Earnings: BBVA Posts Record Profit of €10.5 Billion in 2025 and Will Distribute a Dividend of More Than €5.2 Billion

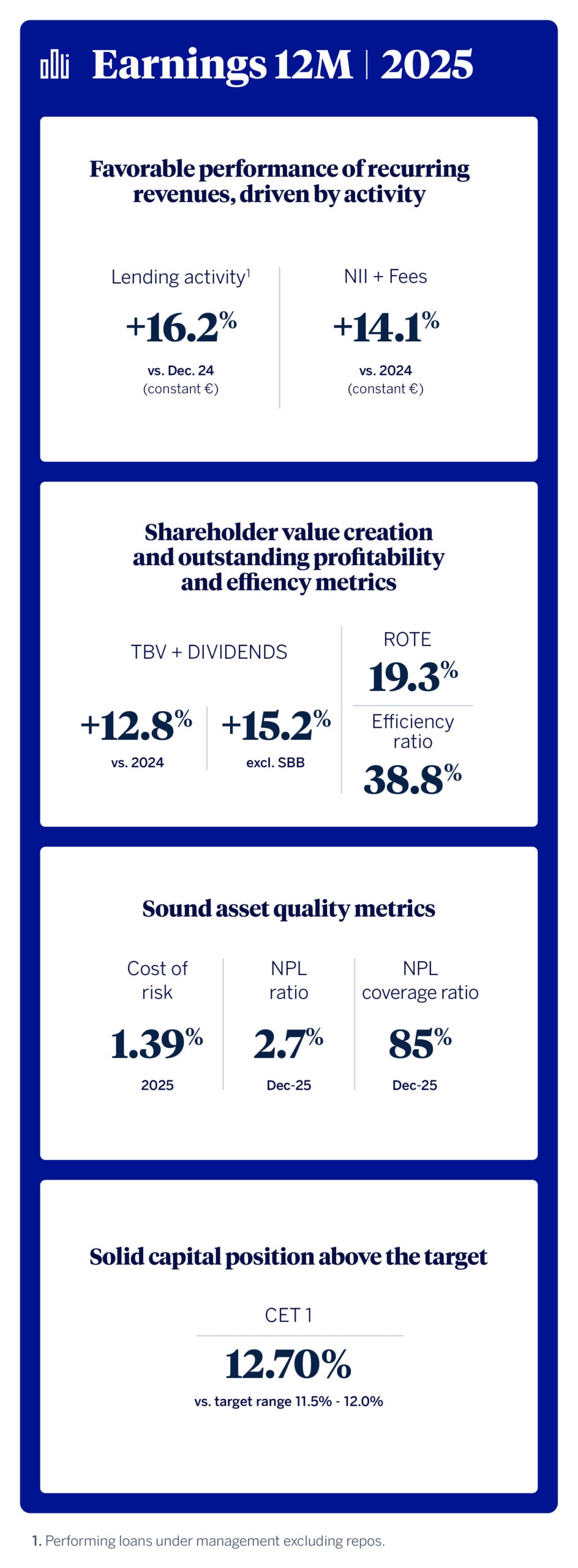

BBVA reported a profit of €10.5 billion in 2025 (+4.5 percent yoy), the highest in its history, mostly driven by core revenues. The BBVA Group stood out for its unique combination of growth and profitability, leading in Europe: lending increased by 16.2 percent (in constant euros) while ROTE reached 19.3 percent. Furthermore, BBVA maintained a solid CET1 capital ratio of 12.7 percent and continued to drive value creation for shareholders, with a tangible book value per share plus dividends growing 15.2 percent¹. In addition, the bank is set to distribute a dividend of €0.92 per share² in cash, the highest ever. This amounts to a total of €5.25 billion³, representing a cash dividend 31 percent higher than that of 2024. Combined with the nearly €4 billion share buyback program announced in December, this represents more than €9.2 billion.

