BBVA posts recurring profit of €1.26 billion in first quarter

BBVA posted a recurring profit of €1.26 billion in 1Q20 (+6.4 percent yoy), driven by the highest operating income in ten years (+14.1 percent), and boosted by a good performance of revenues and a containment in operating expenses. Following front-loaded provisions of €1.43 billion related to the COVID-19 crisis, BBVA earned €292 million in the first three months of the year. Including the goodwill adjustment at the U.S. unit, the bank registered a €1.79 billion loss in the quarter.

Press kit Results 1Q20

- Statements from Carlos Torres Vila (YouTube)

- 1Q20 Results Presentation (Press) (PDF)

- 1Q20 Quarterly Report

- Statements from Carlos Torres Vila - TV

- 1Q20 Results Presentation (Analysts) (PDF)

- Statements from Carlos Torres Vila - Radio

- 'La Vela', main building in the 'Ciudad BBVA' (JPG)

- Carlos Torres Vila and Onur Genç (JPG)

- Statements from Group Executive Chairman (Text)

- Carlos Torres Vila, BBVA Group Executive Chairman (1Q20) (JPG)

Carlos Torres Vila: "We are facing a global health crisis that is having a huge impact. In this situation, we all have to step up and make a difference. At BBVA, we have focused on what is most urgent, saving lives, with a global donation plan of more than €35 million, earmarked for the purchase of essential medical equipment, support for social groups at risk and scientific research on the disease. At the same time, we have focused on supporting our customers, offering individuals flexibility in their payments, and providing companies the liquidity they need to face this crisis. The recurrence of our pre-provision profit and our solid capital and liquidity position have allowed us to face this crisis from a position of strength and frontload provisions related to the pandemic in this quarter".

The BBVA Group started the year with yoy growth across all revenue items of the income statement, and the highest operating income in a decade.

