S&P upgrades BBVA’s rating to A+

The rating agency Standard & Poor’s (S&P) has upgraded BBVA’s rating by one notch, from A to A+, matching Spain’s sovereign rating, with a stable outlook. “BBVA continues to deliver solid risk-adjusted returns and it is our view that BBVA’s financial strength is now in line with that of larger and more diversified European and global peers,” S&P noted.

S&P’s upgrade of Spain’s sovereign rating to A+ with a stable outlook on Friday, September 12, has prompted a more positive view of BBVA’s rating. The agency underscores that “BBVA’s financial strength is now in line with that of larger and more diversified European and global peers.” It also points to the bank’s solid volume growth, a competitive advantage from its leading position in the markets where it operates, growing margins, and strong digital capabilities — all of which contribute to the bank’s ability to deliver sustainable positive results over time.

S&P values BBVA’s profitability levels, with an ROE of 19.5 percent as of June 2025 – well above the 14.3 percent average for comparable European banks. “We think BBVA’s strategic focus and consistent execution will enable it to maintain robust profitability over the next couple of years, albeit moderately lower amid lower interest rates. We expect the group’s performance to benefit from sustained business growth, strong pricing power, and an advanced digital proposition. We expect a strong digital focus to contribute to the bank’s better-than-peers efficiency, with cost to income below 45 percent.” The agency also underscores the BBVA Group’s diversification, with a presence in both developed and emerging economies, as it will help strengthen the bank across different economic cycles.

Finally, the rating agency stresses BBVA’s credit quality, which “has proved remarkably resilient,” with an NPL ratio of 3.2 percent, “the lowest in the past decade.” “We expect asset quality to remain resilient due to the bank’s overall prudent credit risk culture. In this context, we anticipate BBVA capitalization to remain robust,” S&P adds.

S&P believes that the proposed acquisition of Banco Sabadell would provide BBVA “the opportunity to increase its scale in its home market, strengthen its franchise within the small and midsize enterprise segment, and moderately rebalance the group’s footprint toward more stable economies.” Despite the Spanish government’s condition to maintain independent management of both banks for at least three years, the agency views the deal as an “opportunity to boost efficiency and returns.”

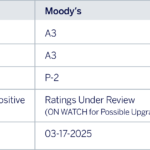

BBVA ratings by major rating agencies