BBVA earns €2.7 billion in first quarter (+23 percent yoy)

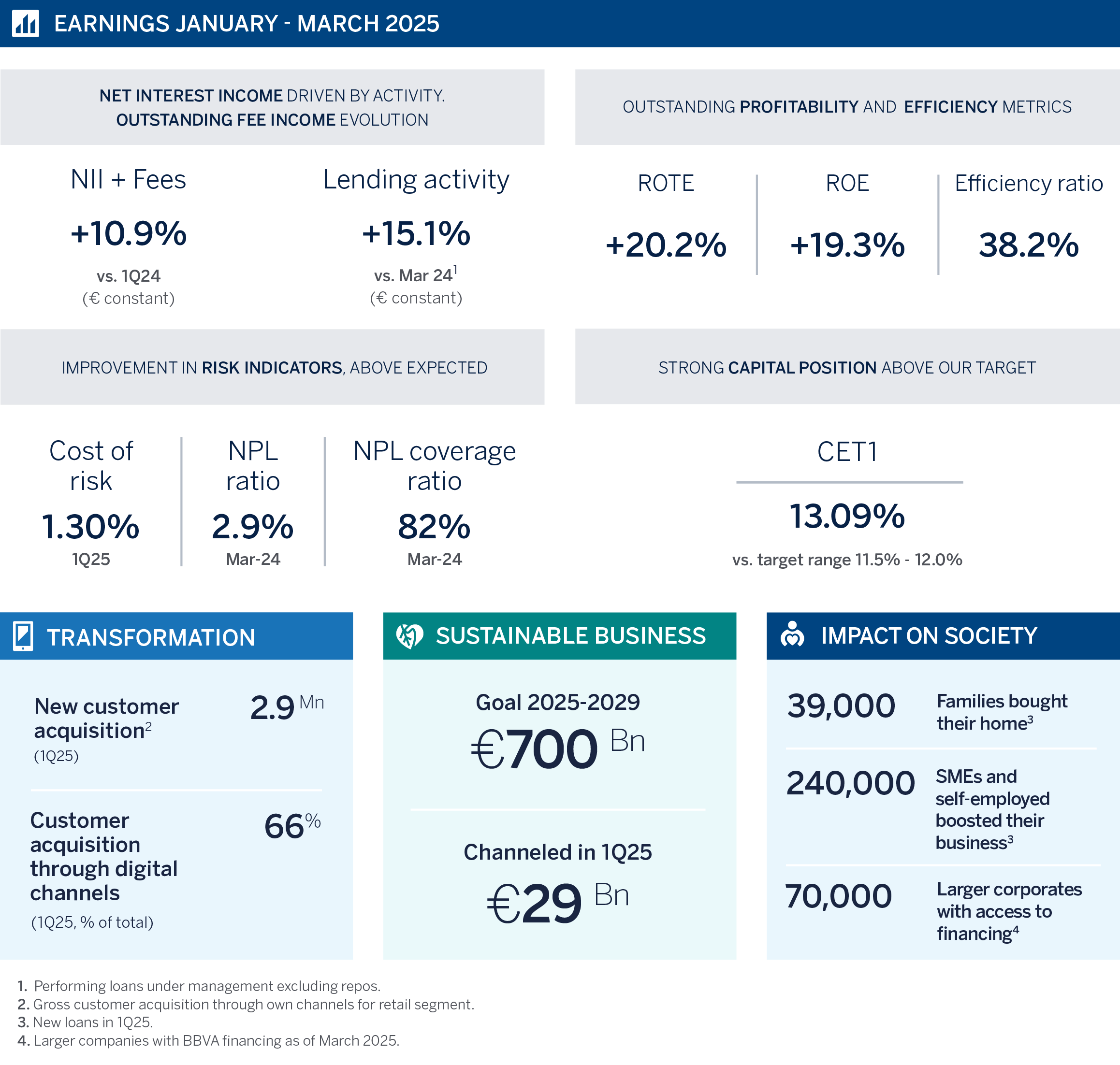

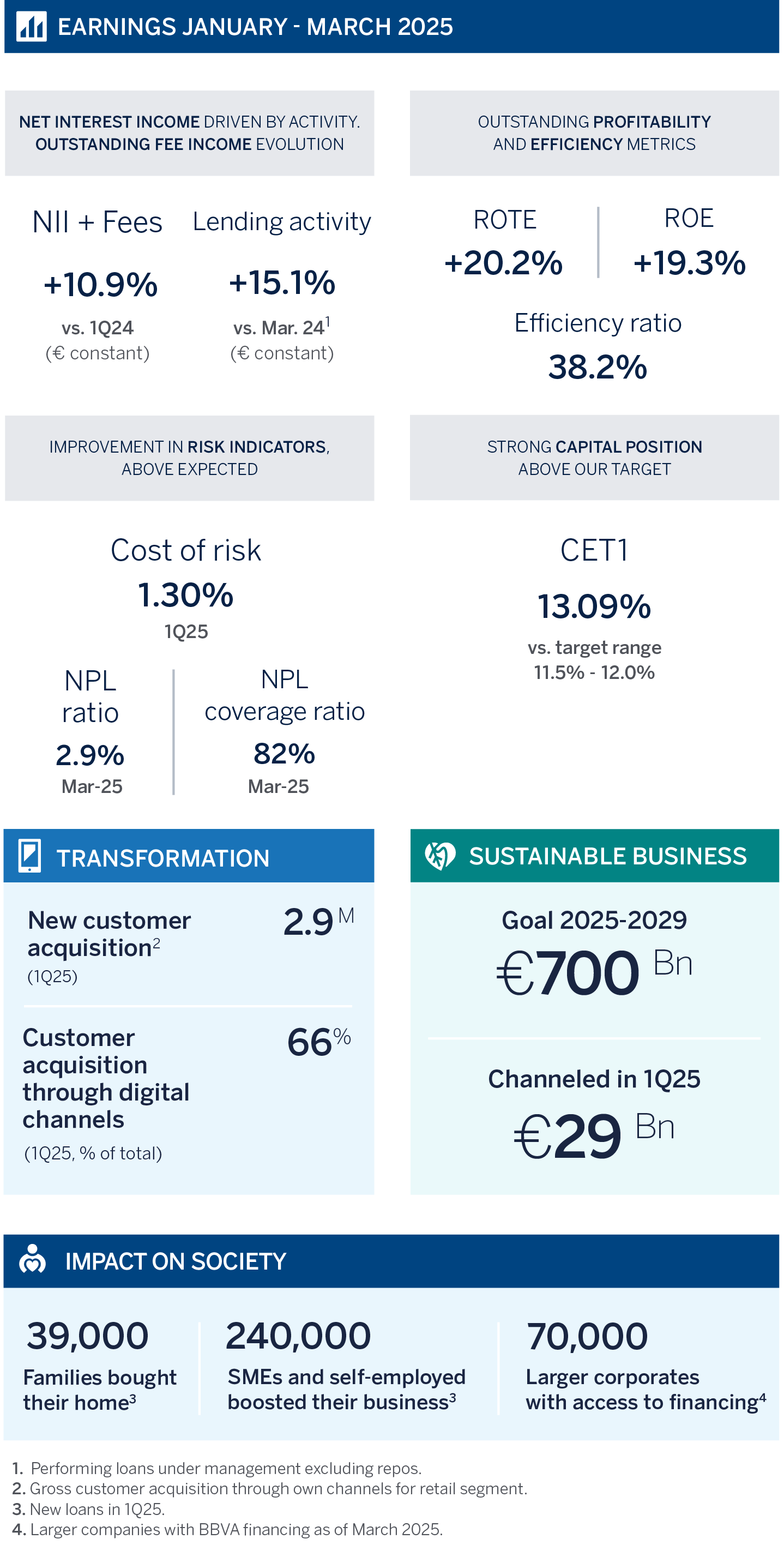

BBVA posted solid results in the first three months of the year. Yet another quarter, BBVA stood out for its distinctive profitability, with an ROTE over 20 percent, and its ability to create value for its shareholders, with a 14 percent yoy increase in the tangible book value per share plus dividends. The Group earned €2.7 billion, up 23 percent in current euros (+46 percent in constant euros), driven by greater activity. The loan portfolio grew by 15 percent in constant euros, with a strong performance of Spain and Mexico. In these two countries, lending for companies and businesses increased by 8.5 and 25 percent, respectively. These earnings strengthened even further BBVA’s capital position, with a CET1 ratio over 13 percent.

