -34 basis points⁹ at the closing of the transaction, which would result in +26 basis points once the closing of the British unit TSB is completed and the payment of the extraordinary dividend approved by Banco Sabadell is distributed.

A reinforced strategic rationale and commitment to all stakeholders

The transaction aims to build a stronger bank and one with greater scale to face the structural challenges now facing the financial industry, while efficiently making the growing investments in digital transformation within an increasingly global sector. The strategic rationale for the transaction has strengthened in recent months, in a context where Europe is set to increase spending and investment, and the need for larger banks in the region has intensified. In addition, scale is becoming increasingly important in the financial sector to address the fixed costs associated with growing investments in technology (including digitization, cybersecurity, data and AI, among others). A greater scale makes it possible to spread these costs across a broader customer base, achieving greater efficiency.

The combination with Banco Sabadell is a growth project that will increase the capacity to finance businesses and households by an additional €5.4 billion per year. Moreover, BBVA has taken on unprecedented remedies to support SMEs and the self-employed, who will benefit from guarantees to maintain future credit volumes- guarantees that would not exist without this transaction.

BBVA, the best partner for Banco Sabadell shareholders

BBVA is going through the best moment in its history, with a unique combination of growth and profitability among large European peers. The bank has achieved record results in recent quarters, driven by diversification, leading franchises in the countries where it operates, and a strategy focused on the client, innovation and sustainability.

All this has resulted in BBVA generating much more value for its shareholders over the past 15, 10 and 5 years, compared to its European and Spanish peers, measured as the evolution of the tangible book value per share plus dividends in those periods. Moreover, since January 2019 through September 4, 2025, BBVA’s total shareholder return has increased by 397 percent, well above the European banking sector average (+221 percent),and the Spanish banking sector (+199 percent), underscoring the market’s recognition of BBVA’s distinctive strategy and execution.

Finally, on July 31, BBVA unveiled financial goals for the 2025-2028 period, with excellent prospects in terms of profit, capital generation, profitability and value creation for shareholders.

How to take part in the offer

The take-up period will run for 30 calendar days starting on September 8, 2025, and will extend until October 7, 2025, inclusive.

During this period, Banco Sabadell shareholders wishing to accept the offer can:

- Submit the acceptance statement to take part in the share exchange in a few minutes, easily and cost-free with the help of a customer representative, whether a BBVA customer or not, in person at any BBVA branch or by calling +34 800 080 032 (for retail investors) or +34 911 859 673 (for institutional investors).

- Submit their acceptance statement in writing to take part in the share exchange to the Iberclear participating entity where their Banco Sabadell shares are deposited, either in person, by electronic means or by any other means accepted by said depositary entities.

Banco Sabadell shareholders who wish to do so may find further information on the transaction and how to accept the offer in the explanatory document available at cnmv.es and bbva.com, as well as at BBVA offices, the CNMV and the stock exchanges.