BBVA earns €5.45 billion through June, expects accumulated profit of €48 billion for 2025-2028, with an average ROTE of about 22 percent

BBVA posted a record €5.45 billion profit, up 9 percent yoy (+31 percent in constant euros) in the first half of 2025, driven by greater activity in Spain and Mexico. The bank reported excellent metrics in profitability -with ROTE above 20 percent-, and value creation for shareholders, with growth of the tangible book value per share plus dividends of nearly 15 percent. BBVA also improved its profitability and efficiency prospects at Group level, as well as lending and net interest income for Spain, among others. The bank also unveiled its financial goals for the 2025-2028 period. It expects to earn an accumulated net attributable profit of around €48 billion over four years, while having €36 billion of highest-quality capital available for distribution to shareholders through 2028¹. Furthermore, BBVA expects average ROTE to reach around 22 percent during this period, with the efficiency ratio improving to levels around 35 percent. The bank also set a goal to increase the tangible book value per share plus dividends by around 15 percent (CAGR).

¹ Subject to the approval of the corresponding governing bodies and the required regulatory authorizations.

Press kit

- Quarterly Report 2Q25 (PDF)

- Results Presentation Analysts 2Q25 (PDF)

- Download Onur Genç video (WeTransfer)

- Download Onur Genç video - Webs (YouTube)

- Download Onur Genç audio (WeTransfer)

- Statement on BBVA 2Q25 earnings from Onur Genç (Text) (pdf)

- BBVA CEO Onur Genç (JPG)

- Ciudad BBVA (JPG)

- Onur Genç, BBVA CEO, during the press conference (JPG)

- Luisa Gómez (CFO), Onur Genç (CEO) y Paula Puyoles (Communications) at the press conference (JPG)

“BBVA is living through one of the best moments of its history. We are one of the most profitable banks in Europe, with the best growth profile, with truly leading franchises in our main markets and excellent prospects for the future, ” said BBVA CEO Onur Genç.

Except where otherwise stated, the evolution of each of the main headings and changes in the income statement described below refer to constant exchange rates. In other words, they do not take currency fluctuations into account.

