Earnings: BBVA Posts Record Profit of Nearly €8 Billion through September, Driven by Solid Lending Growth and Core Revenues

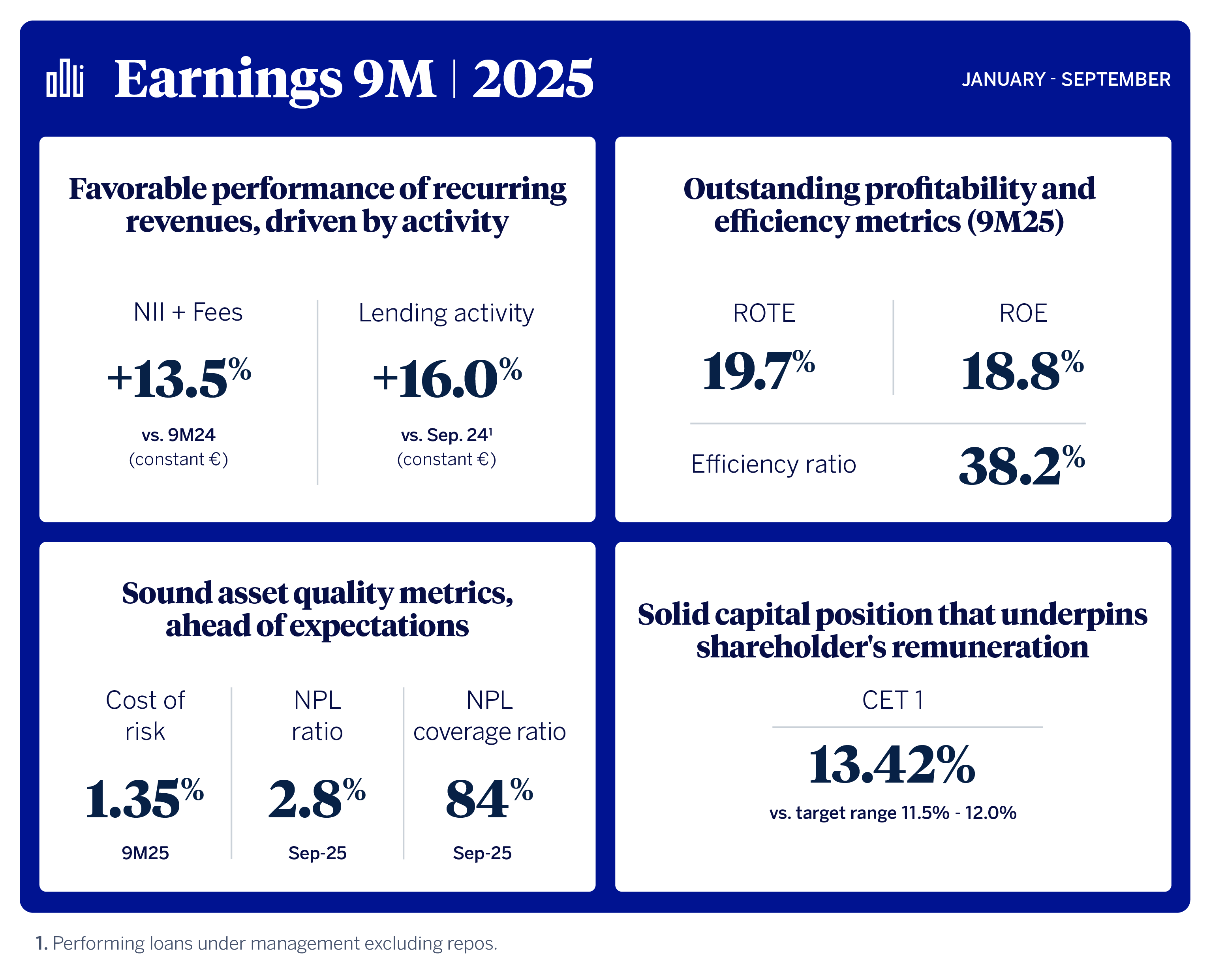

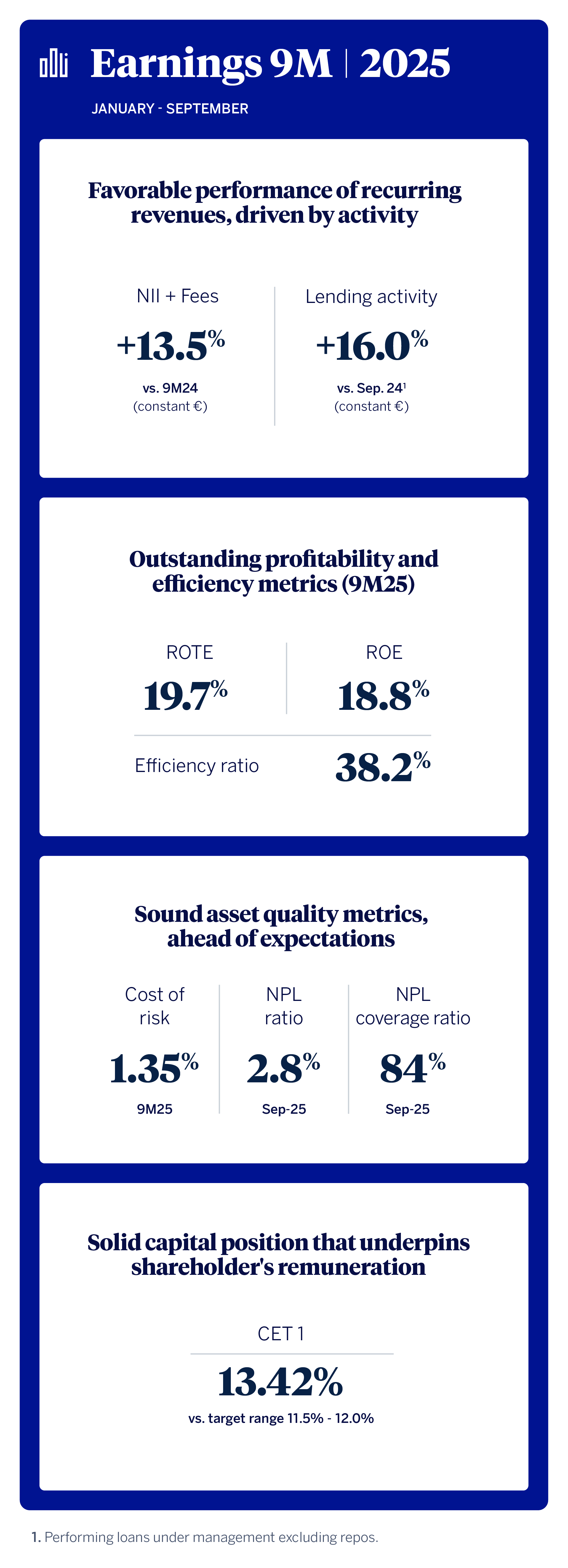

BBVA posted an excellent set of earnings in the first nine months of 2025, driven by solid activity growth (+16 percent in constant euros) and momentum in core revenues (+13.5 percent in constant euros). Net attributable profit reached a record €7.98 billion through September, up 4.7 percent from a year earlier (+19.8 percent in constant euros). The Group continued to show outstanding profitability metrics, with ROTE at nearly 20 percent; while creating value for its shareholders, with an increase of the tangible book value per share plus dividends of 17 percent over the past 12 months. The strength of the CET1 capital ratio, which stands at 13.42 percent, has prompted to accelerate the remuneration plans for BBVA shareholders: on Oct. 31, the bank will start executing the pending share buyback for €993 million; on Nov. 7, it will pay the highest interim dividend ever (€0.32 per share), for a total of €1.84 billion; and, as soon as it receives the authorization from the European Central Bank (ECB), it will launch a significant additional share buyback program¹.

Press kit

- Quarterly Report 3Q25 (PDF)

- Results Presentation Analysts 3Q25 (PDF)

- Download Onur Genç video (WeTransfer)

- Download Onur Genç video - Webs (YouTube)

- Download Onur Genç audio (WeTransfer)

- Statement on BBVA 3Q25 earnings from Onur Genç (PDF)

- BBVA CEO Onur Genç (JPG)

- Ciudad BBVA (JPG)

- Onur Genç, BBVA CEO, during the press conference (JPG)

- Luisa Gómez (CFO) and Onur Genç (CEO) at the press conference (JPG)

“BBVA reported excellent results, with a record net attributable profit, return on tangible equity close to 20 percent and a comfortable capital position, which allow us to accelerate our shareholder remuneration. Looking ahead, we will continue to execute our Strategic Plan with determination to achieve the ambitious financial goals we have set for the period 2025-2028. This roadmap will further strengthen our leading position in terms of growth and profitability among European banks,” BBVA CEO Onur Genç said.