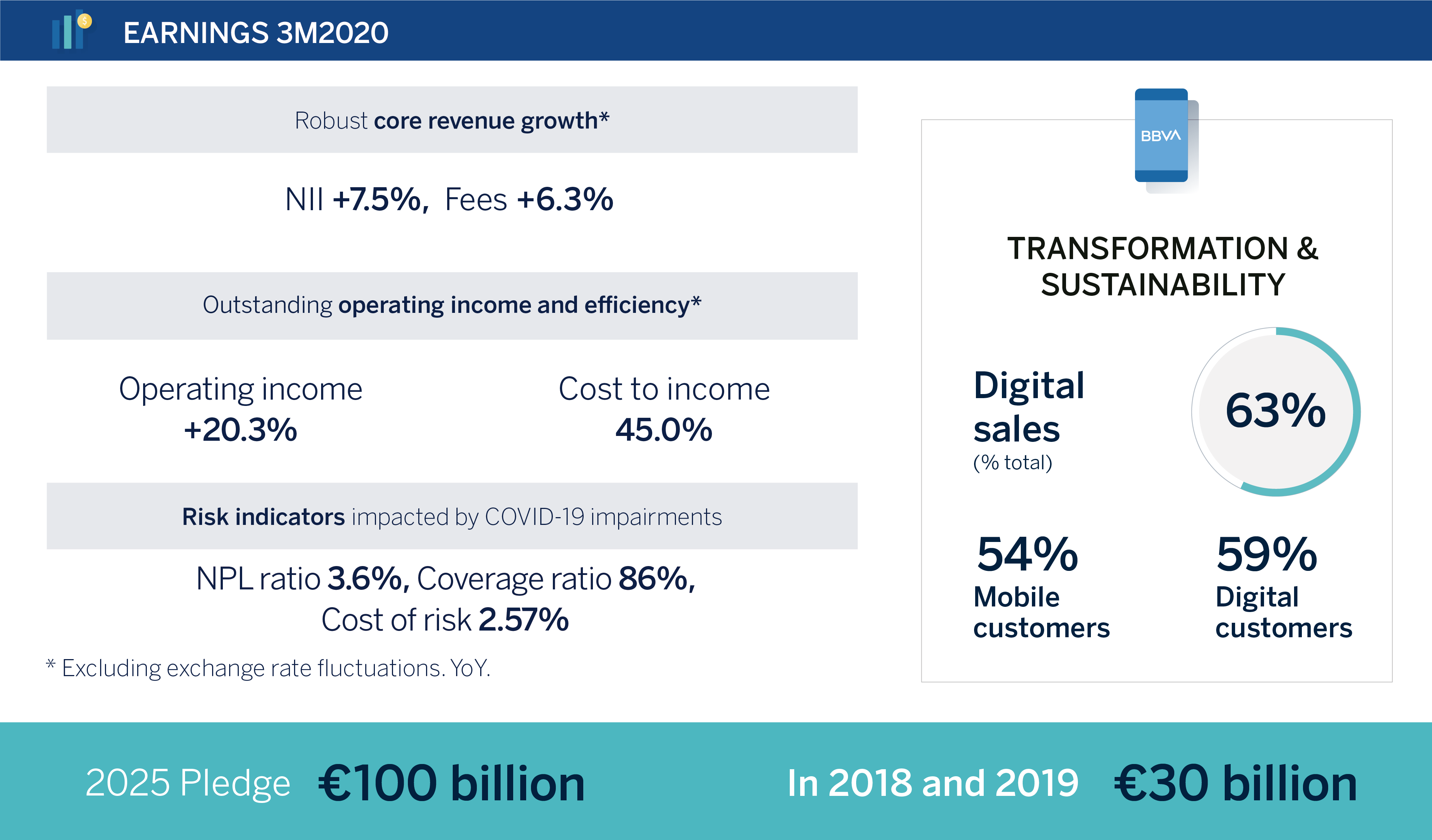

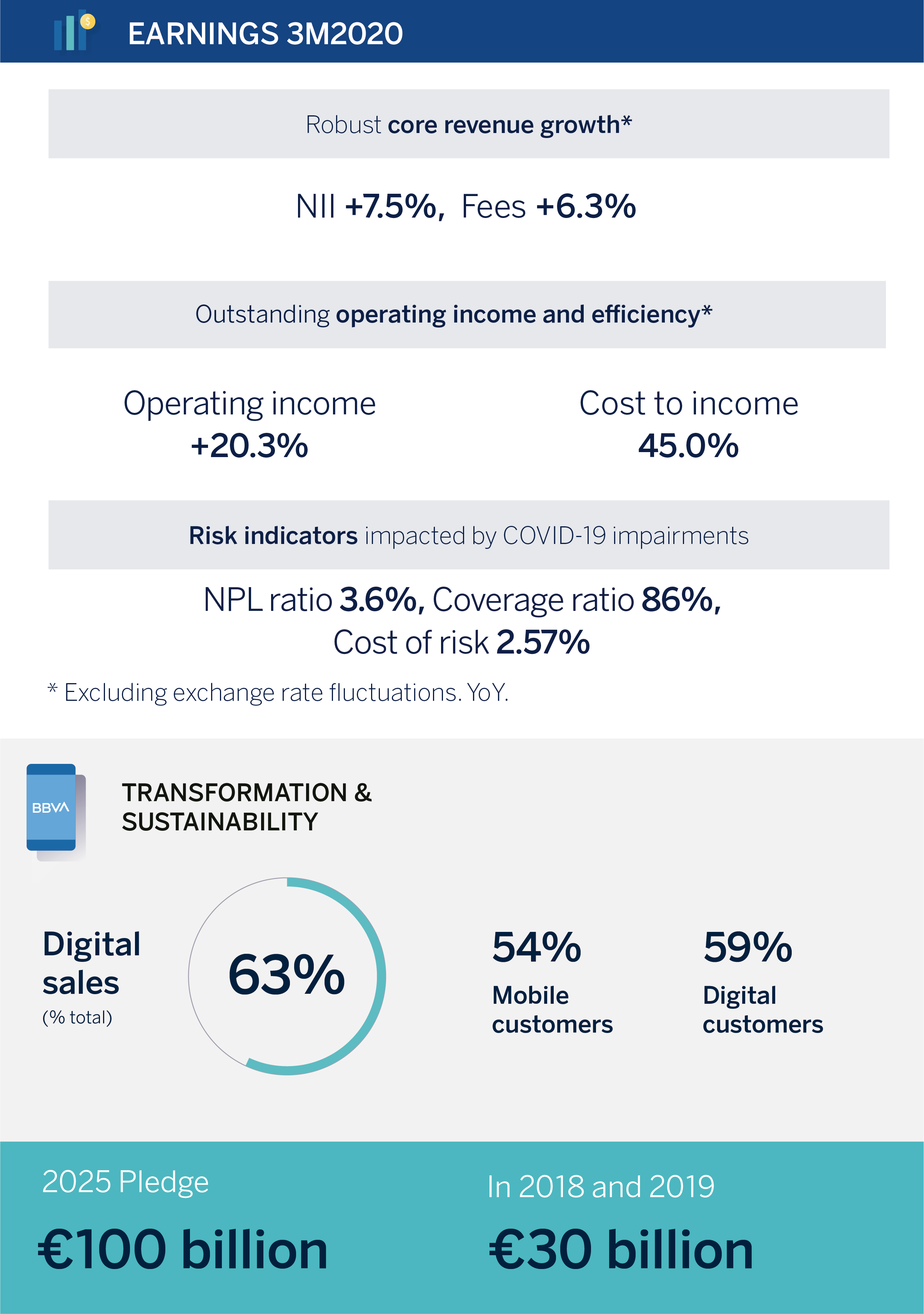

BBVA’s net interest income reached €4.56 billion between January and March, which represents a 7.5 percent yoy increase at constant exchange rates (+3.6 percent at current exchange rates), on the back of a solid business performance in Turkey, South America and, to a lesser extent, Mexico. Net fees and commissions, which received remarkably positive contributions from Spain and the U.S. units, stood at €1.26 billion, up 6.3 percent yoy at constant exchange rates (+3.6 percent taking into account exchange rate fluctuations). Overall, recurring revenues (net interest income and fees and commissions) grew 7.2 percent in the quarter at constant exchange rates (+3.6 percent at current rates).

Net Trading Income (NTI) increased 54.6 percent yoy at constant exchange rates in 1Q20 (+39.5 percent at current exchange rates), to €594 million. This item was positively impacted by the Corporate Center’s gains on foreign exchange rate hedging. Gross income reached €6.48 billion, (+11.4 percent at constant exchange rates, +7.2 percent at current rates).

Operating expenses remained contained at €2.92 billion in 1Q20, after increasing only 2.2 percent at constant rates vs. the same period a year earlier (-0.1 percent at current exchange rates). The average inflation rate across BBVA’s footprint was 5.2 percent in the past 12 months. This containment in operating expenses and the positive evolution of recurring revenue allowed for operating jaws to remain in positive territory. As for the efficiency ratio, it improved significantly, at 45 percent by March-end (the best level since March 2011), compared to 49 percent in 2019, casting an even more favorable comparison against BBVA’s European peers (with an average efficiency ratio of 65.2 percent as of December 2019, the latest available figure).

Despite the environment, operating income grew a remarkable 20.3 percent at constant exchange rates to €3.57 billion (+14.1 percent at current exchange rates), the highest of the past 10 years. This strong growth allowed the Group to absorb a €1.43 billion charge related to impairments for COVID-19.

The Group reported a negative result of €-1.79 billion in 1Q20 as a result of the aforementioned provisions and the €2.08 billion goodwill impairment at the U.S. unit. This accounting adjustment is related to lower expectations in interest rates in the country and the economic slowdown. It has no impact on tangible net equity, capital, or liquidity of the BBVA Group. It is included in the line of ‘Other results’ of the Corporate Center.

