BBVA posts in 2021 its highest recurring profit in 10 years, €5.07 billion

BBVA Group posted a recurring profit of €5.07 billion in 2021, the highest of the past ten years, thanks to the positive evolution of revenues and lower loan-loss provisions. Including non-recurring impacts¹, the net attributable profit rose to €4.65 billion, 3.6 times higher than the €1.31 billion registered in 2020. Last year the bank made extraordinary progress in its strategy. In terms of growth it acquired a record of almost nine million new customers. Additionally, the bank continued to create value for its shareholders: the net tangible book value per share plus dividends increased 10.1 percent in the year. BBVA will pay a total dividend per share of €0.31 for 2021, the highest in cash of the past decade.

Press kit Results 4Q21

- Quarterly Report 4Q21 (PDF)

- 4Q21 Results Presentation - Analysts (PDF)

- Statement on BBVA 4Q21 earnings from Carlos Torres Vila (Text) (PDF)

- 'La Vela', main building in 'Ciudad BBVA' (JPG)

- Carlos Torres Vila, Chair (JPG)

- BBVA CEO Onur Genç and the Chair Carlos Torres Vila (JPG)

- BBVA CEO Onur Genç and the Chair Carlos Torres Vila (JPG)

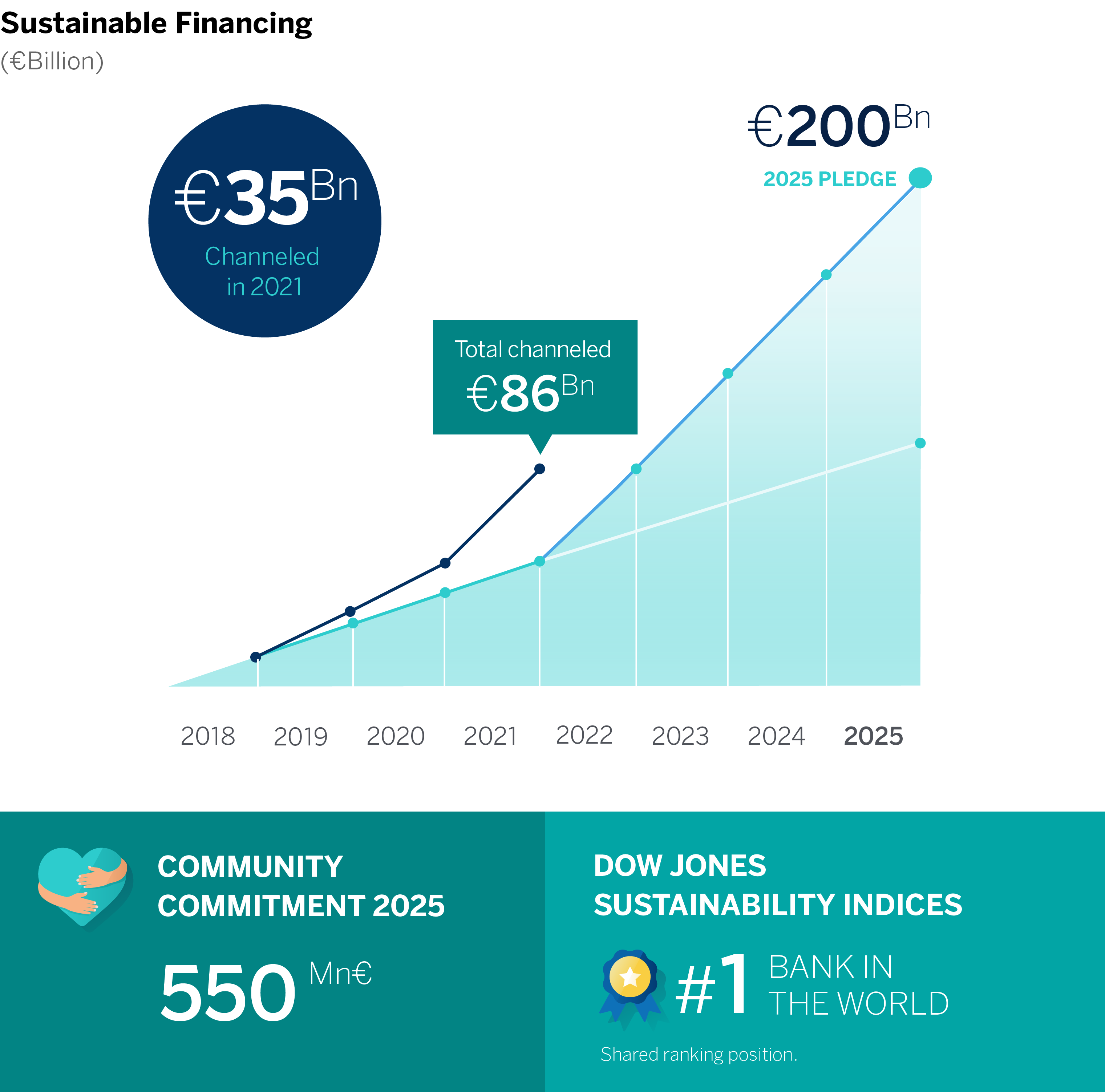

“In 2021, we achieved excellent results, which allowed us to significantly increase distributions to shareholders, with the highest cash dividend per share of the past decade and one of the largest share buybacks plans in Europe. Moreover, in 2021 we made extraordinary progress in our strategy, both in innovation and sustainability. Our digital sales already account for more than 73 percent of total sold units. And in 2021 we have channeled more than €35 billion in sustainable financing,” BBVA Chair Carlos Torres Vila said.

Except where otherwise stated, the changes described under the main headings of the Group’s income statement refer to constant exchange rates. In other words, they do not take currency fluctuations into account.