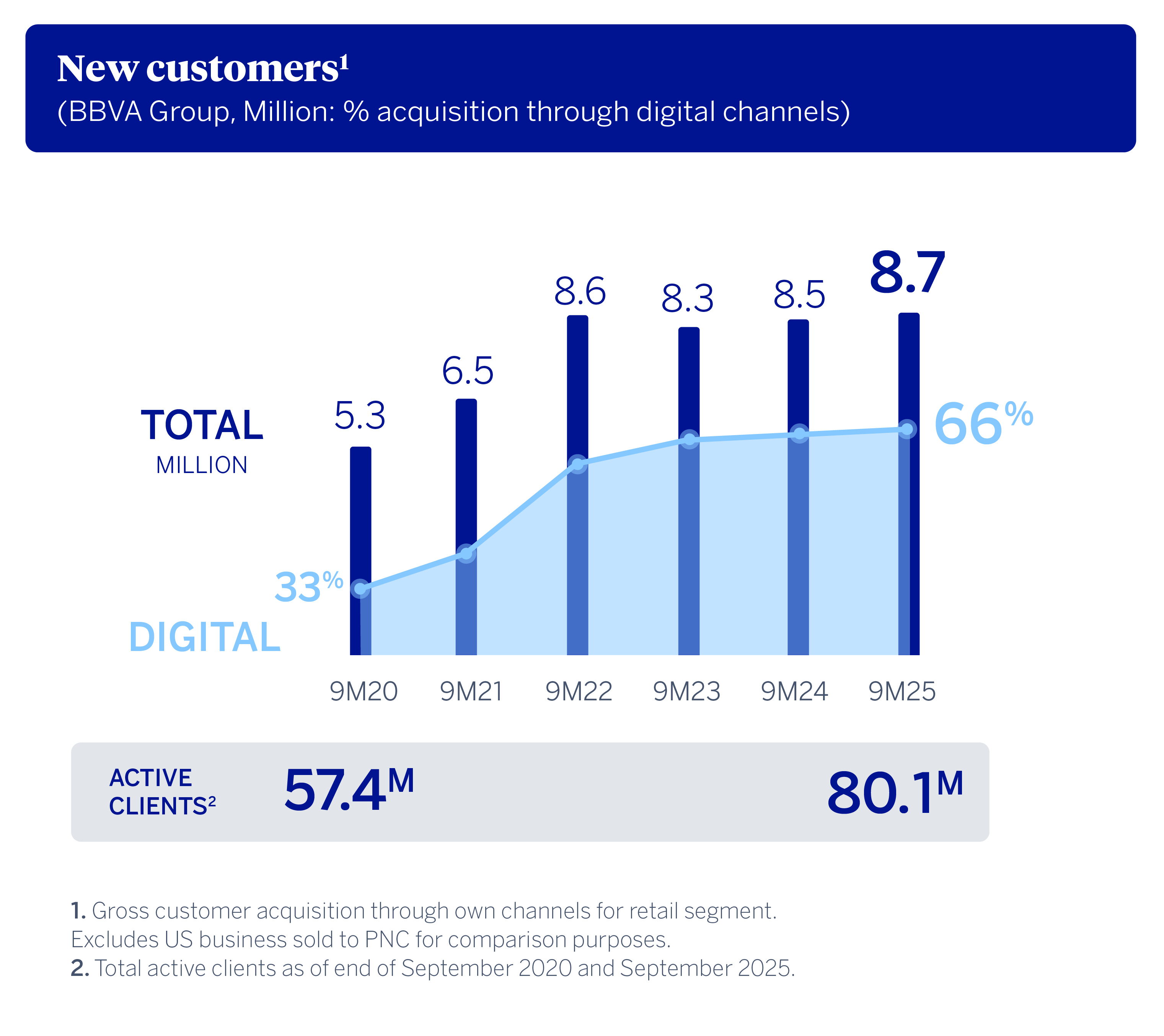

The solid business activity drove BBVA’s earnings in the first nine months of 2025. As of Sept. 30, lending increased by 16 percent yoy in constant euros, with noteworthy performances in Spain (+7.8 percent) and Mexico (+9.8 percent). Furthermore, from January through September, the BBVA Group added a record 8.7 million new customers, of which 66 percent joined via digital channels. Thanks to this acquisition effort, the active customer base surpassed 80 million at the end of 3Q25.

