BBVA increases green bond allocation by 20 percent in 2024

The bank published its latest ‘Green and Social Bond Report’ on fund allocation and the impact of its sustainable issuances through December 2024. BBVA allocated a total of €5.83 billion to environmental, social and governance (ESG) bonds through green initiatives, and €1 billion to projects with a social focus. This year, the amount of resources allocated to activities aligned with environmental criteria rose by 20 percent over the previous year.

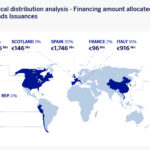

With a presence in four continents, the green bonds issued by the bank have financed projects in countries like the U.S., Spain, Italy, the U.K., China, Chile and Canada, among others. This global approach demonstrates BBVA’s capacity to mobilize capital in diverse regulatory and technological environments, and to support decarbonization in key sectors like renewable energy, energy-efficient construction and electric mobility.

Renewable energy makes up 61 percent of the total amount allocated, with a 45 percent increase over 2023, largely driven by projects in the U.S. Activities classified as ‘enabling’ in the clean transportation category were included for the first time this year, in line with recommendations from the International Capital Market Association (ICMA). Furthermore, BBVA financed 15 energy-efficient data centers in the U.S., each with an energy-saving profile that far surpasses sector standards.

In the green construction category, BBVA has allocated €971 million to projects that promote energy efficiency in residential and commercial buildings. Green mortgages account for 87 percent of the total amount in this category, reflecting a consolidated trend of promoting housing with reduced energy needs and a lower carbon footprint.

From an environmental impact perspective, the projects financed have prevented approximately 1.94 million tons of CO2 emissions - a 50 percent increase over the previous year (1.29 million tons in 2023). Relatively speaking, every million euros allocated prevented 333 tons of CO2 emissions, compared to 265 tons the previous year. In terms of renewable energy, performance has improved by 12 percent, reaching 535 tons of CO2 emissions for every million euros allocated. Meanwhile, relative performance in the green construction category declined (from 2.9 to 0.83 tons of CO2 emissions for every million euros allocated, in line with the concentration of operations in individual mortgages.

In terms of waste, the bank contributed to the processing of 212,142 tons of waste, compared to 170,335 tons in the previous report.

Social bonds: promoting micro-enterprises

On the social front, BBVA allocated the funds from its social bond, which was issued for €1 billion - to 52,154 microenterprises in Spain during the COVID-19 crisis. 70 percent of the funds were channeled to provinces with high or medium-high potential for social impact based on the ECODES PSII Index

Investments like this not only contribute to the climate and social transition - they also act as drivers of economic growth, as they strengthen strategic sectors, such as clean energy, building renovation and sustainable mobility. Sustainability is therefore becoming a catalyst of the productive economy, creating opportunities for innovation, employment and resilience for companies and communities.

“This report reflects BBVA’s commitment to the energy transition and to promoting economic growth, leaving no one behind. Sustainability not only creates environmental and social benefits, it also generates new economic opportunities in key sectors like energy, construction and mobility,” said Javier Rodríguez Soler, Global Head of Sustainability and CIB at BBVA.

The report also incorporates improvements to the methodology and content. The number of reported indicators is higher, the impact per category is provided in greater detail, and new annexes with definitions are included. Furthermore, estimates follow the most recent updates to the ICMA standard, including the Green Bond Principles (June 2025), The Handbook: Harmonized Framework for Impact Reporting (June 2024) and the Green Enabling Projects Guidance.

Looking ahead to the next few years, BBVA has raised its sights with a new target: to channel €700 billion in sustainable business between 2025 and 2029, thus reinforcing its role in financing the global economic transformation.