Moody’s upgrades BBVA’s rating for its fundamentals

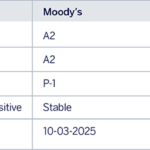

Following the recent upgrade of BBVA’s rating by S&P, another leading ratings agency, Moody’s, has raised BBVA’s rating from A3 to A2, one notch above that of Spain, with a stable outlook. The main reason behind this upgrade is the favorable performance of BBVA’s fundamentals.

In March 2024, Moody’s assigned a positive outlook to BBVA, which was changed a year later, in March 2025, to Rating Watch Positive, as a sign of an upcoming improvement. With the decision announced on Friday, Moody’s concludes the review process of BBVA’s rating.

“The upgrade was driven by the recent improvement in the bank’s credit profile, particularly in terms of profitability,” said Moody’s in a statement. “The bank’s net profit has continued improving in the first half of 2025, after a solid growth recorded in 2024,” despite the challenges in the macro-economic environment, the agency added.

The upgrade also reflects the bank’s credit quality and solvency. The bank “balances a strong internal capital generation with a generous dividend policy, alongside a sound funding and liquidity profile, supported by a large and stable deposit base, an independent funding model for its subsidiaries and broad market access,” it added.

Furthermore, the agency also took into account the improved prospects of the Spanish market, in the wake of the upgrade of the Spanish sovereign rating on Friday, September 26