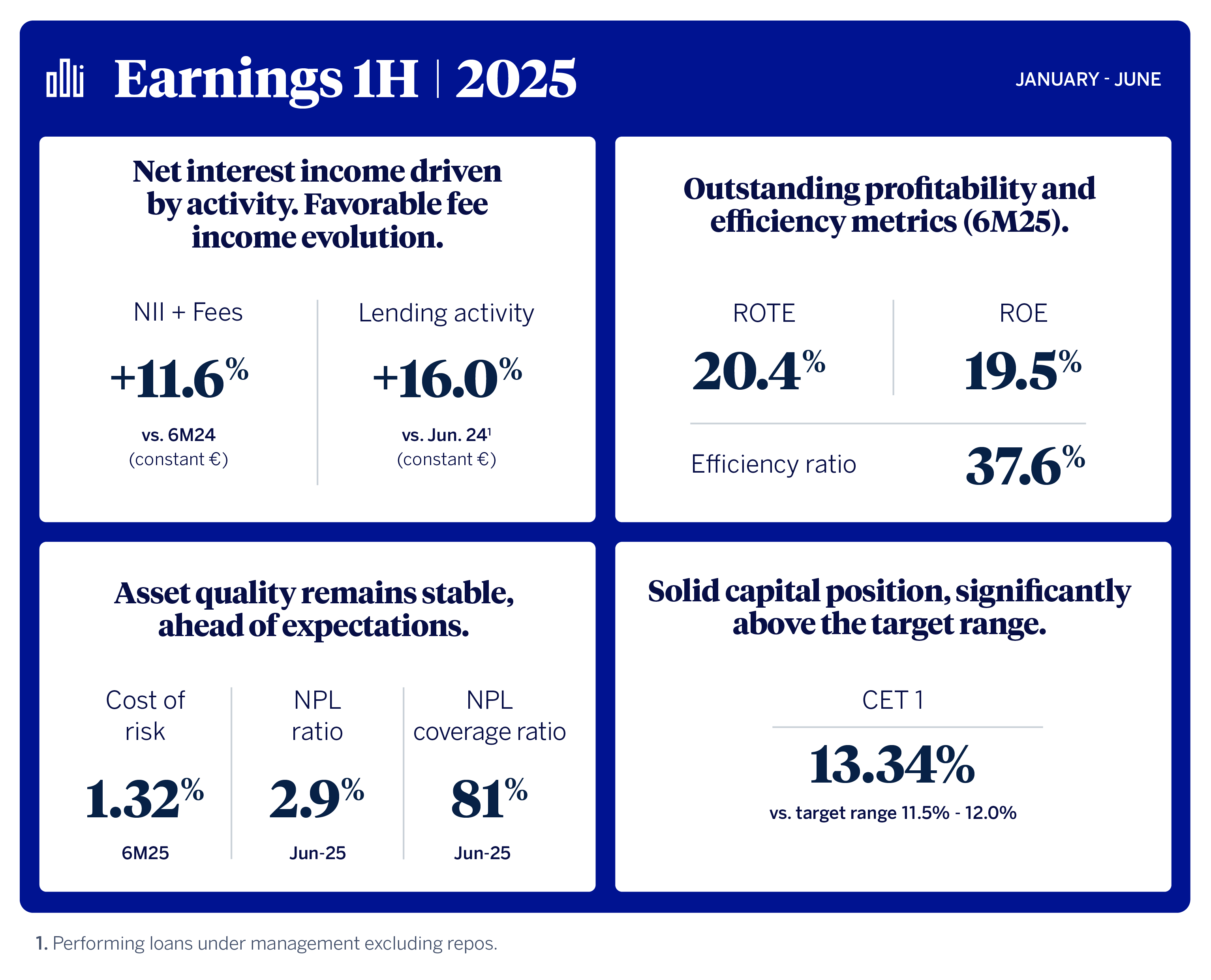

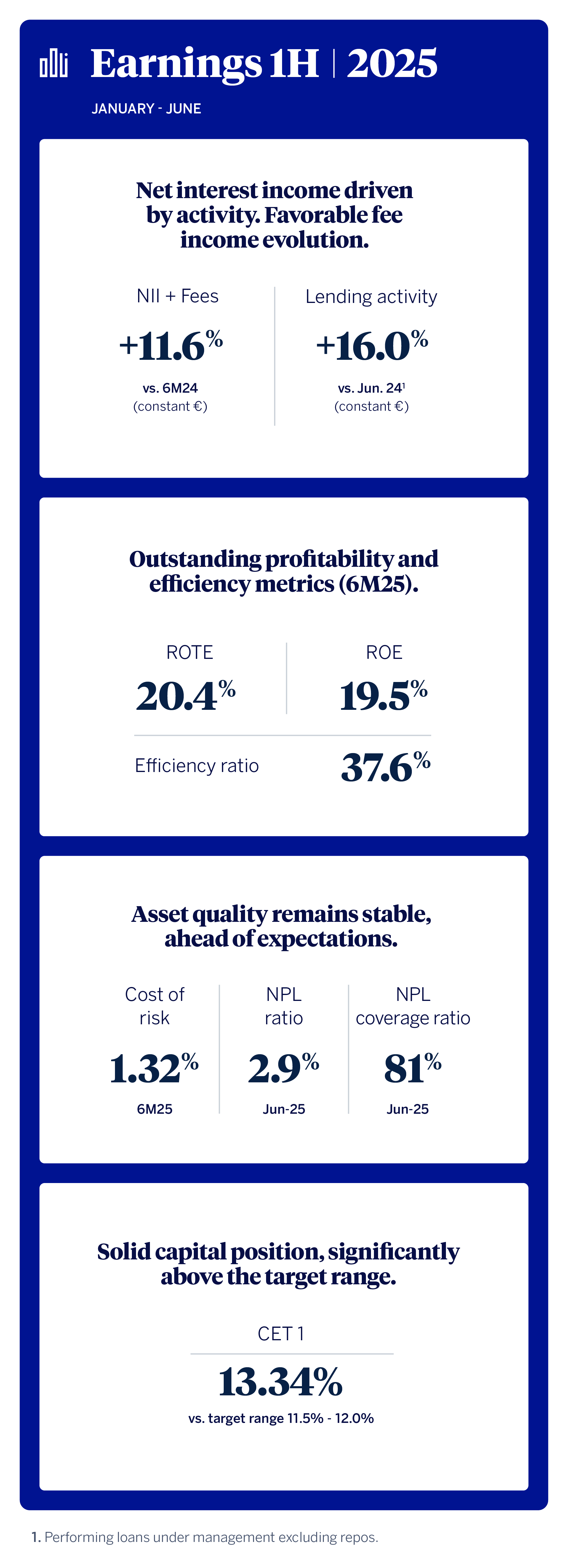

At the top of the P&L account, net interest income stood at €12.6 billion, up 10 percent yoy, boosted by significant activity in Spain and Mexico (+6.3 percent and +11.7 percent, respectively).