In terms of value creation for the shareholder, the tangible book value per share plus dividends stood at €6.04 as of March 2020 (1.7 percent more than a year earlier). Following the European Central Bank’s recommendation issued on March 27th related to dividend distributions during the COVID-19 pandemic, the Board of Directors has decided that BBVA will not pay any dividend amount against 2020 results until the uncertainties caused by COVID-19 disappear and, in any case, never before the end of the fiscal year.

The fully loaded CET1 capital ratio stood at 10.84 percent as of March 31, 2020, losing 90 basis points since the end of 2019, due to the impact of market trends in 1Q20, higher activity and the front-loaded provisions related to COVID-19. Going forward, BBVA Group's goal is to keep a buffer exceeding its new ratio requirement (currently at 8.59 percent) within a target range of 225 to 275 basis points. The current level is within the range.

As for risk indicators, the NPL coverage ratio increased to 86 percent in March 2020 (compared to 77 percent in Dec. 2019), and the cumulative cost of risk to 2.57 percent, both as a result of the increase of loan-loss provisions during the quarter (1.16 percent excluding the impairments on financial assets due to COVID-19). The NPL ratio stood at 3.6 percent as of March 2020 (compared to 3.8 percent in Dec. 2019).

Regarding balance sheet and business activity, in the last three months loans and advances to customers remained virtually stable at Group level (€382.59 billion as of March 31, 2020). Loans to companies increased by €10 billion in 1Q20, which helped offset the drop in retail and public sector loans. Customer deposits also remained almost unchanged at €385.05 billion. Finally, off-balance sheet funds declined 10.5 percent as a result of poor market performance due to COVID-19.

The BBVA Group is facing a scenario of uncertainty and a severe global recession caused by the COVID-19 pandemic from a position of strength.

First, due to the recurrence and stability of its operating income as proven in preceding crises.

Second, BBVA has continuously demonstrated its great capacity to generate capital, multiplying its capital base by 2.3 times compared to 2008 levels. Finally, BBVA Group’s excellent capital quality is evidenced by its solid leverage ratio, which remains clearly above its peer group’s average (6.2 percent versus 5.1 percent).

In regards to liquidity, the Group maintains a comfortable position, with a liquidity coverage ratio (LCR) and a Net Stable Funding Ratio (NSFR) of 134 percent and 120 percent, respectively, as of March 31, 2020, comfortably above regulatory requirements (over 100 percent). Also, the Group has mainly a retail and long-term funding structure, with a loan-to-deposits ratio of about 100 percent across its footprint.

