What Banco Sabadell shareholders need to do to accept BBVA's takeover bid

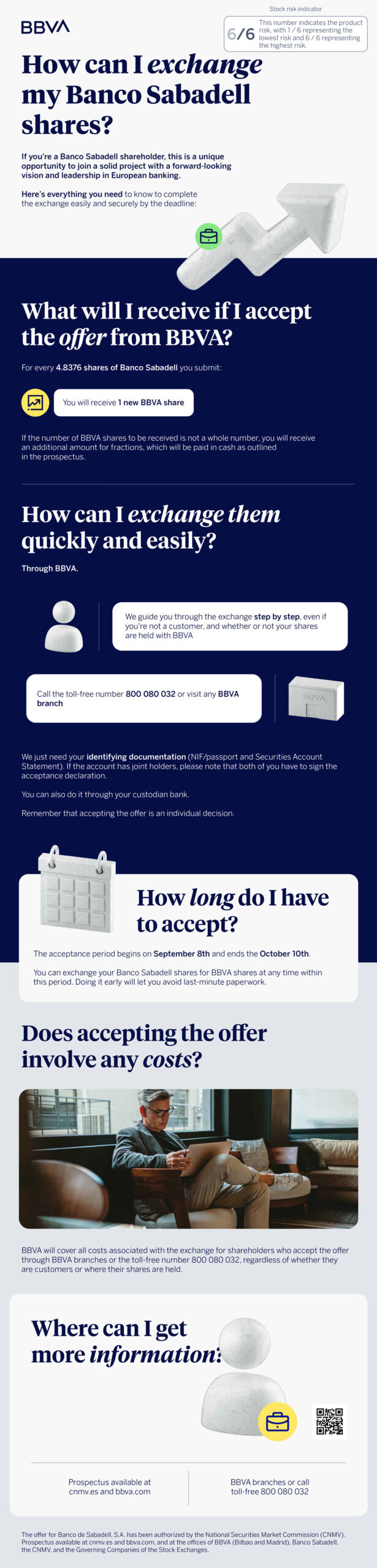

Spain’s National Securities Market Commission (CNMV) has approved BBVA’s new offer for Banco Sabadell shareholders. The take-up period for Banco Sabadell shareholders began on September 8, 2025 and will end October 10, 2025. Banco Sabadell shareholders who take up the offer will receive one new BBVA share for every 4.8376 shares they tender. The new offer represents a 10 percent¹ increase over the previous offer, and is exceptionally attractive for Banco Sabadell shareholders, as it implies the highest share valuation in over a decade. BBVA will cover the costs associated with the exchange for all shareholders who accept the offer through BBVA branches or via the telephone number +34 800 080 032.

What exactly is the take-up period?

The acceptance or take-up period is the window of time during which Banco Sabadell shareholders can decide whether or not to accept the offer presented by BBVA. This timeframe, which is determined by regulation (no less than 30 calendar days and no more than 70 calendar days) and supervised by the CNMV, ensures that investors have sufficient time to assess the offer and make an informed decision.

What is the deadline to accept the offer?

The take-up period for the offer began on September 8, 2025 and will end October 10, 2025, inclusive. BBVA may extend the take-up period one or more times, subject to a maximum limit of 70 calendar days, provided that the CNMV is notified of the extension in advance. However, according to information on the prospectus, the BBVA Board of Directors agreed to waive an extension of the take-up period. The acceptance period for the offer is specified in the supplement to the offer prospectus, which is available at cnmv.es and bbva.com, as well as at the headquarters of BBVA, the CNMV and the stock exchanges.

What should I do if I decide to accept the offer?

The prospectus states that if a shareholder decides to accept BBVA’s offer, they may do so in any of several ways:

-

- Submit the notice of acceptance to take part in the share exchange in a few minutes, easily and cost-free with the help of a customer representative, whether a BBVA customer or not, in person at any BBVA branch or by calling +34 800 080 032 (for retail investors) or +34 911 859 673 (for institutional investors).

- Submit their notice of acceptance in writing to take part in the share exchange to the Iberclear participating entity where their Banco Sabadell shares are deposited, either in person, by electronic means or by any other means accepted by said depositary entities.

The recipients of the offer may accept it for all or some of the Banco Sabadell shares they hold, starting the first day of the take-up period until the last day of such period, both inclusive. Any notice of acceptance must include at least one Banco Sabadell share.

What information must the notice of acceptance of the offer contain?

Notices of acceptance of the offer by holders of Banco Sabadell shares must be accompanied by sufficient documentation to enable the transfer to BBVA, including: (i) full name or corporate name; (ii) address; and (iii) tax identification number or, in the case of shareholders who are not residents of Spain and do not have a Spanish tax identification number, their passport or identification number, nationality and place of residence. When shares are held jointly, in the case of retail investors, all joint holders must sign the notice of acceptance.

What happens if I do not accept the offer during this period?

If a shareholder does not explicitly accept the offer during the take-up period, it will be assumed that they have rejected it under the proposed terms. In this case, they will retain their shares in Banco Sabadell.

Banco Sabadell shareholders will only be able to benefit from the transaction by explicitly accepting the offer, exchanging their Banco Sabadell shares for BBVA shares and receiving the cash compensation.

Can acceptance of the offer be withdrawn once it has been made?

