Scaling up ‘cleantech’ (also known as clean technologies) means expanding innovative projects, those that aim to decarbonize the economy, so they can grow and adapt to market demand. To do so, adequate financing is fundamental in order to produce and distribute this technology at a greater scale and lower cost, boosting competitiveness and the reindustrialization process. According to Cleantech for Europe, banks remain, by far, “the largest financial institutions in Europe” contributing to this effort.

In the race to create innovative solutions that help to mitigate climate change through emission reduction, or adapt to its consequences, there are two key aspects: investment in the initial stages and investment for the roll-out and scalability. In the cleantech ecosystem there are first-tier, more mature technologies that are already being implemented on a massive scale such as renewable energy– and second-tier technologies, which are pioneering projects with a green premium cost known as ‘First of a Kind’ (FOAK). Once these technologies are implemented, they need to grow (such as storage or carbon capture technologies).

While more than €11 billion of venture and growth capital was invested in EU clean technologies in 2023, a 15 fold increase over 2011, in 2024, debt financing rose for these projects, growing from €7.9 billion in 2023 to €23.4 billion in 2024, according to ‘Cleantech for Europe’.

Nevertheless, their report entitled ‘Mobilising Private Finance to Scale European Cleantech’ underscores that the continent is currently facing “a cleantech investment gap.” In terms of financing, European cleantech needs the following:

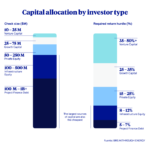

- More equity capital for the early and growth stages (R&D, operational expansion, talent acquisition) of projects, making it possible to secure greater resources from insurers, pension funds, banks and retail investors through venture capital and private capital funds.

- Access to debt and private capital for the scaling phase (roll-out and commercial expansion) which, according to more conservative estimates, will require a €50 billion investment.

In its report, ‘Cleantech for Europe’ stressed the importance of cleantech companies being able to “get improved access to debt, credit or project finance, as they come with a lower cost of capital compared to early-stage equity financing, which requires a higher return for the higher level of risk taken.”

It also stresses that public markets and private capital are a “critical” part of a strategy that integrates this complementary financing to boost the decarbonization of the economy. In this regard, it underscores that “public financing instruments can play a vital role in signalling confidence and direction to private investors to fund investment opportunities in European clean technologies.” In particular, these instruments can “create new markets and bolster demand for cleantech products and services, improving the economic viability and therefore, making it more attractive to private investors.”

Key factors in cleantech financing

The report ‘Cleantech for Europe’ underscores the financial limitations that need to improve in order to advance clean technologies:

- Overall volume of equity capital through venture capital, private equity and growth capital. They recommend the following:

- At the European level, replicate successful national initiatives to moibilze institutional investors, such as the Tibi initiative in France and WIN in Germany.

- Insurers: long-term equity investment (LTEI) and non-investment grade debt. Reform the LTEI regime (Solvency II) so that insurers also allocate resources to unlisted equities and private markets.

- Rethink the role of banks to put a greater focus on activities related to equity and investment funds.

- Pool investment function among small pension funds in order to create scale and greater expertise by Member States with many small pension funds.

- Encourage retail savings products with exposure to illiquid assets among Member States.

- In terms of access to debt financing during the scale-up phase, and when developing FOAK projects, through private loans, bank loans or project finance instruments, they recommend the following:

- Use (counter) guarantees by the European Investment Bank to reduce perceived risk of clean tech companies for banks.

- Develop the European private credit market, which is stronger in Europe; a deeper pre-bank private credit market that is able to provide loans banks are not willing to provide due to the level of risk.

- Create a taskforce to understand why insurers avoid non-investment grade debt and conduct the same exercise for pension funds.

- Review the EU’s Simple, Transparent and Standard (STS) securitization framework to promote products such as green loans for homes (solar panels, batteries, heat pumps, etc.).

In order to make progress in the decarbonization of the economy, boost competitiveness through productivity and reinforce resilience and security by reducing critical dependencies, Europe needs profound reform of capital markets and greater mobilization of private financing, according to the ‘Cleantech for Europe’ report. In addition, public bodies need to send clear signs that build the confidence needed so that investors back the development and adoption of clean technologies.

https://www.bbva.com/wp-content/uploads/2024/12/premium-monografico-cleantech-ingles.pdf