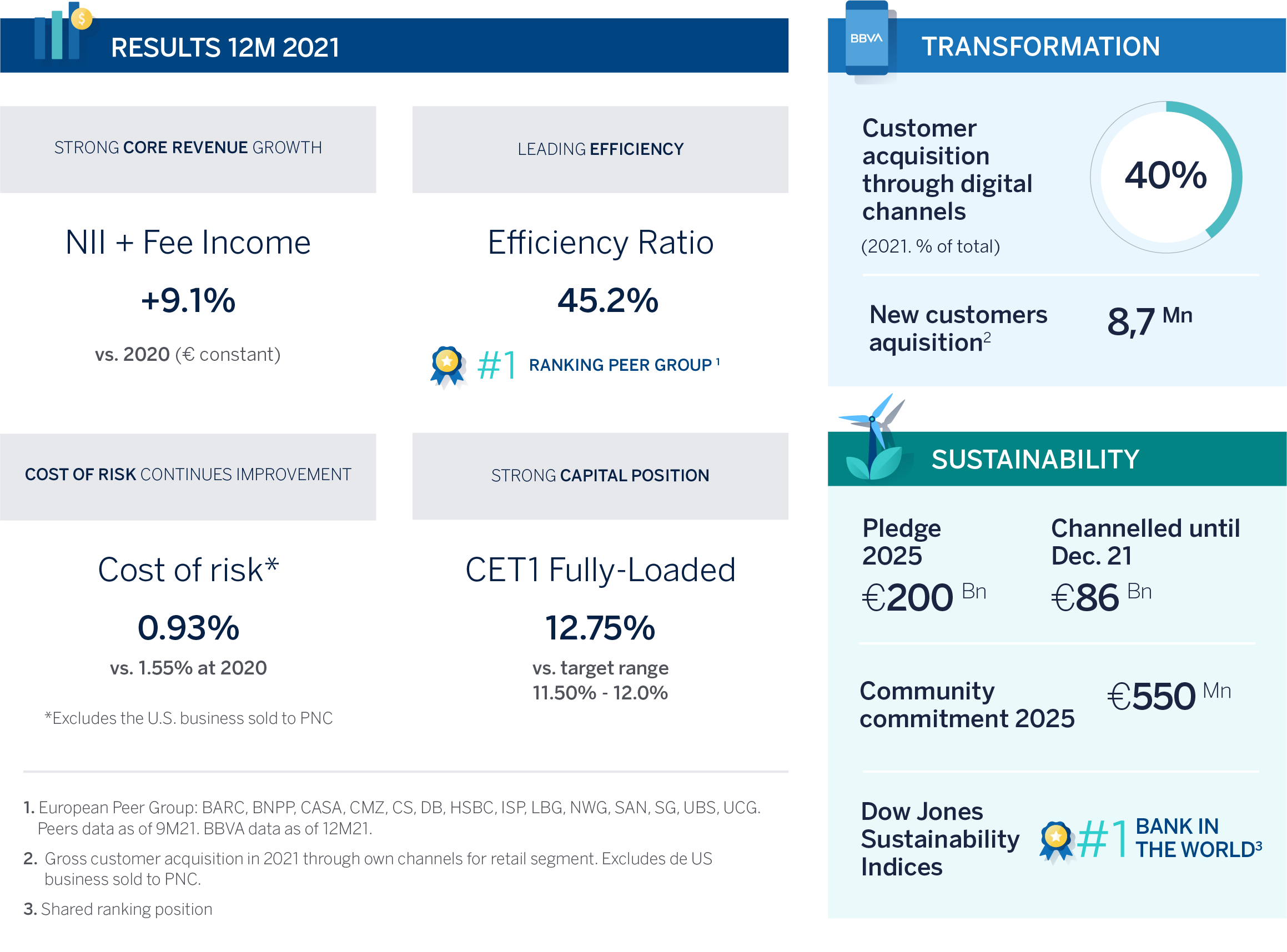

The economic recovery led to a considerable increase of the banking activity in 2021, mostly in the loan portfolio, which was reflected in BBVA’s results. The bank posted its highest recurring profit in ten years, thanks to the strength of operating income, which reached double digit growth (10.8 percent), and driven by solid core earnings (net interest income and fees and commissions). Also notable is the significant reduction in loan-loss provisions compared to 2020, with a better than expected evolution.

At the top of the income statement, net interest income (NII) rose 6.1 percent in 2021 from the previous year, reaching €14.69 billion. Net fees and commissions also increased substantially to €4.77 billion, up 19.8 percent vs. 2020. Overall, net interest income plus net fees and commissions grew 9.1 percent during the year.

The net trading income (NTI) climbed to €1.91 billion in 2021, up 30.5 percent compared to 2020. This is mainly due to a strong performance from the Global Markets unit, especially in Spain and Turkey, and the appreciation of the Group’s stakes in funds and investment vehicles in tech companies.

Strong revenue performance in the year boosted gross income by 9.7 percent, reaching €21.07 billion.

In an environment of recovering activity and rising prices, operating expenses increased 8.5 percent during the year, totaling €9.53 billion. Despite the increase in expenses, the bank delivered positive jaws. The efficiency ratio improved by 53 basis points throughout the year, to 45.2 percent, the best among comparable European peers.

Operating income for the year climbed to €11.54 billion, growing at double digit pace (+10.8 percent).

Impairment on financial assets ended the year at €3.03 billion, significantly lower than 2020 (-38.7 percent), which was marked by the outbreak of the pandemic. Meanwhile, the amount of other provisions in the same period was €262 million, 75.1 percent less than the previous year.