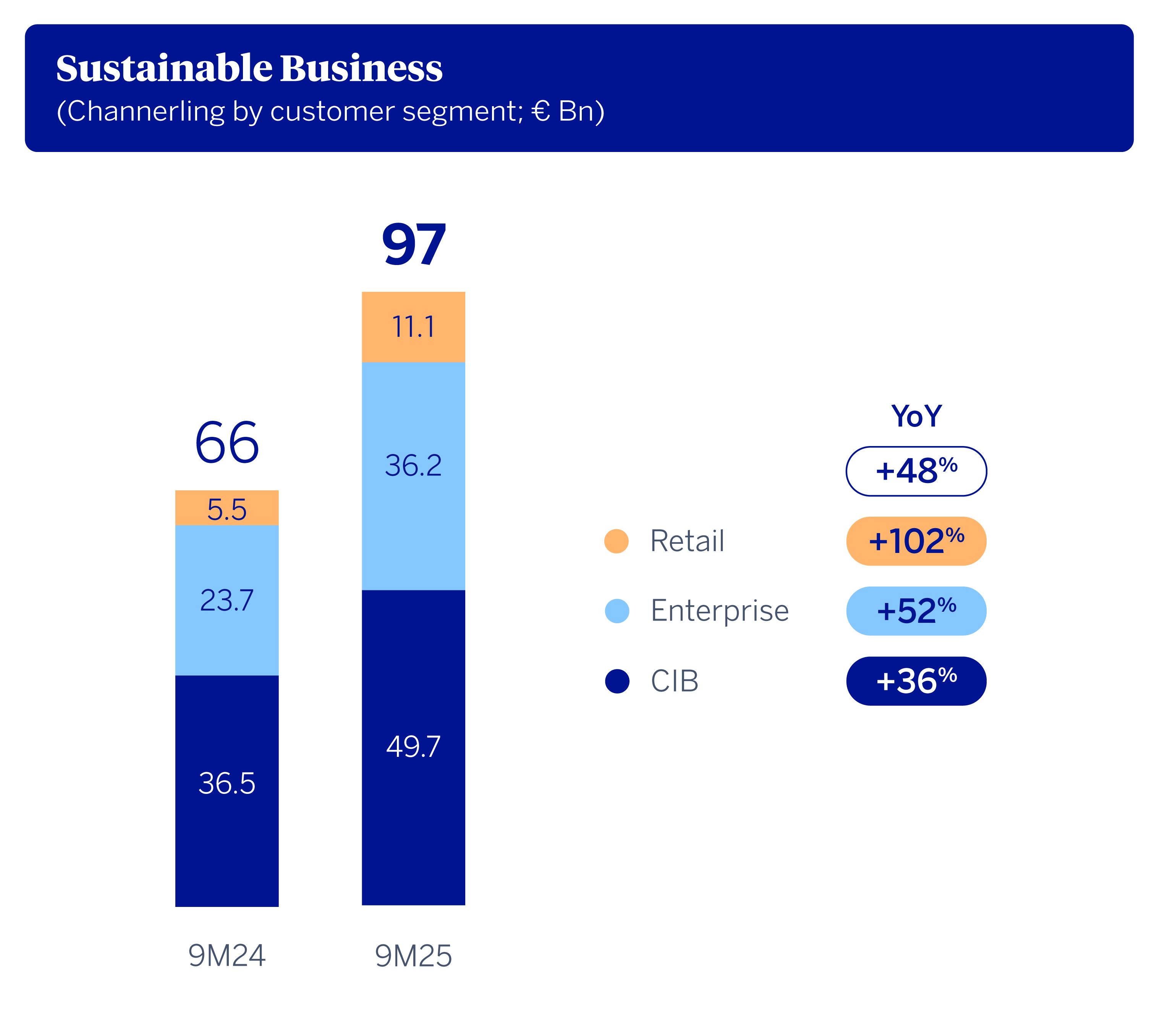

Additionally, the sustainable business maintained momentum as a key growth driver. Through September, BBVA channeled €97 billion in transactions related to environmental or social impact, up 48 percent from a year earlier.

Except where otherwise stated, the evolution of each of the main headings and changes in the income statement described below refer to constant exchange rates. In other words, they do not take currency fluctuations into account.

