The most valuable company in Turkey, Garanti contributed TL 273 billion to revitalize the economy

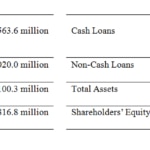

Türkiye Garanti Bankası A.Ş., announced its financial statements dated June 30, 2017. With an asset size of TL 335 billion 942 million 185 thousand, Garanti’s contribution to the economy through cash and non-cash lending reached TL 272 billion 980 million 362 thousand, based on the consolidated financials. The Bank posted a net income of TL 3 billion 100 million 273 thousand in the first six months of 2017. The Bank delivered an ROAE (Return on Average Equity) of 18.1% and an ROAA (Return on Average Assets) of 2.1%.

Commenting on the financial results, Garanti Bank’s CEO Fuat Erbil said: “In the first half of 2017, while further strengthening our solid balance sheet with the confidence of all our stakeholders, we helped revitalize the economy. We successfully renewed our € 1.25 billion syndicated loan; and for the first time in international capital markets we issued Basel III Compliant Subordinated Notes in the amount of US$ 750 million and 10 year tenure. Receiving a record breaking demand of US$ 4 billion, our Basel III Compliant Tier II issuance became the lowest costing transaction of a bank in Turkey, while also generating the largest order book ever. With IFC, we signed an unprecedented agreement based on mortgages that would support 'Green Mortgage' projects, for the first time in Turkey. The loans we have extended under the Credit Guarantee Fund surpassed TL15 billion. Supporting social and economic development of women for over 10 years, the financing we provided to women exceeded TL3.2 billion."

Expressing the pride in contributing to the sustainable future of Turkey on behalf of Garanti Bank, Erbil said; “EMEA Finance named Garanti the Best Project Finance House in CEE (Central and Eastern Europe) region. We lead in the financing of projects contributing to the sustainability of the Turkish economy and offer innovative solutions. We work together and alongside our Retail, SME, Commercial and Corporate customers to find the best solutions for all their needs, and take part in their lives in an uninterrupted and long lasting manner. At every point of contact; physical locations across Turkey and leading on digital platforms; through all channels we bring our services to our customer’s location and work to create the best experience possible. I am grateful for all our stakeholders who trust and support us.”

Selected Figures of Garanti Bank’s Consolidated Financial Statements for the Six-month Period Ended 30 June 2017

Highlights from Garanti Bank's Consolidated Financials

- Net income was TL 3 billion 100 million and 273 thousand.

- In compliance with the legal legislation and international regulations, a total amount of TL 2 billion 463 million 327 thousand was reserved for tax provisions, loans and other provisions.*

- Total assets increased by 7.6% year-to-date and reached TL 335 billion 942 million 185 thousand.

- Return on Average Assets (ROAA) realized at 2.1%.**

- Shareholders’ equity increased by 6.9% year-to-date and reached TL 38.3 billion.

- Return on Average Equity (ROAE) realized at 18.1%.**

- Contribution made to the real economy through cash and non-cash loans increased by 6.0% year-to-date and reached TL 272 billion 980 million 362 thousand as of June 30, 2017.

- Total loans, FC loans and TL loans market shares realized at 11.6%, 12.4% and 11.2% respectively.

- Market share of “mortgage loans” realized at 13.4% and market share of “consumer loans including credit cards” were 14.2%.

- Total customer deposits increased by 7.4% year-to-date and reached TL 187 billion 52 million and 207 thousand, while market share of total customer deposits was realized at 11.4%.

- Capital adequacy ratio (CAR) reached 16.4%.

- Non-performing loan (NPL) ratio decreased to 2.75%.

*Reserve for Employee Termination Benefits and Impairment Losses on Assets to be Disposed are included in provisions.

**Excludes non-recurring items (Income from NPL sale, fee rebates and free provisions) when annualizing Net Income for the rest of the year.

You may access the earnings presentation regarding the BRSA consolidated financial results as of and for the period ending June 30,2017 in English from Garanti Bank Investor Relations website at www.garantiinvestorrelations.com