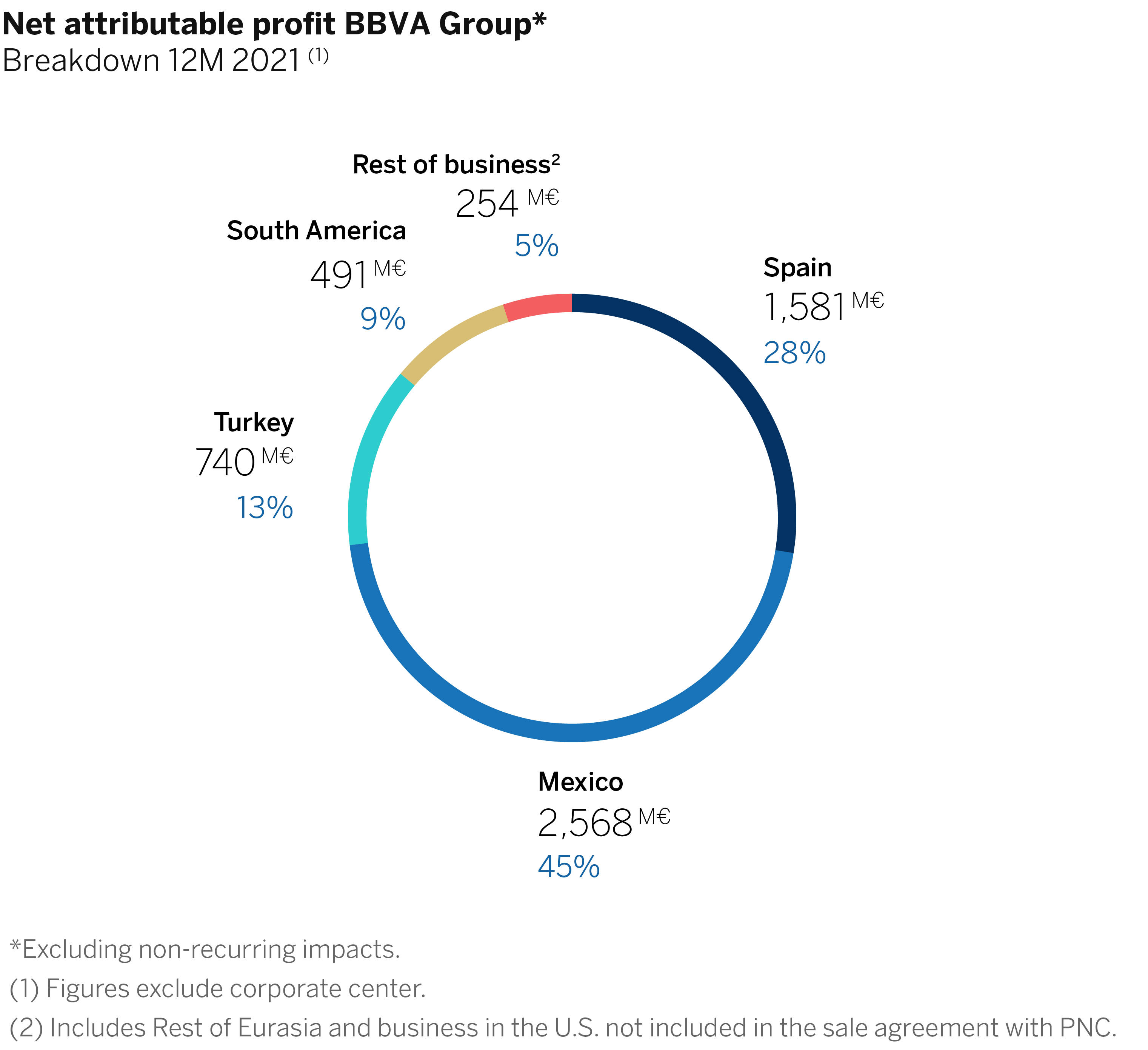

As a result of all of the above, excluding non-recurring impacts, BBVA’s attributable net profit reached €5.07 billion in 2021 (+95.5 percent) - virtually doubling the results from 2020. The non-recurring impacts in 2021 are on the one hand, the results generated by the business sold in the U.S., which totaled €280 million until the closing of the operation on June 1, 2021. On the other hand, €-696 million in net costs associated with the restructuring process of BBVA S.A. in Spain. Including both impacts (€-416 million), BBVA’s net attributable profit rose to €4.65 billion in 2021, 3.6 times more than the €1.31 billion in 2020. In 4Q21 alone, profit (€1.34 billion) surpassed the amount posted for all of 2020.