BBVA’s priorities during the COVID-19 crisis

During the COVID-19 crisis the BBVA Group’s priorities are the health and safety of its employees, customers, and society as a whole; business continuity to keep delivering an essential service in the countries where it operates; and financial support for its customers.

To help society fight the pandemic, BBVA has pledged a €35 million global donation to support health authorities and social organizations, as well as to promote scientific research. Additionally, BBVA employees have donated over €1 million across the world.

Among the measures adopted to protect its employees, BBVA implemented a remote work program across its footprint. As a result, 95 percent of its central services workforce and 71 percent of its branch employees are currently working from home. BBVA has also promoted the use of remote channels to interact with the bank. While 54 percent of branches are currently open, digital sales at Group level accounted for 63.4 percent of total unit sales in March, vs. 59.9 percent in February. BBVA’s leadership in digital and mobile banking is, in this context, a competitive advantage to provide service to customers during lockdown.

BBVA truly believes to be a part of the solution to this crisis and has put in place initiatives of financial support across its footprint to support those bearing the brunt of it. In general terms, the Group has announced a series of repayment flexibility measures for different types of loans and other products, such as insurance policies; is proactively supporting its most vulnerable customer segments, such as unemployed and retirees, advancing the payment of their benefits; and has also rolled out different liquidity and financing measures, especially for self-employed workers and SME businesses.

Additionally, the BBVA’s team running the bank on a global level and in the different countries, a group of around 300 people, has foregone its variable compensation for 2020.

Business Areas

In Spain, lending grew 1 percent compared to December 2019, driven by the corporate banking segments and CIB. In the P&L account, recurring revenues increased 5.5 percent compared to the 1Q19, thanks to the uptick in fees and commissions. This and a favorable evolution of operating expenses, which beat expectations with a decline of 4.4 percent over the same period, allowed operating income to grow 10.3 percent yoy, to €728 million. However, loan-loss provisions in anticipation of the COVID-19 impact on the macroeconomic scenario (€517 million) caused the attributable profit to close at €-141 million.

In the United States, lending activity increased 8.1 percent during 1Q20, driven by the dynamism of the commercial and corporate banking portfolios. As for earnings, it is worth mentioning the double-digit growth of the operating income (+16.4 percent) in 1Q20 compared to the last quarter of 2019, despite a drop in net interest income in the same period (-6.3 percent at constant exchange rates) due to the interest rate cuts implemented by the Federal Reserve. The net attributable profit was €-100 million due to loan-loss provisions related to the COVID-19 crisis and higher provisions in the corporate portfolio, especially in Oil & Gas companies (€280 million).

In Mexico, lending remained strong throughout 1Q20 (+7.8 percent compared to Dec. 2019), driven mainly by the wholesale portfolio. Mexico’s operating income showed a remarkable resilience in the current context (with growth of 6.3 percent at constant exchange rates compared to 1Q19), thanks to revenue growth (with gross income growing 6.0 percent in the period) and the area’s ability to maintain positive operating jaws. The attributable profit reached €372 million, down 39.9 percent yoy at constant euros, due to, once again, the volume of loan-loss provisions related to the COVID-19 crisis (€320 million).

In Turkey, lending activity during the quarter had a positive evolution, both in dollars and Turkish lira. Operating income increased to a yoy rate of almost 48 percent at constant exchange rates, driven by net interest income (+30.2 percent), which benefited from both growth in loan volumes and lower cost of deposits, and also a containment in expenses growth (+9.3 percent at constant exchange rates, compared to an average inflation of 13.5 percent in the last twelve months). Net attributable profit in 1Q20 stood at €129 million, in line with the results of 1Q19, after absorbing provisions, as in other geographies, to accommodate the economic downturn caused by COVID-19 (€169 million).

In South America, the area’s lending activity increased 4.3 percent (at constant exchange rates) in the quarter, with positive contributions from all the countries as a result of the growth in the wholesale portfolio, driven by the increase in drawdowns in business credit lines. The area posted a net attributable profit of €70 million (-53.8 percent yoy at constant exchange rates), mainly as a result of higher impairments of financial assets caused by the COVID-19 crisis.

BBVA is a customer-centric global financial services group founded in 1857. The Group has a strong leadership position in the Spanish market, is the largest financial institution in Mexico, it has leading franchises in South America and the Sunbelt Region of the United States. It is also the leading shareholder in Turkey’s Garanti BBVA. Its purpose is to bring the age of opportunities to everyone, based on our customers’ real needs: provide the best solutions, helping them make the best financial decisions, through an easy and convenient experience. The institution rests in solid values: Customer comes first, we think big and we are one team. Its responsible banking model aspires to achieve a more inclusive and sustainable society.