The three major rating agencies upgrade BBVA’s rating

The three leading rating agencies have upgraded BBVA’s rating over the past three weeks. On Tuesday, Fitch upgraded the long-term senior preferred debt one notch, from A- to A. It also upgraded BBVA’s long-term issuer rating, from BBB+ to A-, with a stable outlook, among other improvements. This latest move joins the recent upgrades by S&P and Moody’s.

“The upgrade reflects a combination of Fitch’s improved assessment of the Spanish operating environment, resulting in a stronger risk and funding profiles for the Group, and BBVA’s record of strong earnings generation, underpinned by income diversification by geography,” the agency noted.

The key drivers supporting Fitch’s upgrade include the bank’s resilience across economic cycles, its decentralized subsidiary model, its geographic diversification, the credit quality of its retail banking model, its strong and growing earnings, its adequate capitalization level, and its funding strategy.

As for the bank’s resilience, Fitch underscored that “BBVA’s rating reflects resilient earnings across multiple economic and interest-rate cycles.” The agency noted that earnings stability is supported by geographically diversified and cost efficient operations, with solid retail franchises and broad, stable deposit bases, complemented by good access to wholesale funding. Fitch also praised BBVA’s decentralized model, with self-sufficient subsidiaries that fund their activities with local resources. “BBVA is Spain’s second-largest banking group and has built strong franchises in Mexico, Türkiye, and several South American countries. This supports its business growth, earnings diversification, and a solid funding profile,” Fitch stated. “BBVA’s potential acquisition of Banco Sabadell would strengthen its footprint in Spain, materially closing the gap with the domestic market leader,” it added.

The agency also considers that BBVA’s retail banking model supports the quality of its assets, as reflected in the bank’s “extensive expertise in periods of stress, effective controls, and franchise strength in foreign markets.”

On earnings, Fitch emphasized that “BBVA’s operating profit is among the strongest of its peers” between 2021 and 2024, with Spain and Mexico as the main contributors. Specifically, it pointed to growth in business volumes, reduced interest rate sensitivity, wide margins in emerging markets, higher fee income, and good cost efficiency.”

Fitch expects that BBVA CET1 capital ratio will gradually steer toward the upper end of its 11.5%–12% target range, supported by further capital distributions, organic growth, and the potential impact of the acquisition of Banco Sabadell. Finally, it underscored BBVA’s funding profile, noting its “solid local franchises” and “strong access to a large investor base via a diversified wholesale funding sources.”

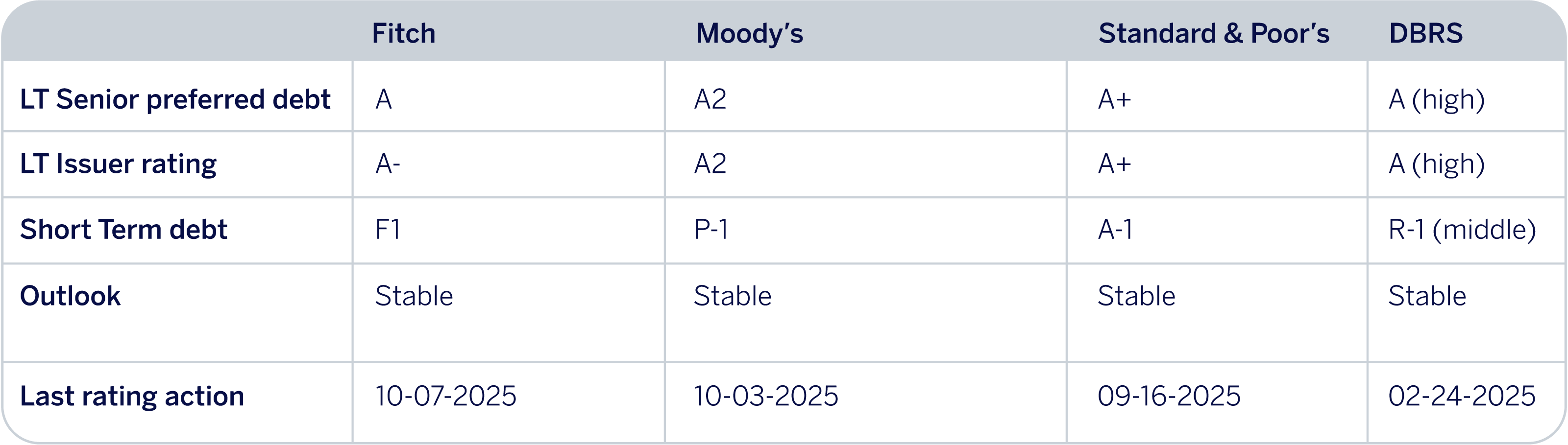

BBVA ratings according to leading rating agencies