BBVA's tax contribution in 2020: €8.33 billion worldwide

Just as every year since 2012, BBVA has voluntarily released its Global Tax Contribution report. In 2020, the Group carried out an additional exercise of transparency including, for the first time ever, non-financial public information in standard GRI 207. This standard allows entities to disclose comparable information regarding their fiscal strategy, governance model and tax risk management, as well as their contribution on a per country basis. Overall, BBVA Group’s worldwide tax contribution in 2020 amounted to €8.33 billion.

Although BBVA already disclosed information on all the topics covered in GRI 207, this year it adapted its disclosures to this new standard in order to allow third parties to establish tax benchmarks and performance indicators. This decision is part of the Group's commitment to transparency, as stated by BBVA Chairman Carlos Torres Vila in the report itself: "At BBVA we consider responsible taxation as part of our commitment to society."

The BBVA Group paid €3.29 billion euros in own taxes in 2020

In financial year 2020, the total tax contribution resulting from BBVA Group's activity across its footprint amounted to €8.33 billion. Of these, €3.29 billion were paid in own taxes, including the Corporate tax and Social Security Contributions by the company; and €5.04 billion in taxes withheld on payments to third parties, including withholdings on account of the income tax of employees and shareholders.

Of the own tax total paid by the Group, €1.56 billion were paid as Corporate Income tax. This means that BBVA Group devoted 43.51 percent of its earnings before taxes to the payment of Corporate Income tax.

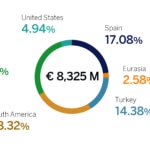

By geographies, last year BBVA paid 17 percent of its taxes in Spain, 28 percent in South America; almost 33 percent in Mexico, a bit over 14 percent in Turkey and nearly 5 percent in the U.S. The remaining 2.6 percent corresponds to the payment of taxes in Eurasia.

BBVA

Specifically, in Spain, BBVA paid €111 million in own taxes last year, on top of the €1.31 billion in third-party taxes that it managed, for a total tax contribution of €1.42 billion.

To calculate the total tax contribution in a fiscal year, BBVA applies PwC’s Total Tax Contribution methodology (or TTC), which factors in the different taxes (Corporate Income, VAT, contributions to Social Security, etc.) that a company or corporation pays as a result of its own activity and the taxes it manages acting as intermediary on behalf of the tax agencies in each country or region where it operates.

BBVA

Taxation and sustainability, hand in hand

"For BBVA, there is a direct relationship between taxation and sustainability," explains José María Vallejo, the Director of BBVA's Tax Advisory Area. In his opinion, "Taxes are essential in order to maintain a sustainable state of well-being. BBVA therefore takes on its condition of taxpayer with great responsibility. It isn't just about complying with the law, but serving as an example. And to do so, transparency regarding how much is paid and where is fundamental, as is the participation of the bank's highest governing bodies in developing our fiscal strategy through a robust model of corporate governance."

In this sense, BBVA's fiscal strategy is aligned with the OECD/G20 Base Erosion and Profit Shifting (BEPS) Project and the UN Sustainable Development Goals and the protection of Human Rights.

Commitment to best practices in tax related matters

BBVA’s commitment to transparency is not limited to the disclosure of its total tax contribution. Besides adopting standard GRI 207, last year, BBVA received the highest possible score (100 points) in the section on fiscal strategy, according to the Dow Jones Sustainability Index, the international sustainability, an international sustainability benchmark carried out by rating agency SAM, part of S&P Global.

Also in 2020, BBVA promoted the publication of a study on the total tax contribution of a group of European multinationals by European Business Tax Forum. In Spain, BBVA also collaborated in the Total Tax Contribution of Ibex 35 report published by PwC in in 2019.