Net fees and commissions grew by 18 percent yoy, to €4 billion, driven mostly by payments and asset management. The sum of NII and fees, which represent the core revenues of the banking business, increased by 12 percent, to €16.6 billion.

NTI contribution was €1.43 billion, down 13 percent yoy.

The line of other operating income and expenses showed a significant improvement in 1H25 vs the same period a year earlier, on the back of a lower impact for hyperinflation in Argentina and Türkiye and the good performance of the insurance business. Likewise, this year’s heading compares favorably vs last year’s, when it registered the total annual extraordinary tax on banking institutions in Spain in 1Q24 (€285 million)².

Gross income reached €18 billion in 1H25, up 20 percent yoy.

Operating expenses grew by 10 percent yoy, to €6.79 billion. This increase is below the average inflation in the Group’s footprint (13.4 percent) over the past 12 months. The solid performance of gross income and the containment of expenses helped to maintain positive jaws, while the efficiency ratio improved 322 basis points compared to June 30, 2024, to 37.6 percent.

As a result of all the above, operating income stood at €11.25 billion, up 26 percent yoy.

Impairments on financial assets increased 10 percent yoy, due to greater loan growth in the most profitable segments. Risk indicators remained stable, at better than expected levels: the accumulated cost of risk in 1H25 stood at 1.32 percent, while the NPL ratio and the coverage ratio at the end of June were 2.9 percent and 81 percent, respectively.

BBVA posted a record net attributable profit of €5.45 billion in 1H25, up 31 percent from a year earlier (+9 percent in current euros), cementing the growing trend of recent years. In 2Q25, net attributable profit stood at €2.75 billion, up 18 percent yoy.

The Group also showcased profitability metrics that were above those of its European peers: ROTE stood at 20.4 percent while ROE was 19.5 percent. Furthermore, the tangible book value per share plus dividends rose 14.6 percent vs a year earlier, to €10.13.

As for capital, the CET1 ratio showed significant growth in the quarter, 25 bps, to 13.34 percent, a level well above both the requirement (9.12 percent) and the target range (11.5-12 percent).

Finally, in 1H25, BBVA added 5.7 million new customers, while the loan book grew by 16 percent in constant euros, all of which helped to generate a very positive impact on society: 77,000 families purchased a home, the bank granted 500,000 new loans to SMEs and the self-employed, and 73,000 larger corporates had financing to invest in their growth.

BBVA improved its prospects for 2025 in several key indicators. Specifically, the BBVA Group expects ROTE to stand at around 20 percent, with the efficiency ratio below 40 percent. In Spain, it expects a greater increase in lending (above 5 percent, surpassing the financial sector), as well as increasing NII and fees and commissions. Additionally, expenses and the cost of risk are expected to be below the estimates at the beginning of the year. In Mexico, it expects a 10 percent increase in lending, with a cost of risk below 350 basis points. In South America, it foresees the cost of risk to remain below 250 bps.

Furthermore, in the short term BBVA will have about €13 billion available for distribution to its shareholders¹.

Business areas

Growth in lending activity and customer funds stood out in Spain. Loans increased by more than 6 percent yoy, with a solid performance of commercial, consumer and cards. Customer funds grew by 5 percent yoy, with significant growth in off-balance sheet funds. Spain posted a net attributable profit of €2.14 billion in 1H25 (+21 percent vs 1H24), driven by core revenues, and particularly NII (+1.5 percent), amid a context of lower interest rates. Risk indicators performed better than expected and remained virtually stable vs March 2025: from January the accumulated cost of risk stood at 0.32 percent, coverage ratio was 61 percent, and the NPL ratio stood at 3.5 percent.

Mexico contributed to the Group’s earnings with €2.58 billion, up 6 percent yoy. Lending showed solid growth (+12 percent yoy), with a significant performance of all segments. Customer funds also grew at a solid pace (+15 percent). The strong activity, together with effective price management, boosted NII growth (+9 percent yoy). Furthermore, loan-loss provisions increased in the face of a more adverse macroeconomic scenario, which drove the accumulated cost of risk higher, to 3.24 percent, a better than expected performance, nonetheless. At the end of June the NPL ratio stood at 2.7 percent, and the coverage ratio was 125 percent.

