BBVA CIB posts record revenues of €3.194 billion in the first half of 2025

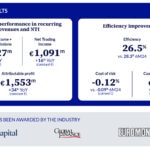

BBVA Corporate & Investment Banking (CIB) posted record revenues of €3.194 billion in the first half of 2025, representing a 28% increase compared to the same period of 2024 (in constant euros, excluding the impact of hyperinflation accounting adjustments). All business units delivered double-digit growth: Global Markets (GM) rose 31% year-on-year; Global Transaction Banking (GTB) 17%; and Investment Banking & Finance (IB&F) 32%. BBVA CIB’s loan book expanded by 10% versus December 2024, driven by both transactional banking and IB&F, supported by landmark operations in project finance and corporate lending across Spain, Mexico, and the U.S. Attributable profit reached €1.553 billion, up 34% year-on-year. Profitability improved across key geographies, particularly in Spain, Continental Europe, and the U.S.

BBVA Corporate & Investment Banking recorded revenues of €3.194 billion in the first half of 2025, representing a 28% increase compared to the same period in 2024. The investment banking division stood out by posting an attributable profit of €1.553 billion, up 34% year-on-year.

Client activity continues to grow, supported by sector specialization

In 2025, BBVA CIB continued to strengthen its relationships with corporate and institutional clients globally, underpinned by its industry model. The bank continues reinforcing its presence in strategic regions such as the U.S, the United Kingdom, Europe, Asia, and Brazil, and consolidating its position as a trusted partner.

Revenues from corporate clients grew 17% year-on-year in the first semester of the year, with particularly strong performance in the energy sector (+17%), consumer & retail (+21%), and industrials & transport (+16%).

Institutional client activity also saw notable growth, especially in the financial sponsors and public sector segments, both exceeding 30% year-on-year increases.

Business unit performance

Global Markets (GM) delivered strong results across all product lines and geographies in a highly volatile and complex risk environment. Foreign Exchange (FX) benefited from macro volatility and momentum in emerging markets. Equities posted solid growth despite headwinds in investor sentiment, with strong contributions from the U.S., Mexico, and Spain. Rates continued to gain relevance as a strategic product, supported by robust client traction and sound risk management. In the credit business, BBVA CIB further reinforced its footprint in the U.S. and Mexico, earning industry recognition with the “Emerging Force in Corporate Bonds 2025” award from GlobalCapital.

Global Transaction Banking (GTB) posted a particularly strong Q2, with accumulated first semester revenues reaching €1.197 billion, a 17% increase versus the first semester of 2024. This performance consolidates the positive trend seen since the start of the year, underpinned by progress in strategic pillars including enhanced capabilities in liquidity and financing solutions, expansion in key markets, and the continued rollout of its sector specialization model. These initiatives supported sustained growth in a more volatile-than-expected environment, marked by declining interest rate margins and heightened geopolitical tensions. Fee income gained significance, growing at a double-digit pace during the semester and contributing to greater revenue stability and recurrence. Cross-border and interbank activity volumes also rose, contributing to efficiency ratios that remain below industry benchmarks.

Investment Banking & Finance (IB&F) delivered exceptional results, posting €650 million in the first semester revenues and growing 32% year-on-year. Performance was driven by strong Corporate Lending activity across the U.S., the U.K., Europe, and Mexico. Structured Trade Finance (STF) saw substantial growth, particularly in Spain and Germany. Project Finance remained highly active, especially in the U.S. and Europe, with a focus on data centers and renewable energy projects in the U.S. market.

Despite ongoing geopolitical uncertainty, volatility, and valuation dispersion in global equity markets, M&A activity remained dynamic, with a significant increase in related revenues during the first half.

Cross-border business momentum

BBVA CIB’s cross-border business continued to show strong momentum, leveraging its multi-geographic footprint. Activity levels remained high, with growth above 10% across all regions—particularly in Mexico and Europe, where BBVA continues to gain market share.

The bank’s value proposition remains especially compelling for clients in the Americas and Asia, who are expanding their operations across BBVA’s footprint through both long-term structured financing and transactional solutions.

Sustainability as a driver of business

Between January and June 2025, BBVA CIB mobilized approximately €31.9 billion in sustainable finance, a 34% year-on-year increase. The bank continues to actively promote clean technology financing and renewable energy projects across the wholesale segment. Key initiatives include sustainability-linked confirming lines, among others. Of note, renewable energy project financing alone totaled €1.6 billion during the first half of the year.

Industry recognition for BBVA CIB

In the first half of 2025, the financial industry once again recognized BBVA CIB’s commitment to excellence, innovation, and client-centric solutions. At the Euromoney Awards for Excellence 2025, BBVA CIB received six accolades, including the prestigious Best Bank in Europe for Large Corporate Clients—awarded to the bank for the first time.

Additional recognition came from Global Finance, naming BBVA CIB Best Sub-Custodian Bank in Spain and Best Treasury and Cash Management Bank in six key regions: Latin America, Spain, Mexico, Colombia, Turkey, and Venezuela. Meanwhile, Global Capital named the bank Emerging Force in Corporate Bonds 2025, further underscoring its growing prominence in international debt markets.