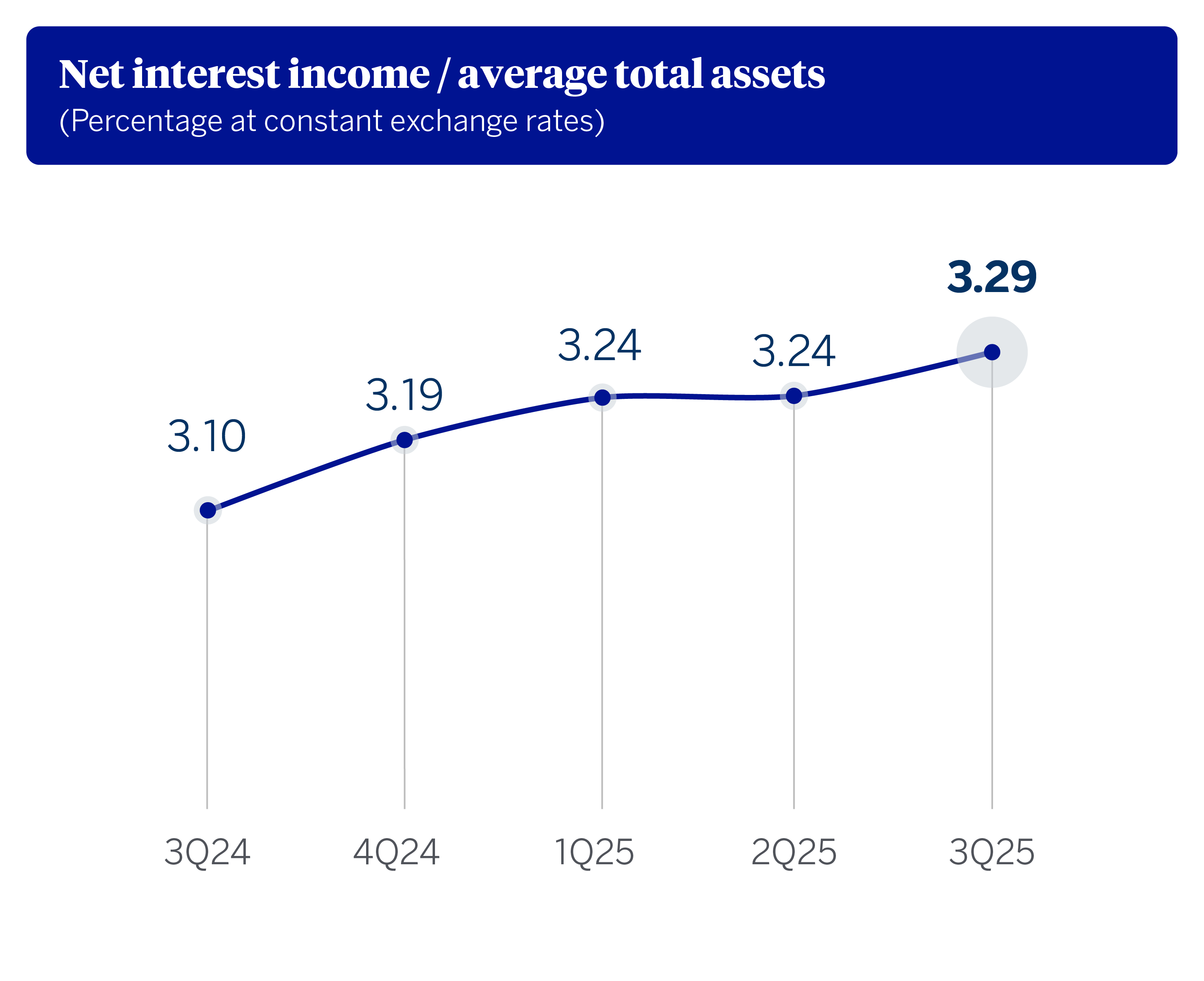

At the top of the P&L account, net interest income saw an increase of 12.6 percent through September, to €19.25 billion, driven by the contribution of Spain, Mexico and Türkiye, in an environment of reduced interest rates in the main markets. Moreover, NII on average total assets -which show the ability of a financial institution to make assets profitable- had a very favorable performance over the past few quarters.

The contribution of net fees and commissions to the P&L account was outstanding in the first nine months of 2025, with an increase of 16.6 percent yoy, to €6.07 billion. It is noteworthy the performance of payments methods and asset management; and among business areas, Türkiye.

In short, the bank’s core revenues (NII and fees and commissions) showed a strong performance, growing 13.5 percent yoy, to €25.32 billion.

NTI stood at €1.96 billion, down 25.6 percent from the same period of last year, mainly due to lower results in Türkiye and a lower contribution from FX hedging at the Corporate Center, in particular, following the appreciation of the Mexican peso over the past 12 months.

The heading of other operating income and expenses saw a significantly improved result at the end of 3Q25, compared to the same period of last year, on the back of a lower negative impact from hyperinflation in Argentina and Türkiye and the good performance of the insurance business. Likewise, the comparison of this heading benefitted from the recording of the extraordinary tax on credit institutions in Spain in 1Q24 (€285 million)².

Gross income, which represents the Group’s total revenues, reached €27.14 billion from January through September, up 16.2 percent yoy.

