What are rating agencies?

Rating agencies are private institutions whose main function is to assess the credit risk of a company or financial product through a series of ratings. These assessments are often used in capital markets as benchmarks for investment decisions.

Rating agencies are organizations specialized in assessing the credit risk of both public and private sector companies that use capital markets for financing. The ratings provide a measurement of these companies’ solvency and of the likelihood that they will not be able to pay their financial obligations. The rating also serves as a benchmark for investors to make decisions as they allow them to see the risk associated with their decisions and therefore, the amount of payment they can demand.

Although the decision to seek a rating is normally made by the company or the institution issuing the product, at least one or two ratings from the main agencies are needed in order to obtain financing (for example by issuing debt or receiving financing by discounting assets in central banks). These main agencies are Standard and Poor’s, Moody’s, and Fitch. All three belong to the U.S. and Canadian group DBRS.

When giving their rating, the agencies use data from the countries or organizations requesting their service and analyze their fundamentals and behavior if certain situations of stress were to occur. Each rating agency uses its own methodology when assigning a rating.

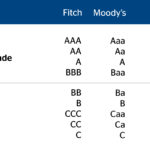

The ratings are scored using alphabetic codes based on a limited scale that is stable over time. Although the rating agencies’ ratings are not completely the same, they are close enough to allow users to determine the credit rating of an issuer or a product immediately. The rating AAA (or Aaa for Moody’s) is the highest credit rating and implies a negligible risk of default. There are also two major groups of ratings: investment grade and speculative grade. Ratings below BBB- (Baa3 for Moody’s) are considered to be speculative grade and have a high risk of default.

The rating agencies’ decisions have a huge impact. For example, losing investment grade status can make financing much more expensive for a company or country, and could event prevent them from obtaining financing.

There have been several attempts to create a public rating agency. In fact, the possibility of creating a public European rating agency was suggested during the crisis, but never materialized.