BBVA Increases Offer to Banco Sabadell Shareholders by 10% and Improves the Tax Treatment of the Transaction

The BBVA Board of Directors has agreed to improve the offer to Banco Sabadell shareholders by 10 percent¹. In addition, the consideration will now be entirely in shares, so shareholders with capital gains would not be subject to taxation in Spain, if acceptance exceeds 50 percent of Banco Sabadell’s voting rights, as the transaction would qualify as tax neutral in that case. The Board of Directors has also agreed to waive both the possibility of making further improvements to the consideration and of extending the acceptance period.

“With this improved offer, we are putting an extraordinary proposal in the hands of Banco Sabadell shareholders —one that combines a historic valuation and price with the opportunity to participate in the substantial value generated by the integration. All of this will result in a significant increase in the expected earnings per share in the future, if they tender their shares," BBVA Chair Carlos Torres Vila said.

10% Increase to the offer

The new offer, which entails one new BBVA share for every 4.8376 Banco Sabadell shares, represents an increase of 10 percent and is exceptionally attractive for Banco Sabadell shareholders:

- The offer values Banco Sabadell shares at €3.39 per share¹, at its highest levels in more than a decade.

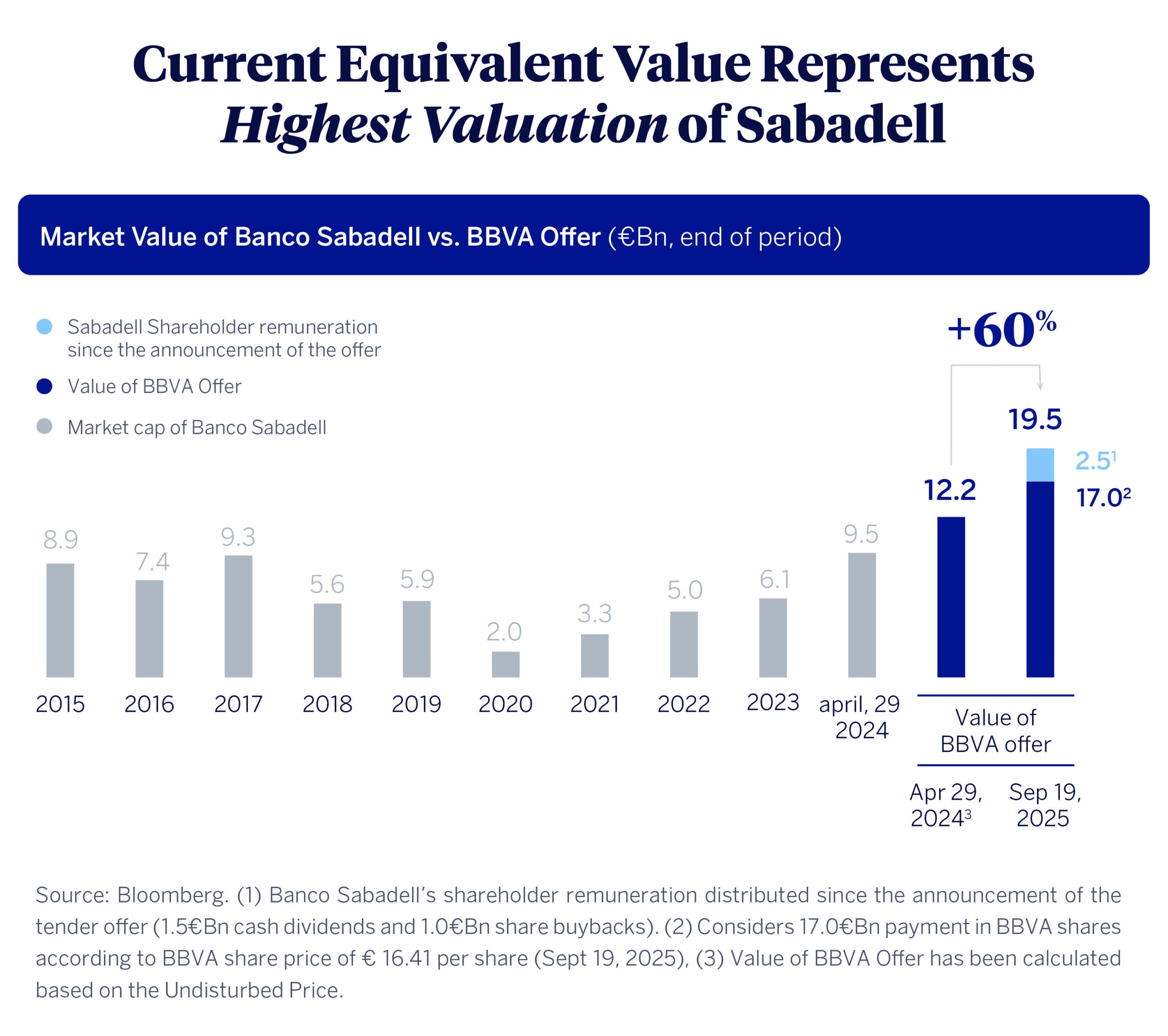

- The current equivalent value of the offer has risen by 60 percent since April 29, 2024, the day before the merger talks were made public, increasing from the initial €12.2² billion offer to the current €19.5 billion³.

- The new offer would give Banco Sabadell shareholders a 15.3 percent stake in BBVA, thus benefiting from the tremendous value generated by the integration project: with the merger, they will obtain earnings per share⁴ (which then determines dividend per share) c. 41 percent higher than with a standalone Sabadell.

- The premium over Banco Sabadell share price, which was very significant when the transaction was announced and well above that of similar transactions in European banking (c. 30 percentage points above the average of these deals⁵), will be substantially improved following this increase in the offer.

Improved tax regime⁶

The consideration is to be 100 percent in shares, so that, as a general rule, shareholders with capital gains would not be subject to taxation in Spain, if acceptance exceeds 50 percent of Banco Sabadell’s voting rights, as the transaction would qualify as tax neutral in that case.

Other relevant conditions

- The BBVA Board of Directors has decided to waive both the possibility of making further improvements to the consideration, pursuant to the provisions of Article 31.1 of Royal Decree 1066/2007, and of extending the acceptance period, under Article 23.2 of Royal Decree 1066/2007.

- Those Banco Sabadell shareholders who have already tendered their shares will also benefit from the improved terms of the offer.

- The take-up period will be suspended until the CNMV approves the corresponding supplement with the improved offer. Once approved, the take-up period will resume.

