Responsibility and ethics in AI, key themes at BBVA’s first FinAI Summit

The first edition of BBVA’s FinAI Summit brought together international experts in artificial intelligence to address how its transformative potential should advance in parallel with its ethical, safe and responsible use. The financial sector must carry out its transformation without losing customers’ trust. Doing so requires a gradual, regulated approach that maintains human interaction, just like BBVA is already doing. Over 6,000 people attended the event in person and online.

You can watch the full event at finaisummit.com

Transparency, responsibility, equity, and ethics were some of the terms repeated throughout the sessions recently organized in Mexico, Colombia, Türkiye and Spain on artificial intelligence implementation, which have drawn large audiences. Over 6,000 people from 30 different countries watched online or attended these talks with global leaders in the development and responsible use of AI. The sessions focused on financial processes that can benefit from its potential and how to align these advances with regulatory demands regarding fairness, transparency, and the explainability of results, in order to prevent risks such as disinformation, inequality, or job loss. The full talks are available at finaisummit.com.

“At a time when AI is changing many industries, especially the financial sector given its reliance on technology, we are proud to start conversations with global leaders about how we expect these changes to impact our day-to-day work as companies, customers and employees,” said Antonio Bravo, Global Head of Data at BBVA, during the opening session in Spain. “We are aware that our success as a financial institution in this technological disruption will depend on the speed with which we incorporate these approaches into bank operations.”

The session in Spain featured Maya Ackerman, CEO of the startup WaveAI, who gave the most creative talk of the event. Ackerman discussed the concept of a ‘humble creative machine’, artificial intelligence that assists human beings with more creative tasks, but without replacing them, and leaving them in charge of decision-making. Meanwhile, Kay Firth-Butterfield, CEO of Good Tech Advisory and the former Head of Artificial Intelligence at the World Economic Forum, explained how data used by AI contain historical biases that exclude many voices. In light of its risks (from hallucinations and job loss to the environmental impact and disinformation) it is important to consider what kind of AI we want and for which tasks. The key lies in responsible governance, informed human decisions and use that gives priority to inclusion, trust and collective wellbeing.

The two experts shared a roundtable with Elena Alfaro, Global Head of AI Adoption, and Ricardo García, Global Head of Analytics Transformation at the bank, to discuss creativity, responsible innovation, future outlooks and how BBVA puts data governance and regulation at the heart of its AI strategy with the goal of increasing the human capabilities on its teams. “It isn’t a bad thing that AI sparks both feelings of love and hate. In fact the opposite is true as this helps us to navigate its opportunities and its risks,” said Elena Alfaro. Meanwhile, Ricardo García emphasized that “in such a regulated environment like ours, innovating requires responsibility. At BBVA, we encourage experimentation with AI in controlled environments to then apply rigorous governance when systems move into production.”

BBVA is integrating AI into the organization to boost its operational efficiency and offer its 78 million customers hyperpersonalized service. To do so, as discussed at the event in Türkiye, the Group has modified its internal regulations to comply with international standards (such as the European AI Act) on governance and data quality, transparency, model monitoring and training its teams of professionals—steps that are essential to maintain customer confidence. The session featured Sertaç Doğanay, one of the main promoters of responsible innovation in the country, who warned of the economic, disinformation, and workforce-related risks posed by the improper use of technology. He advocated for responsible AI to be put at the heart of the global conversation and to create corporate roles that incorporate it into company strategy.