Press Kit

- Quarterly Report 4Q25 (PDF)

- Results Presentation Analysts 4Q25 (PDF)

- Video of Carlos Torres Vila on 4Q25 results (YouTube)

- Download video of Carlos Torres Vila (WeTransfer)

- Download BBVA footage (WeTransfer)

- Audio clip of Carlos Torres Vila in English (WeTransfer)

- Transcript of Carlos Torres Vila’s statement on earnings (PDF)

- BBVA Chair Carlos Torres Vila (JPG)

- Onur Genç and Carlos Torres Vila (JPG)

- Ciudad BBVA (JPG)

“2025 was another excellent year for BBVA. We earned a record-breaking profit and once again, we stood out for our unique combination of growth and profitability. This outstanding performance has resulted in an excellent value creation, which allows us to significantly accelerate shareholder remuneration, with a record dividend and the largest share buyback program to date,” BBVA Chair Carlos Torres Vila said. “We look to 2026 with positive prospects in all our markets and we expect to continue growing faster than our peers and increase profitability to levels around 20 percent. BBVA is at its best moment. The new Strategic Plan provides a very clear roadmap and the bank is well positioned to deliver on the ambitious targets through 2028,” he added.

BBVA’s earnings in 2025 were driven by momentum in banking activity and customer growth. Lending increased by 16.2 percent in constant euros, supported by gains in market share in the Group’s main markets (+20 bps in Spain, +29 in Mexico and +36 in Türkiye). This growth had a positive impact on society: in 2025, 160,000 families purchased a home; one million SMEs and self-employed workers boosted their business with new loans, and 73,000 larger companies invested in their growth. Moreover, BBVA channeled €30.2 billion in social initiatives, such as the construction of hospitals and schools.

In 2025, the bank added a record 11.5 million new customers, of which 66 percent joined through digital channels. These new customers are a source of future growth for BBVA. In Spain, for example, revenue per customer multiplied by 3.7 in the first five years since joining, while in Mexico 75 percent of new credit cards sold in 2025 are of customers acquired over the past five years.

The adoption of a radical client perspective is the cornerstone of the current Strategic Plan, and has enabled BBVA to secure leading positions among clients in terms of recommendations (measured through NPS) in all its markets.

Innovation plays a crucial role in BBVA’s ambition to improve people’s lives. By using artificial intelligence (AI), BBVA aims to offer a more personalized experience for its clients, while providing a better service. With this goal in mind, the bank has launched eight initiatives, including Digital Advisor (Blue), AI Assistant for Bankers, and efficiency improvements in different areas and processes, such as software development. Furthermore, the bank has stepped up the deployment of this technology through a strategic partnership with OpenAI.

Finally it’s worth mentioning BBVA’s unique growth in strategic areas such as enterprise cross-border business (with a 20 percent increase in 2025, in constant euros, +12 percent in current), or sustainability (with €134 billion in sustainable business channeled in 2025, up 44 percent from a year earlier, in current euros).

Except where otherwise stated, the evolution of each of the main headings and changes in the income statement described below refer to constant exchange rates. In other words, they do not take currency fluctuations into account.

At the top of the P&L account, net interest income (NII) rose 13.9 percent in the year, to €26.28 billion, mostly in its main markets. Moreover, NII over average total assets showed a very favorable evolution over the past few quarters (3.27 percent in 4Q25 vs 3.17 percent a year earlier), reflecting greater efficiency to make its assets profitable, thanks to stronger growth in the segments with higher customer spreads. Net fees and commissions increased by 14.6 percent, to €8.22 billion, with growth in all business areas, especially payment methods and asset management. Core revenues topped €34.50 billion, 14.1 percent more than a year earlier.

NTI stood at €2.66 billion in 2025, down 23.7 percent yoy, mainly due to lower results in Türkiye and the Corporate Center.

The line of other income and expenses showed a significant improvement in 2025 compared to last year, thanks to the good performance of the insurance business and a lower impact from hyperinflation in Argentina and Türkiye. The comparison is also favorably impacted by the reporting in this line in 1Q24, of the full annual amount of the extraordinary tax on credit institutions in Spain, totalling €285 million.⁴

Gross income, which represents total revenues, rose to €36.93 billion in 2025, up 16.3 percent yoy.