These solid results boosted BBVA’s profitability in 2021, with ROTE of 12.0 percent and ROE of 11.4 percent (excluding non-recurring impacts), which allowed the bank to continue fulfilling its commitment to create value for shareholders. Proof of this is the fact that the tangible book value per share plus dividends paid during the year stood at €6.66 in December 2021, 10.1 percent higher than the level of the previous year.

Regarding shareholder distributions, the bank is to submit for approval to the AGM the payment of a gross cash dividend of €0.23 per share. This payment is expected to be paid in April 2022 and is in addition to the dividend of €0.08 per share paid in October 2021. All in all, €0.31 for 2021, which is the highest cash dividend per share of the past 10 years and represents a payout of 44 percent².

Moreover, the bank is carrying out one the largest share buyback plans in Europe for up to €3.5 billion. From the first tranche, with a maximum amount of €1.5 billion, execution stands at 60 percent as of January 31, 2022. BBVA has agreed to carry out a second and final tranche of the plan for a maximum amount of €2 billion, which will begin after the end of the execution of the first tranche and will end no later than October 15, 2022³.

Risk indicators remained solid throughout the year. The accumulated cost of risk as of December 2021 improved over previous forecasts and stood at 0.93 percent, below the 1.55 percent figure from a year earlier, heavily impacted by the pandemic outbreak, and also below the 1.04 percent figure from 2019. The NPL ratio ended the year 10 basis points below the 2020-level, at 4.1 percent, while the NPL coverage ratio stood at 75 percent at the end of 2021.

As for the balance sheet and activity, the gross figure for loans and advances to customers posted a 2.1 percent increase in 2021 vs. December 2020, reaching €330.1 billion. Customer resources grew 4.5 percent, to €465.5 billion, on the back of a positive evolution of demand deposits and off-balance sheet funds.

In regards to capital adequacy, the Group’s fully-loaded CET1 ratio stood at 12.75 percent at the end of December 2021, well above the regulatory requirement of 8.60 percent, and also higher than the target range set by the Group, which stands between 11.5 percent and 12 percent. The 12.75 percent figure already includes the deduction of the entire €3.5 billion share buyback plan.

