What are credit ratings?

Credit ratings are estimates that gauge the ability of a company, public administration or financial product to meet their financial commitments. In many cases they are taken as key indicators in capital markets when making investment decisions.

Ratings are assigned to companies, public administrations or financial products by private specialized credit risk assessment organizations (rating agencies). These assessments provide an indication of a company’s solvency and its probability of default. Credit ratings are used as reference by investors when making decisions and assessing investment-related risks, therefore, the remuneration they can demand.

To determine credit ratings, rating agencies asses the data provided by the countries or companies requesting their services and analyze, each one based on its own rating methodology, said country’s or company’s fundamentals and behavior under certain stress scenarios.

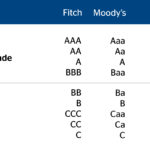

Ratings are scores that work with alphabetic codes, according to a particular scale that remains stable in time. Although rating agencies' ratings are not completely homogeneous, they are similar enough to allow immediately determining the credit quality of an issuer or product. Thus the AAA rating (Aaa in the case of Moody's) represents the best credit quality, with immaterial risk of defaults.

Ratings can be accompanied by an outlook or perspective that can be positive or negative. This outlook reflects the likelihood of a rise or fall of the rating in the event of certain factors occurring in a period of 12 to 24 months. In contrast, if a rating company assigns a positive or negative watch status to a credit rating, the agency agrees to make a decision on this in a maximum of three months.

In addition, there is a barrier that divides ratings into two large groups: investment grade and speculative grade. Risks rated under the BBB- (Baa3 in the case of Moody's) threshold are considered to have speculative grade and high probability of default. Bonds issued by issuers in this grade are also known as a junk bonds.

The decision to have or not to have a rating usually corresponds to the rated company issuing the product. However, in order to obtain financing (for example by issuing in the market or obtaining financing by discounting assets in central banks), it is necessary to have at least one or two qualifications assigned by the top agencies. These are Standard and Poor’s, Moody’s, and Fitch, which belong to U.S, Canadian DBRS and the European Scope Ratings.