Financial impacts for BBVA shareholders following the offer increase

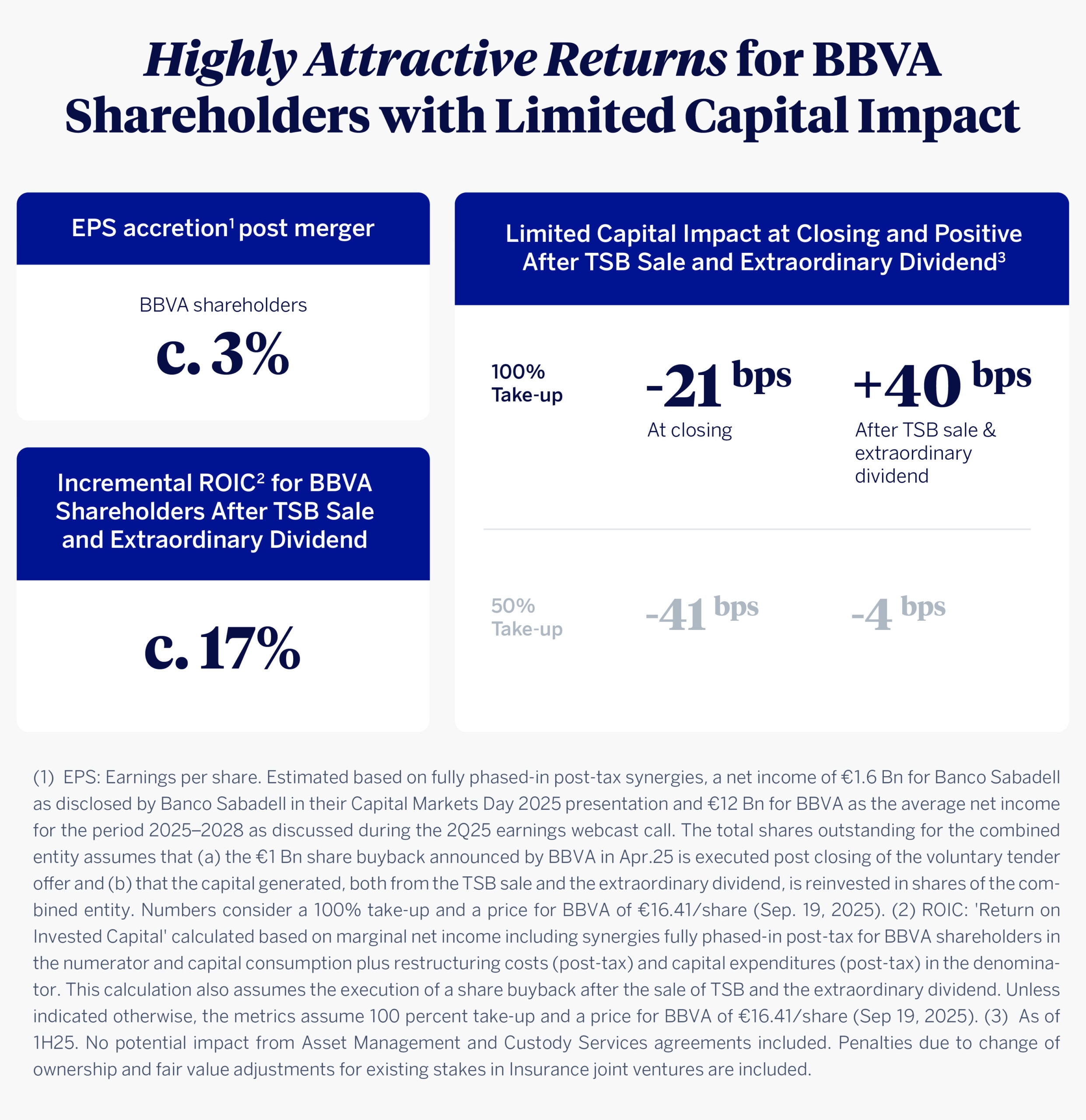

For BBVA shareholders, this transaction is also accretive in terms of earnings per share from the first year following the merger, with an improvement of c. 3 percent and a high return on investment (incremental ROIC of around 17 percent).

All this with a limited impact on the CET1 capital ratio of approximately -21 basis points at the closing of the transaction, which would result in +40 basis points once the closing of the sale of TSB is completed and the payment of the extraordinary dividend approved by Banco Sabadell is distributed⁷.

Strategic rationale and commitment to all stakeholders

The transaction aims to build a stronger bank and one with greater scale to address the structural challenges now facing the financial industry. The strategic rationale of the transaction has strengthened in recent months: in a context where Europe is set to increase spending and investment, the need for larger banks in the region has intensified.

In addition, scale is becoming increasingly important in the financial sector to address the fixed costs especially associated with growing investments in technology (digitization, cybersecurity, data and AI, among others). A greater scale makes it possible to spread these costs across a broader customer base, achieving greater efficiency.

The combination with Banco Sabadell is a growth project that will increase the capacity to finance businesses and households by an additional €5.4 billion per year, following the merger. Moreover, BBVA has taken on unprecedented remedies with the CNMC, which reflect a firm support to SMEs and the self-employed, who will benefit from guarantees to maintain future credit volumes that would not exist without this transaction.

“Banco Sabadell shareholders who accept the offer will be part of a bank with a much higher potential of growth and value creation, with an ability to achieve 41 percent higher earnings per share than they would obtain otherwise. We invite them to join us in building a project that will bring significant benefits to customers, employees and shareholders of both entities and to society as a whole,” BBVA CEO Onur Genç said.