Record in customer acquisition

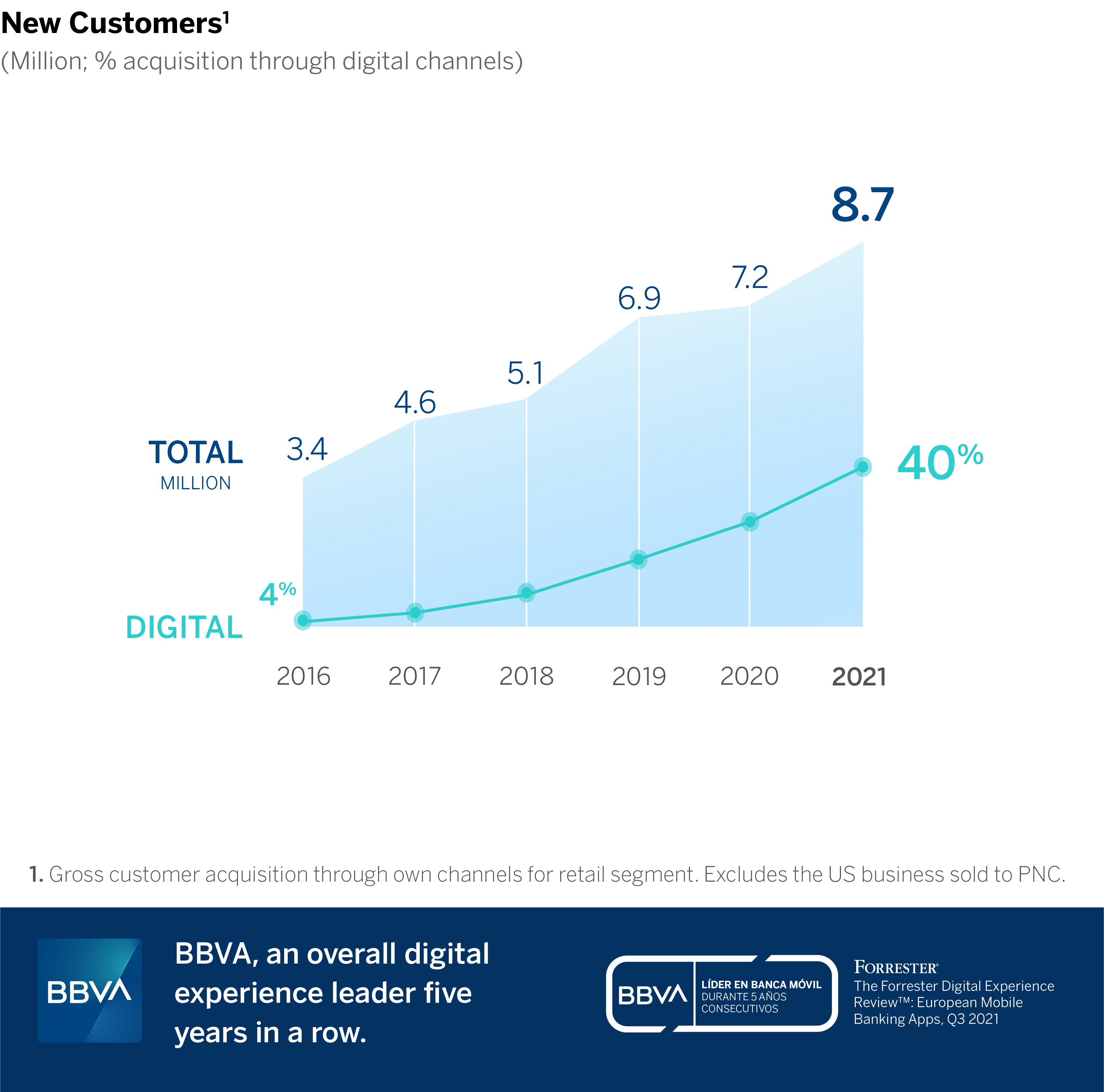

The progress in BBVA’s strategy is producing results in customer acquisition. In 2021, BBVA added 8.7 million new customers (+47 percent yoy), a new record. Of this amount, 40 percent were added through digital channels, compared to only 4 percent just five years ago. Additionally, digital sales now account for 73 percent of total units, while digital customers represent 69.4 percent and mobile ones account for 66 percent. In 2021, BBVA led mobile digital experience for a fifth consecutive year, according to Forrester. Furthermore, the Group maintains its commitment to investing in innovation as a driver of growth through digital companies like Atom Bank and Solarisbank, and fintech-dedicated venture capital funds, such as Propel.

BBVA has been recognized as the most sustainable bank in the world, according to the Dow Jones Sustainability Index. In 2021 BBVA channeled €35.4 billion in sustainable financing, bringing the total since 2018 to €86 billion. This is part of its goal to reach €200 billion in 2025. BBVA also announced this year that it would stop financing coal-related activities by 2030 in developed markets, and by 2040 in the rest of its markets. Likewise, the Group unveiled intermediate targets to reduce carbon intensity in its loan portfolio by 52 percent in power, 46 percent in automobile manufacturing, 23 percent in steel production and 17 percent in cement production for the 2020-2030 period. The bank will focus on providing its customers and clients with financing, advice and innovative solutions as part of a global decarbonization effort.

The Group also launched an ambitious social plan in order to promote inclusive growth, in which BBVA and its Foundations are committing €550 million for social initiatives through 2025. The plan expects to grant more than €7 billion in micro-loans to vulnerable entrepreneurs through the BBVA Microfinance Foundation.