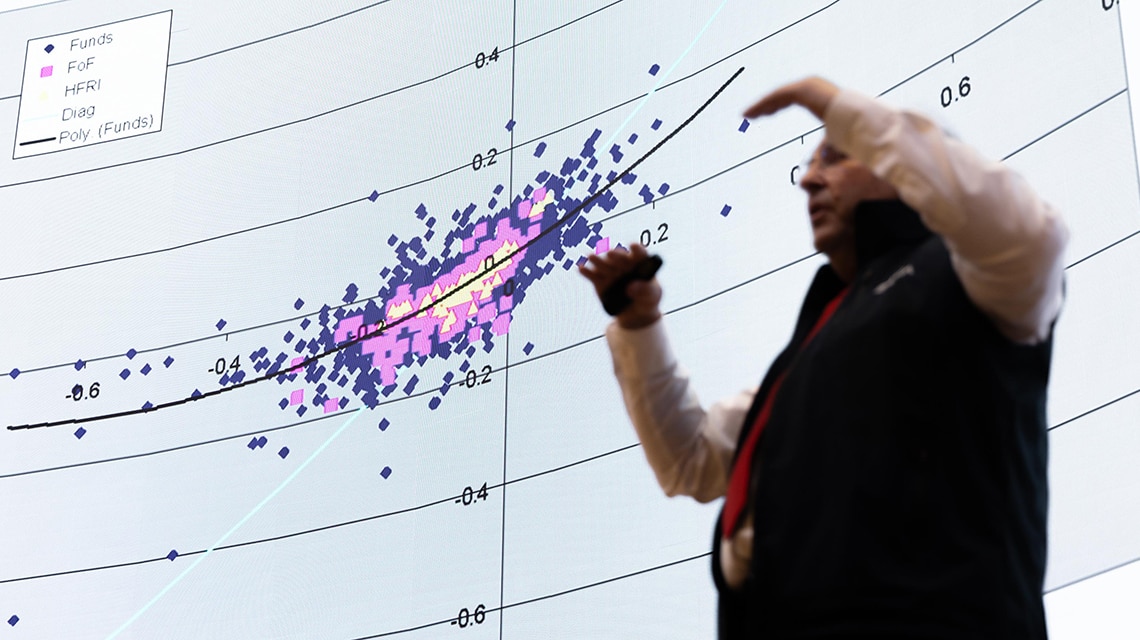

BBVA Mexico also noted that AI’s real competitive advantage lies in the speed with which it can be applied to financial services with empathy and responsibility. They also discussed examples of financial processes that banks are making more precise and efficient with artificial intelligence such as credit rating—where this technology is capable of identifying patterns and relationships that previously went unnoticed. The expert researcher in systematic risk, Raphaël Douady, participated in the event, explaining how AI can identify risk behaviors, anticipate financial movements that traditional models overlook and build investment portfolios.

BBVA Colombia analyzed how, to introduce AI successfully, financial institutions must transform their corporate culture, adapt swiftly to regulation and define strategies that have a real impact on their customers, maintaining security and trust in the financial system. AI, especially generative AI, will have a major impact on advances in customer service, but its adoption must be gradual, regulated and combined with human interaction. Sergio Álvarez-Teleña, CEO of the fintech SciTheWorld Group and the former Global Head of Data Science at BBVA, shared the latest advancements in financial robotics and AI-driven trading, along with current explorations into how AI can transform entire production sectors to build ‘extremely efficient’ nations.

Furthermore, over the past three days several simultaneous masterclasses took place, where those registered learned to enhance customer service using voicebots, turn data into meaningful stories through visual narratives, and leverage the potential of machine learning, reinforcement learning and language models to create practical solutions for businesses.

“The 2025 FinAI Summit demonstrated what we can achieve when we start the conversation and work as a community. We will take with us the lessons learned, connections, and above all, the conviction that artificial intelligence has to be built in an open, responsible and collaborative way,” said Marco Bonilla, Head of Strategy & Execution and of Knowledge Management in Analytics Transformation, and the organizer of the event, during the closing session.

-

1

1Roundtable in BBVA México with Daniel Ordaz, Raphael Douady, Hugo Nájera and Juan Manuel Yañez.

-

2

2Raphael Douady, expert researcher in systematic risk.

-

3

3Keynote on polymodels applied to investment portfolios.

-

4

4Sergio Álvarez-Teleña, CEO of SciTheWorld Group.

-

5

5Debate in BBVA Colombia with Carolina Ramírez, Sergio Álvarez-Teleña, Gregorio Blanco and Andrés Carrandi.

-

6

6Sertaç Doğanay, leader in technology and sustainability.

-

7

7Roundtable organized in Türkiye with Sertaç Doğanay, Sadi Evren Seker, Ayşen Büyükakın and Ugur Boncuklu.

-

8

8Antonio Bravo, Global Head of Data, during the closing day at BBVA in Spain.

-

9

9Maya Ackerman, cofounder of WaveAI.

-

10

10Kay Firth-Butterfield, CEO of Good Tech Advisory LLC.

-

11

11Panel with Elena Alfaro, Maya Ackerman, Kay Firth-Butterfield and Ricardo García Martín.

-

12

12Marco Bonilla closes BBVA's FinAI Summit.