Supply Chain Finance: solutions for your company’s working capital

The term Supply Chain Finance (hereinafter SCF) is a broad term that encompasses a vast variety of financial solutions (finance) that provide support to the different commercial partners engaging in the different stages of the productive chain (supply chain) of a company, from the time the purchase order is issued until the corresponding invoice is paid.

One benefit that all SCF solutions bring is that they allow, each one in their own way, companies to improve their working capital position and therefore their profitability to, ultimately, drive profits.

SCF solutions allow companies to improve their profitability to drive profits

This article focuses on describing the SCF solution that, due to the number of benefits it brings, is being adopted by an increasing number of companies: reverse factoring, also known as approved payables finance.

What is reverse factoring?

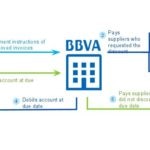

Let’s consider the following scenario: a company purchases – on account - a product or service that has been satisfactorily delivered, receives the corresponding invoice from its supplier and verifies that all the terms specified in the invoice comply with the terms agreed beforehand. In this situation, the company issues an order to its bank to pay the invoice in compliance with the terms agreed with the supplier.

If this happens within a reverse factoring solution, the bank will decide to offer the supplier the possibility to collect the pending invoice’s total before it is due, in exchange for the nonrecourse sale of its rights on the accounts receivables for its customer to the bank. If the supplier does not wish to have the invoice paid in advance, the bank will pay the invoice on its due date.

The advantages are clear, both for the buyer and its suppliers:

- The buyer can negotiate longer payment terms with suppliers, thus optimizing its working capital. The impact of this type of scheme is also very relevant in the strengthening of the financial capability of its suppliers, which in turn helps build a more robust supply chain, which in turns offers better support to the buyer’s activities.

- Suppliers, on the other hand, optimize their working capital by getting paid earlier, and additionally gain access to a new line of funding - normally at a much lower cost, as it takes into account the purchaser’s solvency - without consuming their own credit lines, and eliminate the risk of default, as it is a nonrecourse deduction.

Where is this business heading towards?

According to a report by McKinsey presented in the 2015 edition of SIBOS, revenues generated by reverse factoring solutions are expected to grow at an annual rate of 20%, approximately. The report estimated that reverse factoring could offer access to an untapped market worth $800 billion in unrealized profits as of today. This figure only takes into account the solutions offered to purchasing companies rated as investment grade.

Reverse factoring could offer access to an untapped market worth $800 billion in unrealized profits

For this reason, and taking into account the appealing margins that the current interest rate environment offers, many global financial institutions are focusing on reverse factoring as strategic business.

BBVA’s reverse factoring offer

Besides a wealth of experience accrued over two decades pioneering the deployment of this kind of services in Spain, BBVA Group has the capabilities required to offer both global and local reverse factoring solutions to its customers, in line with their necessities.

Specifically, BBVA’s global reverse factoring solution includes a set of clearly distinctive features that allow providing unrestricted support to its customers, for example, in terms of number, location or size of its suppliers, or currencies in which the payments are denominated

.