In Türkiye, growth in lending was noteworthy, both in Turkish lira (+42 percent yoy) and foreign currency (+21 percent). Customer deposits also increased handsomely, particularly in Turkish lira (+40 percent yoy). The solid performance of lending and the improvements in customer spreads in Turkish lira boosted NII. Net attributable profit in 1H25 stood at €412 million, up 17 percent in current euros, as a result of a better performance of core revenues and a lower impact from hyperinflation. As for asset quality indicators, the accumulated cost of risk at the end of June stood at 1.64 percent, the NLP ratio was 3.4 percent, and the coverage ratio stood at 86 percent.

In South America, growth in lending activity (+16 percent) and customer funds (+18 percent) stood out. The area reported a net attributable profit of €421 million in 1H25, up 33 percent in current euros, as a result of a lower adjustment for hyperinflation in Argentina and a more contained level of impairments. In the country breakdown, Peru posted a net attributable profit of €156 million, Argentina earned €91 million, and Colombia reported €73 million. Risk indicators saw an improvement in the region. The cost of risk shrank to 2.33 percent, and the NPL ratio stood at 4.2 percent. The coverage ratio remained virtually stable at 89 percent.

Medium-term financial goals

BBVA also presented its financial goals for the 2025-2028 period -not including the impact from the transaction with Banco Sabadell-, which are part of the strategic plan presented at the beginning of the year. Specifically, the bank expects ROTE to stand around 22 percent, with the efficiency ratio improving to levels around 35 percent. Likewise, BBVA plans to continue creating value for shareholders, with an increase in the tangible book value per share plus dividends of around 15 percent (CAGR). Finally, the bank aims to reach an accumulated net attributable profit of approximately €48 billion over four years.

Revenue growth and value creation

These goals are supported by several plans that will provide a significant boost to revenue growth and value creation:

- Ongoing improvement of market share thanks to customer base growth.

- BBVA’s core countries will improve even further its high profitability, driven by activity and a lower cost of risk.

- Improvement of the franchises now operating in countries with hyperinflation (mainly Türkiye and Argentina), in particular in the second part of the 2025-2028 period.

- A significant increase in the contribution to earnings from the corporate segments and Corporate & Investment Banking, on the back of cross-border businesses and sustainability.

- An emphasis in business segments with higher revenues in commissions, such as insurance, asset management, and in transactional products.

Furthermore, the bank will amplify the impact through two additional levers: an active management of the balance sheet in order to optimize the use of capital and productivity programs through ‘Next Gen’ technologies and artificial intelligence.

Goals for geographical areas are as follows:

Capital generation available for distribution

BBVA expects to have approximately €49 billion of highest quality capital, or CET1, over the 2025-2028 period. The bank expects to generate organically €39 billion in capital over four years, and an additional €5 billion through securitizations and significant risk transfers (SRT). Moreover, BBVA already had €4.5 billion in excess capital above the 12 percent CET 1 ratio, at the end of 2024³.

Of this capital, BBVA will use about 30 percent to invest in growth (approximately €13 billion) and the remaining 70 percent would be available for distribution to shareholders -about €36 billion. Of this amount, taking into account a maximum payout of 50 percent set in BBVA’s dividend policy, €24 billion would be ordinary distributions; and the rest, €12 billion, would be excess capital above the 12 percent of CET1, available for distribution. In both cases, distribution to shareholders will materialize through cash dividends or share buybacks¹.

¹ Subject to the approval of the corresponding governing bodies and the required regulatory authorizations.

² In 2025, the accrual of the new tax on NII and fees and commissions is being registered under the income tax heading. The amount for 1H25 is approximately €150 million, of which €65 million have been registered in 2Q25.

³ Includes the €993 million share buyback pending of execution.

About BBVA

BBVA is a global financial services group founded in 1857. The bank is present in more than 25 countries, has a strong leadership position in the Spanish market, is the largest financial institution in Mexico and it has leading franchises in South America and Turkey. BBVA contributes with its activity to the progress and welfare of all its stakeholders: shareholders, clients, employees, providers and society in general. In this regard, BBVA supports families, entrepreneurs and companies in their plans, and helps them to take advantage of the opportunities provided by innovation and technology. Likewise, BBVA offers its customers a unique value proposition, leveraged on technology and data, helping them improve their financial health with personalized information on financial decision-making.