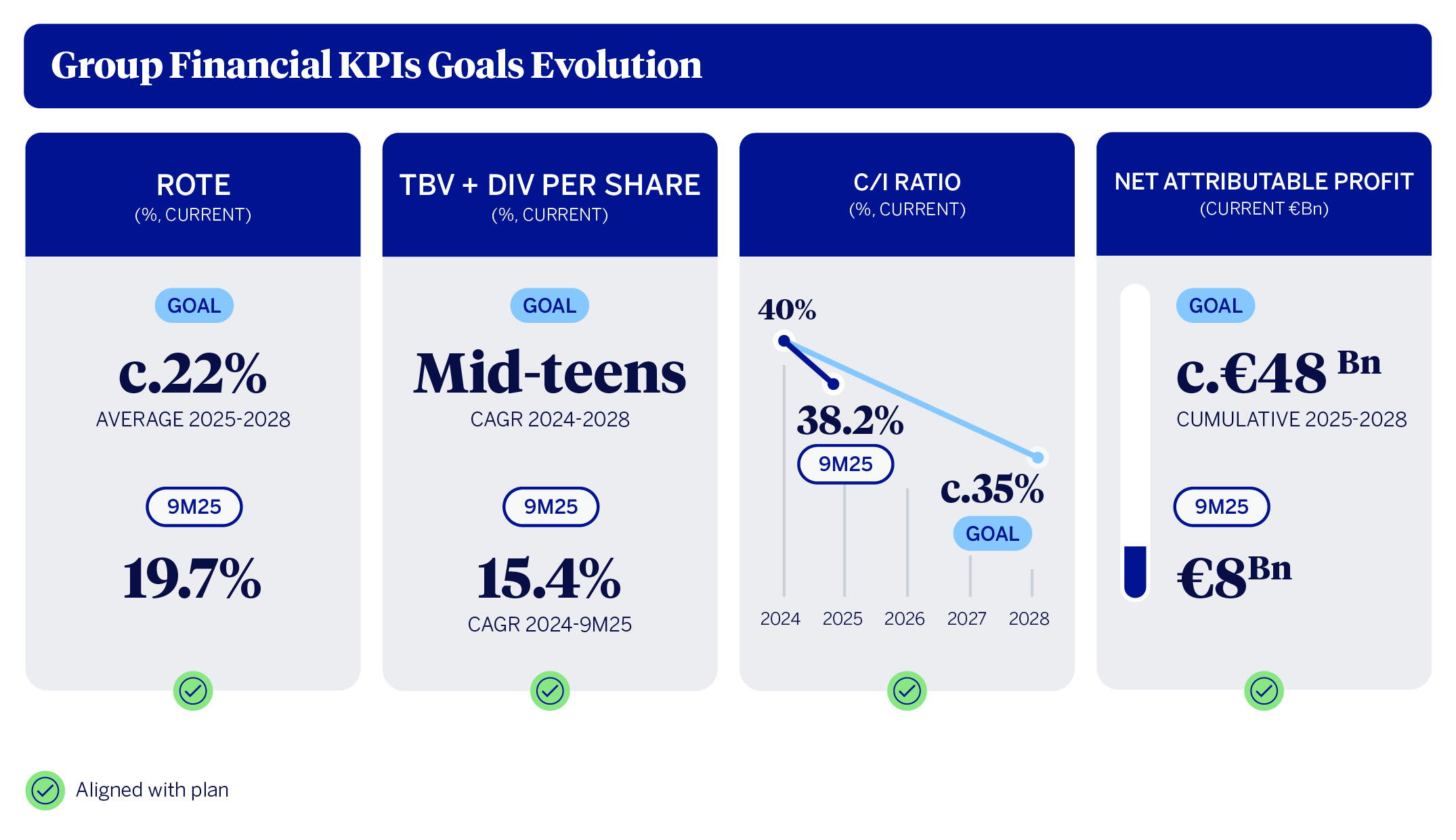

Operating expenses increased by 11 percent yoy through September, to €10.36 billion, mostly impacted by tech investments in recent years and new hirings. This increase remained slightly below the average inflation in the Group’s footprint (11.4 percent) over the past 12 months. Furthermore, jaws remained positive, while the efficiency ratio improved 178 bps compared to September 2024, to 38.2 percent.

As a result of all this, operating income stood at €16.78 billion, up 19.7 percent from a year earlier.

Impairments on financial assets rose by 12 percent yoy. The accumulated cost of risk,however, performed better than expected, standing at 135 bps (7 bps lower than a year earlier and just 3 bps above the June figure). As of Sept. 30, the NPL ratio and the coverage ratio stood at 2.8 percent and 84 percent, respectively, (with improved both metrics when compared to 3.3 percent and 75 percent a year ago).