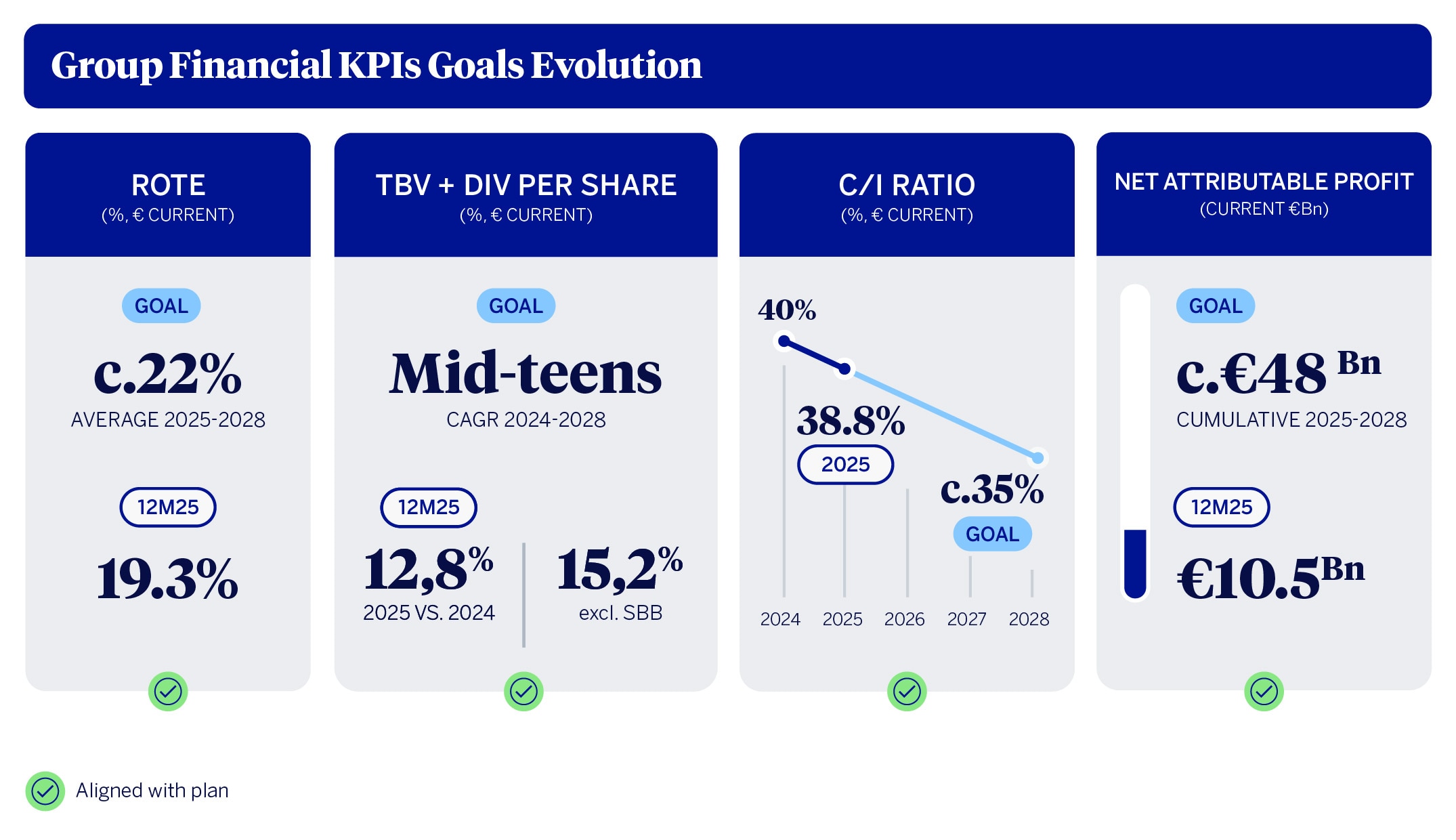

Operating expenses increased 10.5 percent, to €14.33 billion. The resilience of gross income offset said increase, enabling the Group to maintain positive jaws, and an improvement of 206 bps in the efficiency ratio, to 38.8 percent.

As a result of all the above, operating income reached a record €22.60 billion, up 20.4 percent from a year earlier.

In 2025 impairments on financial assets (€6.07 billion) were 15.5 percent higher vs 2024. This increase is mainly due to greater lending activity (16.2 percent), especially in retail portfolios. The accumulated cost of risk (1.39 percent) and the NPL and coverage ratios (2.7 percent and 85 percent, respectively), improved compared to last year.

The BBVA Group reported a record net attributable profit: €10.5 billion, up 19.2 percent yoy (+4.5 percent in current euros). This figure further reinforces the upward trend of earnings in recent years, including earnings per share (EPS), which increased at an even faster pace (+5.8 percent yoy in current euros), driven by the share buyback during the year. ⁵

The solid performance was also reflected in profitability metrics, once again at the forefront of Europe, with ROTE of 19.3 percent, as well as in value creation for shareholders: in 2025 the tangible book value per share plus dividends rose 12.8 percent, to €10.42 (+15.2 percent excluding share buybacks).