Business areas

In Spain, the most profitable segments, such as SMEs, consumer loans and credit cards helped lending to increase 1.7 percent in 2021. Customer resources grew 2.8 percent, driven by mutual funds and demand deposits, which helped offset the decline in time deposits. The P&L account showed solid growth of net fees and commissions (+21.5 percent yoy), thanks to a recovery in activity. Likewise, results benefited from the bancassurance business (mainly thanks to the agreement with Allianz) and from NTI with a significant contribution from the Global Markets unit. Still, NII decreased 1.8 percent, in line with expectations, mostly due to the interest rates environment and a lower contribution from the ALCO portfolio. Stability in operating expenses contributed to a 14.5 percent growth in operating income in this period. Net attributable profit stood at €1.58 billion in 2021, the best result in the past 11 years, and up 143 percent from 2020. As for asset quality, the cost of risk maintained its downward trend throughout the year, reaching 0.30 percent in cumulative terms, compared to more than double in 2020. The NPL ratio ended at 4.2 percent and the NPL coverage ratio stood at 62 percent.

In Mexico, lending activity showed momentum (+6.5 percent) in all segments, particularly in SMEs, credit cards and mortgages. Customer resources grew at a solid pace of 11.5 percent in 2021, on the back of a strong performance of demand deposits and mutual funds. In the P&L account, gross income grew 5.8 percent in the year, thanks to a good evolution of the net interest income (+5.4 percent) and net fees and commissions (+11.6 percent). Operating income also grew (3.3 percent), with an increase of 10.9 percent in operating expenses in an environment of relatively high inflation. The net attributable profit stood at €2.57 billion (+42.6 percent yoy). As for risk indicators, the accumulated cost of risk improved significantly to 2.67 percent. The NPL ratio ended at 3.2 percent and the NPL coverage ratio was 106 percent.

In Turkey, lending in Turkish lira stood out, increasing 28.1 percent in 2021 vs a year earlier. On the contrary, loans in foreign currency decreased 13.3 percent during the same period. Customer resources rose 24.5 percent in Turkish lira and 5.1 percent in foreign currency. The P&L account also benefited from recurring revenues, following an increase of 11.2 percent in the NII, 44.4 percent in net fees and commissions, and NTI contribution, which rose 137.4 percent. Operating income rose 23.8 percent in the year, and net attributable profit stood at €740 million, up 71.4 percent from 2020. The cost of risk ended December at 1.33 percent in cumulative terms, significantly below the 2.13 percent in the previous year. The NPL ratio stood at 7.1 percent and the NPL coverage ratio was 75 percent.

In South America, the lending portfolio increased 10.3 percent in 2021, with growth in all segments and throughout the region, particularly in consumer loans and credit cards. As a whole, loans grew 10.3 percent in 2021. Customer resources rose 5.7 percent compared to 2020, with growth in demand deposits and off-balance sheet funds. The P&L account reflects a year on year increase in NII and net fees and commissions (+15.5 and +34.9 percent, respectively). Net attributable profit rose to €491 million in 2021, up 23 percent compared to a year earlier. The cost of risk improved to 1.65 percent for the full year, with the NPL ratio ending at 4.5 percent, and the NPL coverage ratio at 99 percent.

¹Non-recurring impacts include: (I) Profit (loss) after tax from discontinued operations in 2021 and 2020; (II) the net cost related to the restructuring process in 2021; and (III) the net capital gain from the bancassurance operation with Allianz in 2020.

²This ratio has been calculated taking into consideration: (i) 2021 results, including the results of the US business sold to PNC and the net impact of the restructuring process; and (ii) the number of shares with right to dividends as of January 31, 2022.

³The preliminary estimated execution term is between 4 and 5 months, although the actual term will be determined in the subsequent communication with the specific terms and conditions of the Second Tranche.

