BBVA CIB Reports Record Revenues of €4,832 Million through September

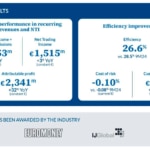

BBVA’s Corporate & Investment Banking (CIB) division posted revenues of €4,832 million between January and September 2025, representing a 27% increase versus the same period in 2024 (at constant euros, not including the effect of hyperinflation accounting). All business units recorded double-digit growth: Global Markets (GM) +27% year-on-year; Global Transaction Banking (GTB) +19% year-on-year; and Investment Banking & Finance (IB&F) +35% year-on-year. Additionally, loan book grew by 15% compared to December 2024, both in transactional banking and IB&F, supported by landmark project finance and corporate lending transactions in Spain, Mexico and the United States. Attributable profit stood at €2,341 million, a year-on-year increase of 32%. Over the nine-month period, business profitability continued to strengthen, in line with the trend seen throughout the year and with a particularly strong performance in Spain, the United Kingdom, Continental Europe and the United States.

BBVA Corporate & Investment Banking reached €4,832 million in revenues through September 2025, a 27% increase year-on-year. The division delivered an attributable profit of €2,341 million, up 32% compared to the same period the previous year.

Sustained growth in client activity, driven by sector specialization

Despite global uncertainty, BBVA CIB has reinforced its commitment to supporting the sustained growth of wholesale clients in 2025, thanks to a sector specialization model built on tailored solutions and a long-term strategic vision.

This approach is reflected in a 16% year-on-year increase in revenues from the corporate segment through September, with particularly strong performance in the energy (+23%), consumer & retail (+19%) and TMT (+16%) sectors. In the institutional segment, growth accelerated to 23% year-on-year, driven by strong performance in the public sector (60%) and among financial sponsors (+49%).

Business unit performance

Global Markets (GM) continued to deliver strong growth across all strategic areas, with currencies (FX) and equities playing a key role. Revenues reached €1,847 million through September, up 27% year-on-year. FX saw exceptional performance in Turkey and Mexico, driven by significantly higher trading volumes and the volatility stemming from geopolitical tensions. The equities business benefited from strong institutional activity in the U.S. and Asia, as well as the integration of BBVA Trader into the retail channels. The positive performance of the rates business was supported by activity in the U.S. and the financing business. Meanwhile, the credit business continued to perform solidly in the U.S., Europe and Mexico, underpinned by strong origination activity.

Global Transaction Banking (GTB) maintained strong momentum in the third quarter of 2025, with cumulative revenues reaching €1,841 million in the first nine months of the year, a 19% increase versus the same period in 2024. This performance reflects the consolidation of structured receivables solutions and notable progress in inventory, liquidity and supply chain management. Sustained growth was recorded in key markets, supported by higher transaction volumes across geographies and business units within the Group. These factors contributed to year-on-year improvements despite a more challenging environment marked by lower returns on interest rates and persistent geopolitical tensions. In this context, activity reached record levels in loans, deposits and guarantees, driving double-digit growth in both net interest income and fees. As a result, GTB’s efficiency ratio remained below industry standards, reflecting highly effective execution.

Investment Banking & Finance (IB&F) delivered an outstanding performance in the first nine months of the year, with results reaching €1,038 million, a 35% increase compared to the same period in 2024. This strong performance was mainly driven by corporate lending activity in the U.S., United Kingdom, Rest of Europe and Mexico, as well as structured trade finance in Spain and Rest of Europe. In addition, project finance continued to show strong momentum, particularly in the U.S. and Europe, with renewable energy and TMT projects as the main drivers of growth.

In a context marked by geopolitical uncertainty and market volatility, corporate finance activity remained resilient and dynamic, posting a significant increase in revenues over the nine-month period.

Cross-border business at BBVA CIB

Cross-border business continues to be one of the key growth drivers for BBVA CIB, strengthening market connectivity and supporting clients in their international expansion. So far this year, it already accounts for 43% of the division’s total revenues, following a strong momentum in recent months that has resulted in 17% growth. Mexico remains the most attractive market for clients, while the franchise continues to deepen its presence in the United States and United Kingdom, and relevant transactions are being closed in Brazil. This progress is underpinned by large structured financing deals and the development of innovative global trade finance solutions, particularly in prepayments and inventory finance.

Sustainability as a business driver

Between January and September 2025, BBVA CIB channelled approximately €49,700 million in sustainable finance, a 36% year-on-year increase. BBVA continues to promote the financing of clean technologies (cleantech) and renewable energy projects in the wholesale segment, as well as solutions such as sustainability-linked supply chain finance (confirming). Notably, financing for renewable energy projects reached €2,100 million through September.

Industry recognition for BBVA CIB

BBVA has once again stood out in the main international financial industry awards, which recognised both its leadership in financial markets and its commitment to sustainability. At the Euromoney Foreign Exchange Awards 2025, the bank was named Best FX Bank in Argentina, Colombia, Peru, Spain and Turkey, in addition to receiving awards for Best FX Bank for Research in Latin America and Best FX Bank for Corporates in Mexico. BBVA was also recognised at the IJGlobal ESG Awards 2025 for its role in major energy transition and decarbonisation transactions in the United Kingdom.