Notice of acceptance of the offer can be revoked at any time before the last day of the take-up period. It will be considered invalid if made subject to any conditions..

Are there any costs or fees for shareholders who accept the offer?

Depending on the depositary institution, or financial intermediary, there may be sales or administrative fees. BBVA does not charge any fees to accept the takeover bid, but each shareholder should check with their bank or financial intermediary regarding the corresponding fees. BBVA will bear the costs associated with the exchange for all shareholders who accept the offer through BBVA branches or via the telephone numbers provided by BBVA. For further information, please refer to Chapter III of the prospectus for the offer.

How many BBVA shares will Banco Sabadell shareholders receive?

Shareholders who accept the offer will receive one new BBVA share for every 4.8376 Banco Sabadell shares they own.

When exchanging the shares, if the number of BBVA shares to be received is not an exact number, BBVA has put in place a mechanism to ensure that shareholders can receive the remaining amount in cash. This surplus amount is referred to as ‘cash in lieu of fractional shares’. Therefore, Banco Sabadell shareholders who accept the offer with a number of shares that does not entitle them to at least one whole BBVA share, or who are entitled to receive a whole number of BBVA shares, but have an insufficient number of Banco Sabadell shares to qualify for an additional BBVA share, can receive the excess amount in cash.

How is the cash-in-lieu of shares calculated?

Given the exchange ratio, the cash-in-lieu of shares payment will only be given to Banco Sabadell shareholders who take up the offer and hold a number of Banco Sabadell shares that is not a multiple of 6.047.

Banco Sabadell shareholders who take up the offer with fewer than five Banco Sabadell shares will not receive any BBVA shares, but will receive cash in lieu of fractional shares. Meanwhile, Banco Sabadell shareholders participating in the offer with a number of shares that is a multiple of 6.047 will receive the corresponding newly issued BBVA shares as payment. They will not receive any cash payments as cash-in-lieu of shares.

The price of fractional shares will be calculated according to the exchange ratio based on the weighted average trading price of BBVA shares in the last 15 trading sessions during the offer take-up period (including the last day of such period).

This payment of cash in lieu of fractional shares will be made on the same date that the Banco Sabadell shares to be exchanged are registered in BBVA’s favor, also corresponding to the settlement date of the offer.

What happens if there are more acceptances than expected or if a minimum threshold is not reached?

BBVA has set a minimum acceptance threshold of over half of the voting rights of Banco Sabadell shares by the end of the offer take-upperiod (excluding any treasury shares held at that time).

In case of higher-than-expected acceptances: If BBVA reaches or exceeds this percentage, the takeover bid will be settled.

In case the minimum threshold is not met: If this threshold is not reached, BBVA will decide whether to cancel the takeover bid or waive this condition, according to the terms in the prospectus.

How is the end of the take up period made official?

On the last day of the take-up period, the acceptance register will be closed. Subsequently, the institutions to which the acceptance notices have been submitted will calculate the number of shares tendered in acceptance of the offer and report the results to the stock exchanges, which in turn will forward them to the CNMV. Once the CNMV publishes the official results—through a disclosure of Other Relevant Information—BBVA will inform Banco Sabadell shareholders of the completion of the process and the next steps (settlement, payment, etc.). For more information, see section V. 17 of the suplement to the offer prospectus.

What happens to the Banco Sabadell shares of holders who have not accepted the offer?

Banco Sabadell shareholders who do not accept the offer will remain holders of their Banco Sabadell shares. Nevertheless, BBVA may exercise its squeeze-out right on those shares if, on the settlement date of the offer: (i) BBVA holds shares representing at least 90 percent of the voting share capital of Banco Sabadell, and (ii) the offer was accepted by holders of shares representing at least 90 percent of the voting rights of Banco Sabadell to which the offer was addressed.

If BBVA exercises its squeeze-out right over the Banco Sabadell shares not tendered in the offer, it will inform the relevant shareholders in advance by publishing a disclosure of Other Relevant Information. These shareholders will receive the same consideration as the original offer (one BBVA share and for every 4.8376 Banco Sabadell shares).

BBVA will exercise this squeeze-out right against the remaining shareholders of Banco Sabadell as soon as possible after the settlement of the offer, within three trading days following the publication of the offer results.

In this notice or during the following two trading days at the latest, by means of a new notice from BBVA to the CNMV, which will be publicly announced, BBVA will disclose the date on which it has decided to carry out the squeeze-out transaction. This date will be set 15 to 20 business days after this notice. BBVA’s decision will be irrevocable. For further information, please see section III.2.2 of the offer prospectus.

Where can I find additional information or get help making my decision?

- Official documentation on the takeover bid. The prospectus approved by the CNMV is available at cnmv.es and bbva.com, as well as at the headquarters of BBVA, the CNMV and the stock exchanges.

- Investor Customer Service: BBVA is providing a consultation channel for shareholders with any questions or concerns. Email address: info.opa@bbva.com. Phone numbers: +34 800 080 032 / +34 911 859 673

- Independent financial advisors: If personal advice is needed, shareholders can go to their financial institution or a financial advisor they trust to help them assess their participation and plan their investment strategy.

¹ Calculated with BBVA share price at closing on Sept 19, 2025 (€16.41 per share).