Press kit

- Quarterly Report 1Q25 (PDF)

- Results Presentation Analysts 1Q25 (PDF)

- Download video for TV (WeTransfer)

- Download video for webs (YouTube)

- Statement from Onur Genç in English (Audio) (WeTransfer)

- Statement on BBVA 1Q25 earnings from Onur Genç (Text) (PDF)

- Luisa Gómez Bravo and Onur Genç (JPG)

- BBVA CEO Onur Genç (JPG)

- Ciudad BBVA (JPG)

“We got off to a strong start in 2025. Lending has been a clear highlight, with an outstanding profitability and a solid increase in the tangible book value per share plus dividends. Despite the uncertain environment, we are experiencing very positive dynamics across our businesses thanks to our diversified model with leading franchises in high-growth markets. We maintain our forecast to achieve profitability levels (ROTE) similar to those of 2024,” BBVA CEO Onur Genç said.

Greater activity set the pace in the first quarter of 2025. From January to March, BBVA’s loan portfolio grew by 15 percent yoy. Growth in banking activity in recent years has prompted BBVA to substantially increase market share in all countries where it has a significant presence. The Group also managed to consolidate its leadership in markets with high growth potential, given their low levels of banking penetration compared to other countries.

BBVA added 2.9 million new customers in 1Q25, of which 66 percent joined the bank through digital channels. Furthermore, BBVA channeled about €29 billion in sustainable business, up 55 percent from a year earlier, kick-starting the new €700 billion goal for the period 2025-2029.

Except where otherwise stated, the evolution of each of the main headings and changes in the income statement described below refer to constant exchange rates. In other words, they do not take currency fluctuations into account.

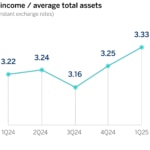

At the top of the P&L account, net interest income (NII) reached €6.4 billion, up 8 percent yoy, with growth in all business areas. Türkiye stood out in this heading on the back of improved customer spreads, as well as Mexico, which saw solid growth of its loan portfolio (+17 percent) and lower financing costs. NII over average total assets, which reflects the ability of a bank to make its assets profitable, has had a positive performance in recent quarters.

Net fees and commissions grew by 19 percent, to €2.1 billion, boosted by activity of payments and asset management, particularly in Türkiye. In Spain the contribution of asset management fees also stood out, and to a lesser extent, those from securities and insurance. The sum of NII and fees and commissions, which represent the core revenues of the banking business, increased by 11 percent, to €8.5 billion.

NTI contribution also stood out this quarter, with €948 million (+40 percent yoy), driven by hedging of foreign currency positions, especially the Mexican peso and the performance of the Global Markets unit.

The line of other operating income and expenses also posted a notably improved result in 1Q25 compared to a year earlier, thanks to a lower impact from hyperinflation in Argentina and Türkiye, and the good performance of the insurance business. Likewise, in 1Q24 BBVA registered in this heading the total amount of the annual extraordinary tax on banking institutions in Spain (€285 million).

All in all, gross income reached €9.3 billion, up 28 percent yoy.

Operating expenses (€3.6 billion) grew by 14 percent, at a lower pace than gross income, which further favored positive jaws, and an improvement of the efficiency ratio of 469 bps over the past year, to 38.2 percent. Furthermore, the increase in expenses remained below the average inflation rate in BBVA’s footprint (about 17 percent over the past 12 months).

Operating income stood at a record €5.8 billion in 1Q25, up 39 percent from a year earlier.

At the end of March, risk indicators performed better than expected: The accumulated cost of risk stood at 1.30 percent in 1Q25 (12 bps below the previous quarter). The coverage ratio and the NPL ratio improved to 82 and 2.9 percent, respectively.