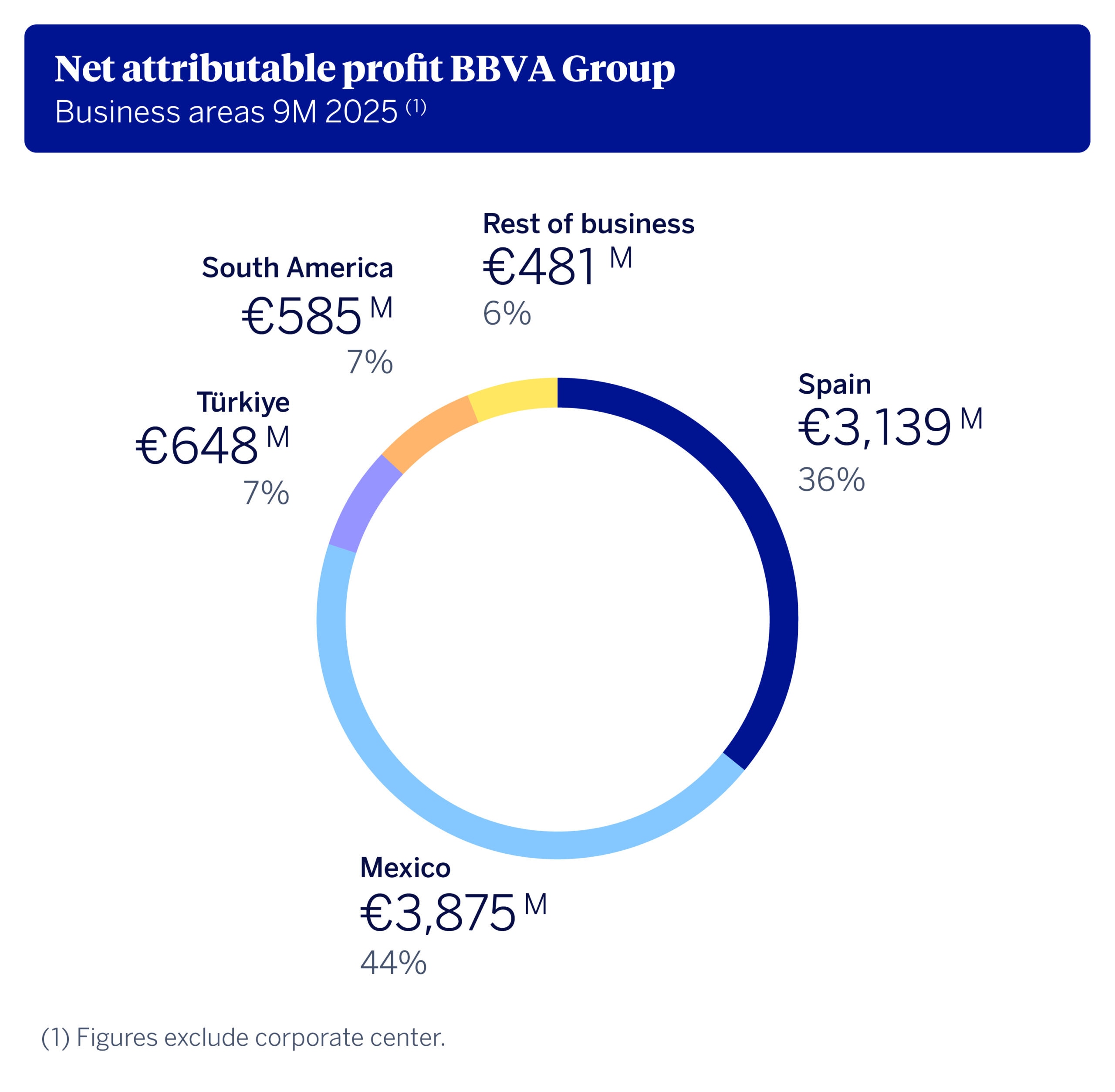

The BBVA Group posted a record attributable profit of €7.98 billion through September, up 19.8 percent from the same period a year earlier. The bank has consolidated the upward trend in earnings in recent years, while ROTE and ROE stood once again at the forefront of Europe, at 19.7 and 18.8 percent, respectively. All this accounted for greater value for BBVA shareholders. The tangible book value per share plus dividends rose to €10.28 per share, following a 17 percent increase compared to a year earlier.

These figures have reinforced even further BBVA’s capital position: in the wake of an increase of 8 bps in the quarter, the CET1 ratio stood at 13.42 percent at the end of September, noticeably above the target range set by the bank (11.5 to 12 percent). Moreover, BBVA has received authorization to release between 40 and 50 additional bps of CET1 at the end of 2025.

