BBVA CIB Posts A Record 2025: €6,558 Million In Revenues

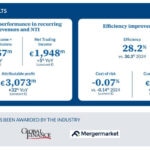

BBVA’s Corporate & Investment Banking (CIB) division recorded revenues of €6,558 million in 2025, up 29% from 2024 (at constant euros, not including the effect of hyperinflation accounting). All business units contributed to this growth, posting double-digit year-on-year increases that underscore the strength and diversification of the division: Global Markets (GM) +35%, Global Transaction Banking (GTB) +19%, and Investment Banking & Finance (IB&F) +33%. Loans activity also showed a very positive performance, increasing 28% compared to December 2024. This growth was driven by both GTB and IB&F, supported by notable project finance and corporate lending transactions in Spain, Europe, and the United States. Attributable profit reached €3,073 million, representing a 32% year-on-year increase. Overall, 2025 marked a continued path of rising profitability across businesses, with solid performance in all geographies.

BBVA Corporate & Investment Banking (CIB) closed 2025 with record revenues of €6,558 million, a 29% increase compared to 2024. In addition, the Group's investment banking division stood out for achieving an attributable profit of €3,073 million, up 32% year-on-year, confirming the strong performance of the business throughout the year.

Looking at performance by geography, all countries delivered solid growth during the year, with particularly strong contributions from Spain, Mexico, the United Kingdom, Continental Europe, Asia and the United States. In these regions, CIB has continued to show strong momentum in recent years as a result of the implementation of strategic plans, which have strengthened both its product and commercial capabilities and driven the development of new solutions aimed at enhancing the value proposition and deepening client relationships.

Business unit performance

Global Markets (GM) posted its best year ever in 2025, reaching €2,442 million in results. This milestone reflected the strength of the business model, the unit’s ability to generate sustainable growth in a highly volatile environment, and performance above the industry average. In this context, Equity delivered record results after a year of strong growth across all regions, supported by key advances in operational and technological transformation, laying the groundwork for a new phase of expansion. G10 Rates also performed strongly, with solid growth in the corporate segment, the development of project finance solutions, and the reinforcement of capabilities in securities financing. FX once again proved to be a key component of the Global Markets business mix, with growing revenues, record volumes traded, and a strong contribution from both transactional and hedging solutions. Meanwhile, Credit delivered a landmark year, with especially strong growth in the United States, continued leadership in Mexico, and an increased contribution from private credit in its value proposition for institutional clients.

Global Transaction Banking (GTB) also posted an exceptional 2025, following an especially demanding year. Revenues reached €2,529 million, up 19% year-on-year, including a record fourth quarter of €708 million. The year ended with record levels of activity across the three pillars of the business, loans, deposits and guarantees, translating into double-digit growth in both net interest income (+19%) and fees (+17%). These results reflect the consolidation of key initiatives, such as the institutional banking business and the strengthening of working capital and trade finance solutions, which closed the year with new capabilities for clients and landmark transactions for BBVA. At the same time, GTB continued to grow its presence in different markets, reinforcing local structuring capabilities and strengthening its leadership in sustainable finance, consolidating the division’s diversified and resilient business model. As a result, GTB’s efficiency ratio improved once again in 2025, remaining below industry standards.

The Investment Banking & Finance (IB&F) unit exceeded expectations in 2025, reaching over €1,441 million in revenues, up 33% from the previous year. This growth was driven by strong corporate lending activity in the United States, the United Kingdom, and Europe, along with the strong momentum in structured finance across the same regions. Project finance also recorded notable growth, particularly in the United States and Europe, with renewable energy and the TMT sector as the main drivers. In a particularly challenging environment, corporate finance once again demonstrated its strength and value creation capacity, with solid revenue growth supported by positive performance in Spain, Mexico, and Turkey.

Profitable growth with clients and global reach in 2025

In a context of global uncertainty, BBVA CIB continued to place clients at the center of its activity in 2025, relying on a relationship model based on sector specialization and tailored solutions. This approach allowed the bank to support wholesale clients in their strategic decisions and consolidate sustained growth in business activity.

The effectiveness of this model was reflected in a 16% year-on-year increase in revenues from the corporate segment, with particularly strong growth in the consumer and retail (+20%), energy (+16%) and TMT (+18%) sectors. In the institutional segment, growth accelerated to 27% year-on-year, driven by the public sector (+71%) and financial sponsors (+46%).

This growth was further supported by increasing client activity across geographies, with BBVA CIB continuing to accompany its clients wherever they operate, leveraging its international presence and ability to deliver coordinated solutions across different markets.

The cross-border business grew by more than 21%, with double-digit increases in both the corporate and institutional segments, reflecting the strength of the bank’s global offering. Results were particularly strong in the United Kingdom and the United States, where activity increased by nearly 50%, strengthening BBVA’s position in these key markets. Mexico maintained its status as a priority geography, consolidating its role as a key destination for client investment in the region.

Among the most in-demand cross-border solutions were structured finance, market hedging products, and multicurrency debt issuance, all essential to supporting clients’ international activity.

Sustainability as a business driver

Between January and December 2025, BBVA CIB channeled close to €68,000 million in sustainable business, representing a 34% increase compared to the same period in the previous year.

In the wholesale banking segment, BBVA continued to promote financing for clean technologies, renewable energy projects, and sustainability-linked confirming, among other strategic lines.

Within the annual total, renewable energy project financing stood out, exceeding €3,000 million, with a particularly strong contribution from the United States and Europe.

Industry recognition for BBVA CIB

In the fourth quarter of 2025, BBVA CIB received new international accolades that reflect the strength of its business model and the specialization of its teams. At the European M&A Awards 2025 by Mergermarket, BBVA was named Iberia Financial Adviser of the Year, reinforcing its position as a leading advisor in corporate transactions in the region.

This recognition was further supported in the markets space, where Global Finance named BBVA World’s Best FX Bank for Corporates in the Foreign Exchange Banks 2026 awards, and also recognized the bank as Best FX Bank in Spain, Argentina, Colombia, and Turkey. In trade finance, Global Finance included BBVA among The World’s Best Trade Finance Providers 2026, naming it Best Trade Finance Bank in Latin America and in Argentina, Peru, Spain, and Uruguay.