BBVA to Launch Share Buyback Program of Nearly €4 Billion, the Largest Ever

BBVA is to launch on December 22 an extraordinary share buyback program for a maximum amount of €3.96 billion, after obtaining all required authorizations. This is the largest buyback ever carried out by the Group. The program is part of the €36 billion that BBVA expects to make available for distribution to shareholders between 2025 and 2028¹, through both ordinary remuneration and additional distributions, such as this program.

BBVA CEO Onur Genç underscored that the bank “is and will continue to be a very attractive story that combines growth, profitability and excellent returns to shareholders.”

The new plan is in addition to distributions already made in the last quarter. Specifically, BBVA shareholders received €1.84 billion in cash on 7 November as an interim dividend against 2025 earnings, the highest in the bank’s history. And on December 10, BBVA successfully completed its €993 million share buyback program as part of ordinary remuneration for 2024.

BBVA CFO Luisa Gómez Bravo underscored that “once the full program is finished, we remain committed to return the excess capital generated above the upper end of our capital target range of 12 percent in a disciplined and continuous manner.” She also emphasized that the bank’s capital position remains very solid. The €3.96 billion program is equivalent to 100 basis points of CET1 and will be deducted from the Group’s capital ratio in December. On a pro‑forma basis as of September 2025, the ratio would have stood at 12.42 percent, and well above BBVA’s target range of 11.5 to 12 percent.

The program will be executed over several months and completed in tranches. Shares acquired under this program will be cancelled to reduce share capital.

The first tranche of the buyback will amount to €1.5 billion and its execution will begin on December 22, 2025. J.P. Morgan SE will be responsible for executing purchases on the Spanish electronic trading system - Continuous Market and on the trading platforms of Cboe Europe, Turquoise Europe and Aquis Exchange. This initial tranche is estimated to end neither before March 6 and nor later than April 7, 2026, and, in any event, when within such period the maximum cash amount (€1.5 billion) is reached or the maximum number of shares (557,316,433) is acquired. BBVA will subsequently continue with the remaining amount of the maximum of €3.96 billion.

Over €10 billion in buybacks since 2021

Since launching its first program in 2021, and with the addition of this new one, BBVA has devoted more than €10 billion to share buybacks, reducing the number of outstanding shares. These repurchases have had a positive impact on BBVA’s earnings per share (EPS). As such, while attributable profit grew by 31 percent in 2022, 21 percent in 2023 and 25 percent in 2024, EPS grew well above these rates, with increases of 48 percent, 26 percent and 27 percent, respectively.

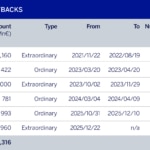

A total of five share buyback programs have been executed to date, two of them extraordinary (€3.16 billion between 2021 and 2022 and €1 billion in 2023) and three as part of ordinary shareholder remuneration (€422 million charged to 2022, €781 million charged to 2023 and €993 million charged to 2024).

¹ Subject to the approval of the corresponding governing bodies and the required regulatory authorizations.