Thanks to its solid capital position and following the withdrawal of its offer to Banco Sabadell shareholders, BBVA has accelerated its shareholder remuneration plan: on Oct. 31 it will start executing the pending share buyback of around €1 billion; on Nov. 7, it will pay the highest interim dividend ever (€0.32 per share), for a total of about €1.84 billion; and, as soon as it receives the authorization from the ECB, it will launch a significant additional share buyback program¹.

Furthermore, BBVA is fully committed to its Strategic Plan and financial goals for the 2025-2028 period, as reflected in the business figures for the first nine months of the year.

Business areas

In Spain, lending and customer funds showed great momentum. Loans grew by 7.8 percent over the past 12 months, on the back of a strong new production (+13 percent yoy), particularly in the business segments. Customer funds rose 6.7 percent. On the P&L account, activity growth translated into higher core revenues: despite the reduction of interest rates in Europe and the seasonality of 3Q25 due to the summer, net interest income reached 2.3 percent yoy, while fees and commissions increased by 4.2 percent. Gross income improved 5.8 percent, with operating income growing 9.7 percent. Yet another quarter, net attributable profit stood at around €1 billion, which prompted a record €3.14 billion in the first nine months of the year, up 10.5 percent yoy. The cumulative cost of risk through September performed in line with expectations and stood at 0.34 percent. The coverage and the NPL ratios also improved, to 65 percent and 3.13 percent, respectively.

In Mexico, lending activity grew by 9.8 percent yoy, with a positive performance of all customer segments, particularly retail. Deposits rose at a similar pace, 10.0 percent, while total customer resources increased 13.7 percent. In the P&L account, activity fostered the growth of core revenues, with an 8.3 percent increase in net interest income, and 6 percent in net fees and commissions. All this contributed to gross income (+8.0 percent). Consequently, efficiency stood at an outstanding 30.5 percent. Cumulative net attributable profit stood at €3.88 billion through September, up 4.5 percent more than the same period a year earlier. As for risk indicators, the performance of the cost of risk was noteworthy, which stood at 3.27 percent, a better than expected level. Moreover, the NPL ratio was 2.78 percent and the coverage ratio stood at 123 percent.

Lending activity stood out in Türkiye both in Turkish lira (+45.3 percent) and foreign currency (16.4 percent). Customer resources also performed strongly: up 34.8 percent in Turkish lira and 21.4 percent in foreign currency. Türkiye posted a net attributable profit of €648 million through September, which compares very favorably from a year earlier (€433 million), driven by the performance of core revenues and a lower negative impact from hyperinflation. The coverage ratio stood at 78 percent, while the NPL ratio was 3.69 percent. The cumulative cost of risk stood at 1.76 percent, in line with expectations.

In South America, lending performed strongly (+15.6 percent), boosted by the wholesale portfolio. Customer funds also grew at a similar pace (+15.7 percent). The region contributed €585 million to the BBVA Group in the first nine months of the year (+24.1 percent at current exchange rates). Argentina earned €104 million as a result of a lower adjustment for hyperinflation compared to 2024; Colombia contributed €122 million and Peru €227 million. Both Colombia and Peru showed a solid risk performance. Consequently, the cumulative cost of risk in the region performed in line with expectations, standing at 2.43 percent, with coverage ratio at 93 percent and NPL ratio of 4.1 percent.

Finally, the Rest of Business area contributed €481 million to the Group’s results in the first nine months of 2025 (up 20.0 percent yoy), mainly driven by increased activity. The loan portfolio grew by 34.4 percent yoy, particularly in project finance and corporate lending both in Europe and the United States. Fees associated with these transactions, along with those of debt issuances in the primary market, largely explain the outstanding performance of the net fee income line, which rose by 53.9 percent yoy. Customer funds also grew by 46.2 percent, supported by customer deposits in Europe, with notable contributions from the U.K. (CIB), digital banking in Germany and Italy, and Asia. Risk indicators also showed a good performance: NPL ratio stood at 0.18 percent, the coverage ratio was 136 percent and the cumulative cost of risk stood at 0.10 percent.

About BBVA

BBVA is a global financial services group founded in 1857. The bank is present in more than 25 countries, has a strong leadership position in the Spanish market, is the largest financial institution in Mexico and it has leading franchises in South America and Türkiye. In the United States, BBVA also has a significant investment, transactional, and capital markets banking business. BBVA contributes with its activity to the progress and welfare of all its stakeholders: shareholders, clients, employees, providers and society in general. In this regard, BBVA supports families, entrepreneurs and companies in their plans, and helps them to take advantage of the opportunities provided by innovation and technology. Likewise, BBVA offers its customers a unique value proposition, leveraged on technology and data, helping them improve their financial health with personalized information on financial decision-making.