BBVA is to distribute to its shareholders a gross dividend in cash of €0.92 per share, the highest ever, 31 percent higher than the cash dividend in 2024. This dividend is against 2025 earnings. Of this figure, the bank already paid (gross) €0.32 per share on November 7, 2025. The final dividend, a gross €0.60 per share, will be submitted to the governing bodies for approval, and is expected to be paid in April 2026. In total, BBVA will distribute €5.25 billion as ordinary shareholder remuneration for 2025³.

Furthermore, this past December, the Group announced an extraordinary share buyback program for €3.96 billion⁶, of which it is already underway a first tranche for €1.5 billion (execution stands at 42.8 percent with data as of January 30, 2026).

When taking into account both the ordinary dividend and the extraordinary share buyback program, the Group’s CET1 ratio stood at 12.70 percent at the end of 2025. BBVA maintains its commitment to distribute any excess capital above the upper end of its target range of 11.5 to 12 percent⁷.

Financial Goals 2025-2028

In short, 2025 represented a year of very significant progress for BBVA in the execution of its new Strategic Plan, as well as in the financial targets set for the 2025-2028 period:

Business areas

In Spain, new production drove lending (+8 percent yoy), with special momentum in loans to corporate and CIB (+18.3 percent), public sector (+15.6 percent), and mid-sized companies (10.7 percent). BBVA Spain reported a record profit of €4.18 billion, with a yoy growth at double digit (+11.3 percent), on the back of a good performance of core revenues (NII increased by 3.2 percent, and net fees and commissions, 3.7 percent); cost containment efforts (-0.7 percent) and lower impairments on financial assets (-5.1 percent). All risk indicators performed favorably throughout the year: the accumulated cost of risk fell to 0.34 percent, the NPL ratio stood at 3.1 percent and the coverage ratio improved to 67 percent.

In Mexico, the loan portfolio grew by 7.5 percent in 2025 (+9.9 percent excluding the dollar depreciation in the wholesale portfolio), supported by the performance of retail segments. BBVA posted a net attributable profit of €5.26 billion, up 5.7 percent from a year earlier, thanks to the good evolution of NII (+8.1 percent), as a result of higher retail lending volumes and a lower cost of funding in a declining interest rate environment. Growth in core revenues (with gross income up 8.4 percent yoy), allowed efficiency to remain around 30 percent, standing out among local peers. Risk indicators performed in line with expectations, with NPL ratio standing at 2.7 percent; coverage ratio, at 124 percent; and an accumulated cost of risk at 3.31 percent.

In Türkiye, the performance of loans in Turkish lira (+44.5 percent) stood out. The area posted a net attributable profit of €805 million in the year, (+31.8 percent in current euros), as a result of the good evolution of core revenues and a lower negative impact from hyperinflation. Risk indicators showed a normalization trend throughout the year, in line with expectations: the NPL ratio stood at 3.9 percent, the coverage ratio was at 76 percent, and the cost of risk stood at 1.94 percent.

In South America, lending saw an increase of 13.9 percent yoy, with a more solid performance of the wholesale portfolio.The area posted a net attributable profit of €726 million in 2025 (+14.3 yoy at current exchange rates). Notably, attributable profit improved in Peru and Colombia, alongside a less negative hyperinflation adjustment in Argentina. Peru posted a net attributable profit of €295 million; Colombia, €143 million; and Argentina €133 million. Risk indicators performed favorably and in line with expectations: the NPL ratio stood at 4.0 percent; coverage ratio was 92 percent, and the accumulated cost of risk stood at 2.5 percent.

Finally, the Rest of Business area reported a 37.8 percent increase in lending. The wholesale banking business (CIB) is driving this growth, particularly in Europe and the U.S. with significant transactions in project finance and corporate loans, as well as in Asia. Greater activity resulted in improved NII (+15.9 percent yoy) and fees and commissions (+56 percent), both supported by the issuance activity in the primary debt market. The area posted a net attributable profit of €627 million (+29.4 percent yoy). Furthermore, risk indicators performed positively, with NPL ratio standing at 0.2 percent. Coverage ratio was 173 percent and the cost of risk stood at 0.16 percent.