PPP Forgiveness Series, Part 3: A visual timeline

Parts 1 and 2 of the BBVA USA Paycheck Protection Program (PPP) Forgiveness Series detailed two key pieces of the entire process: The lender’s responsibilities and the borrower’s responsibilities. The details of these topics can be found in the main source of the Forgiveness Series: the BBVA USA Forgiveness Webinar, a comprehensive look into the PPP that untangles frequent questions.

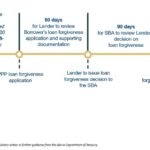

In Part 3 of this four-part series, BBVA USA provides a visual timeline that displays milestones relating to a business owner’s PPP loan. According to the webinar, which can be found here, the dates for each milestone will vary from one borrower to the next - depending on the loan disbursement date, the applicable covered period, and the date the borrower applied for loan forgiveness.

Launched in April, the PPP was the small business relief component of the CARES Act that was crafted in response to the COVID pandemic. The PPP allowed businesses with 500 or fewer employees to borrow money from lenders guaranteed by US Small Business Administration (“SBA”) to fund up to 2.5 times their average monthly payroll and other expenses, including mortgage interest payments, rent payments and utility payments.

If the full time equivalent number of employees were retained throughout the covered period and certain other conditions are also met, businesses may be eligible to have their PPP loan balances forgiven.

Below is the visual timeline with key forgiveness-related milestones. To view the entire webinar, including a detailed breakdown of the following timeline, click here:

In May, BBVA USA announced it had funded approximately $3.3 billion small business loans in less than 60 days, processing more than 22,000 applications and impacting approximately 360,000 jobs through its efforts in the PPP. For context on the size of the bank’s commitment to the PPP, the bank’s total SBA 7(a) loan originations for the fiscal year ending Sept. 30, 2019 were 259 loans totaling nearly $270.7 million, an outcome that garnered the bank the no. 14 rank nationally in dollar volume for SBA loans originated.