The BBVA Group reported a net attributable profit of €2.698 billion in the first quarter, up 46 percent from the same period of the previous year (+23 percent in current euros). Earnings per share grew at a slightly faster pace, boosted by the share buyback program in 2024.

Thanks to these earnings, profitability indicators improved: ROTE stood at 20.2 percent, and ROE at 19.3 percent. These metrics place BBVA at the forefront among European peers. Moreover, BBVA continued to create value for its shareholders. The tangible book value per share plus dividends stood at €9.84 at the end of March, up 14 percent from a year earlier.

These figures have allowed BBVA to increase even more its capital position. The CET1 ratio stood at 13.09 percent at the end of March, up 21 bps from Dec. 2024, and well above its requirement and its target range.

Business areas

In Spain, lending increased by nearly 7 percent yoy, with a solid performance of the commercial segment (which in total grew by 8.5 percent), and consumer and cards (+7.5 percent). Customer funds rose 3.5 percent, boosted by off-balance sheet funds, mainly investment funds and managed portfolios. Spain reported a net attributable profit of €1.02 billion in 1Q25, up 44 percent from a year earlier, driven by core revenues, improvement in efficiency -591 bps to 32.2 percent- and lower loan-loss provisions. The cost of risk improved to 0.30 percent vs the end of 2024. The NPL ratio and the coverage ratio also improved to 3.5 percent and 61 percent, respectively, which represents a better-than-expected performance.

In this quarter and under the heading of taxes on profit, it also stood out the recording of the 1Q25 accrual of the new tax on NII and fees and commissions, which amounted to about €85 million.

In Mexico, greater lending activity set the pace in the quarter, which grew by more than 17 percent yoy, with significant increases in all portfolios, particularly in commercial (+25 percent including all segments), consumer (+16 percent), and cards (+14 percent). Customer funds also grew strongly (+16 percent), especially off-balance sheet funds (mutual funds) and demand deposits. Mexico posted a net attributable profit of €1.33 billion in 1Q25 (+8 percent), with outstanding performance of core revenues. NII, in particular, was boosted by greater lending activity and lower costs of customer resources as well as wholesale financing. Risk indicators performed better than expected, driven by the positive evolution of retail portfolios: The cost of risk stood at 3.05 percent, the NPL ratio was 2.4 percent, and the coverage ratio stood at 129 percent.

In Türkiye, lending increased, boosted by loans in Turkish lira (+39 percent yoy), and to a lesser extent, by foreign currency loans (+20 percent). Customer funds in Turkish lira also grew by 59 percent, while the resources in foreign currency increased by 8 percent. In the P&L account, the strength of core revenues, together with a lower adjustment for hyperinflation, drove profit by 10 percent in current euros, to €158 million. The cost of risk stood at 1.89 percent, the coverage ratio was 93 percent, and the NPL ratio stood at 3.2 percent.

In South America, lending activity increased by 17 percent yoy, while customer funds grew by 24 percent. The area posted a net attributable profit of €218 million in the first quarter, which represents an increase of 83 percent in current euros. It is noteworthy a lower adjustment for hyperinflation in Argentina, a better performance of fees and commissions, as well as a more contained level of loan-loss provisions. In the country breakdown, Peru reported earnings of €84 million; Argentina, €50 million; and Colombia, €33 million. Risk indicators improved in the region compared to Dec. 24, with the cost of risk standing at 2.30 percent, the NPL ratio at 4.3 percent and the coverage ratio at 90 percent.

About BBVA

BBVA is a global financial services group founded in 1857. The bank is present in more than 25 countries, has a strong leadership position in the Spanish market, is the largest financial institution in Mexico and it has leading franchises in South America and Turkey. BBVA contributes with its activity to the progress and welfare of all its stakeholders: shareholders, clients, employees, providers and society in general. In this regard, BBVA supports families, entrepreneurs and companies in their plans, and helps them to take advantage of the opportunities provided by innovation and technology. Likewise, BBVA offers its customers a unique value proposition, leveraged on technology and data, helping them improve their financial health with personalized information on financial decision-making.