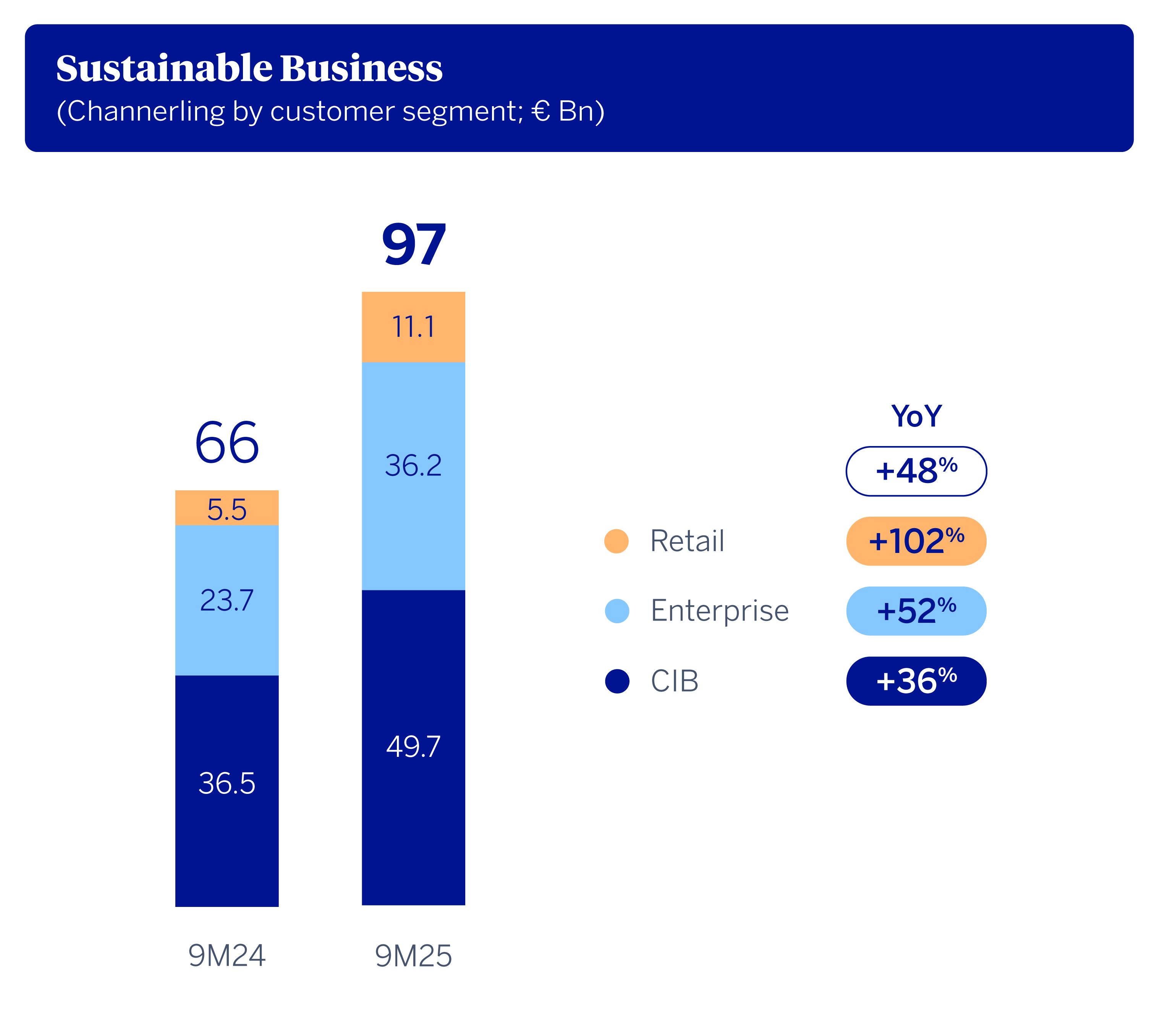

BBVA Channels €97 Billion into Sustainable Business Between January and September 2025 (+48 percent yoy)

BBVA’s sustainable business continues to grow, now at a faster pace than ever. The bank channeled around €97 billion into sustainable business in the first three quarters of 2025 alone, representing a 48 percent¹ increase compared with the same period of the previous year and not far off the €99 billion channeled throughout all of 2024. Notably, in the third quarter alone, it mobilized upward of €34 billion, setting a new quarterly record.

Of the total amount channeled between January and September 2025, 76 percent went toward climate change and natural capital projects (which includes activities linked to efficient water use, agriculture, or the circular economy), while the remaining 24 percent was targeted at social endeavors, with projects that include social, educational, and health infrastructure; support for entrepreneurs and young companies; and financial inclusion.

Scaling up across all segments

In the first nine months of the year, retail banking channeled €11.1 billion, marking an increase of 102 percent. In this segment, financing for the acquisition of electric and hybrid vehicles was one of the main components (exceeding €1.3 billion), as is the development of digital tools that help customers make their homes and vehicles more energy efficient.

Meanwhile, Enterprises channeled €36.2 billion, up 52 percent yoy. During this period, the bank continued to offer solutions aimed at improving energy efficiency and natural resource management. Within this line, financing linked to natural capital played a prominent role, at nearly €3.9 billion, particularly in Mexico and the agricultural sector.

In the Corporate & Investment Banking (CIB) segment, BBVA channeled €49.7 billion, 36 percent more than in the same period of the previous year. Here, financing for clean technologies (or ‘cleantech’ for short) and renewable energy projects stood at an impressive €2.1 billion. The bank also continued to promote solutions such as sustainability-linked reverse factoring.

Key sustainability initiatives

BBVA views the agri-food sector as a strategic pillar when it comes to sustainability, given its contribution to the economy and its key role in food security. The bank’s strategy aims to support companies in the sector as they transition toward more efficient and sustainable models, focusing on modernization, digitalization, and expansion into new markets.

This commitment was recently reflected at Fruit Attraction, one of the world’s largest gatherings for the fruit and vegetable sector, where BBVA reaffirmed its role as the financial partner of choice for the agri-food sector. There, the bank presented its value proposition focused on sustainability and internationalization. Nearly 30 percent of the exhibiting companies at this year’s event happen to be BBVA clients, further illustrating the bank’s support for the development and growth of this key sector for the economy and the green transition.

BBVA’s strategic commitment to sustainability

BBVA aims to make sustainability a key growth driver and, by doing so, create new business opportunities. Climate, natural capital, and social opportunities are the three pillars underpinning its sustainability strategy. The bank has set a sustainable business channeling target of €700 billion for the 2025–2029 horizon. This is more than double the previous target, which envisioned a total of €300 billion between 2018 and 2025. The bank reached that goal in December 2024, a year ahead of schedule. The new, more ambitious target is also set for a shorter period (five years instead of eight).

The criteria used by the bank when calculating the products that count toward sustainable business channeling are described in its Guide to the Channeling of Sustainable Business.

BBVA is pressing ahead with its transition plan to achieve net zero emissions by 2050. Aside from its interim decarbonization targets for 2030 in ten sectors (oil and gas, electricity, automotive, steel, cement, coal, aviation, maritime transport, aluminum, and commercial and residential real estate), BBVA is working hard to set targets in other sectors, such as agriculture.