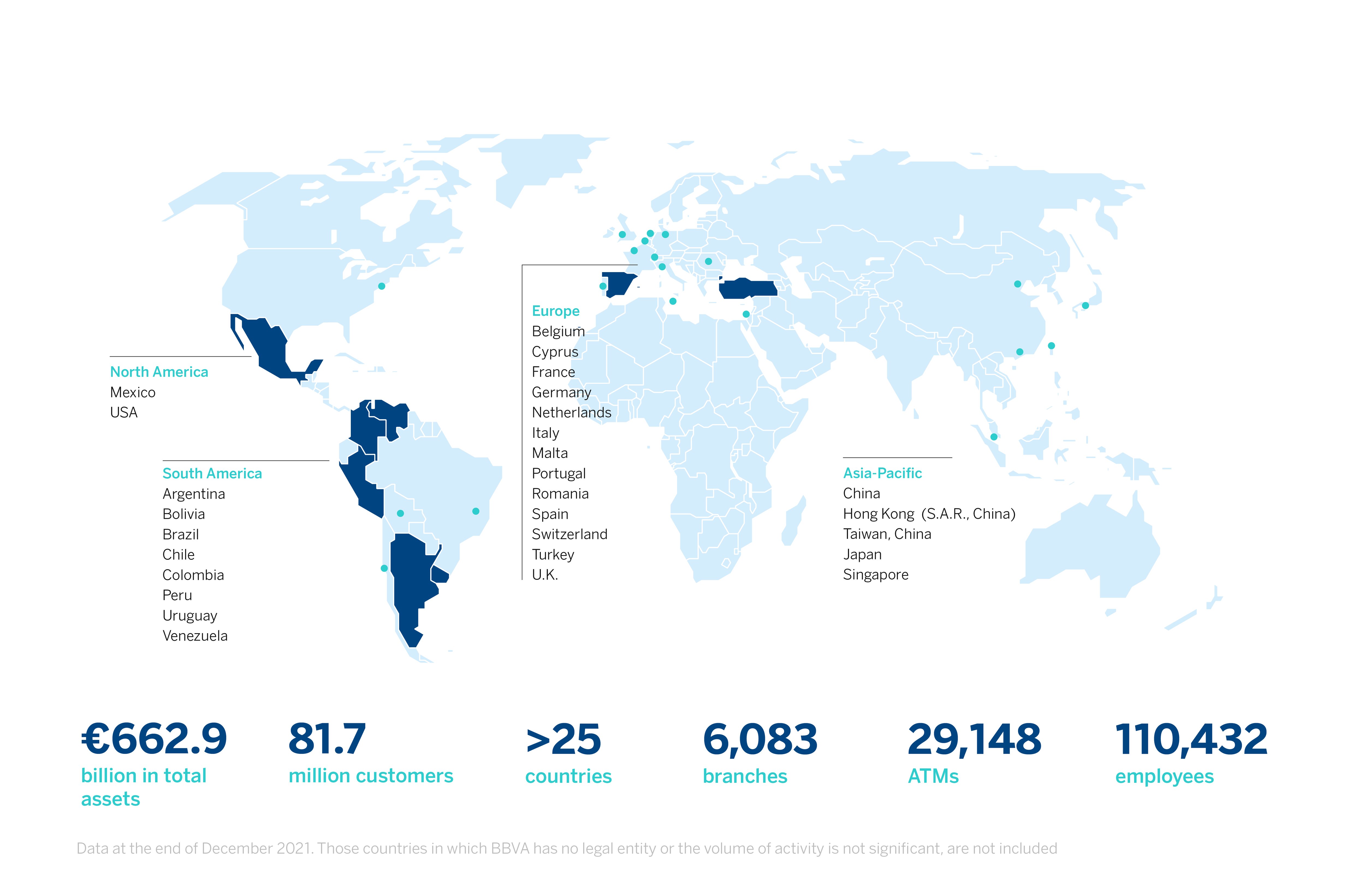

BBVA is a customer-centric global financial services group founded in 1857. The Group has a strong leadership position in the Spanish market, is the largest financial institution in Mexico and it has leading franchises in South America. It is also the leading shareholder in Turkey’s Garanti BBVA and has an important investment, transactional and capital markets banking business in the U.S. Its purpose is to bring the age of opportunities to everyone, based on our customers’ real needs: provide the best solutions, helping them make the best financial decisions, through an easy and convenient experience. The institution rests in solid values: Customer comes first, we think big and we are one team. Its responsible banking model aspires to achieve a more inclusive and sustainable society.