BBVA's decarbonization targets: What do they mean and what is their scope?

The role of banking is fundamental as a funder of all productive sectors. In addition, it plays a key role by channeling funds toward activities that contribute to decarbonization, and due to the influence that can be exerted on the behavior of banking customers and their environmental performance, through such financing, in order to achieve the objectives of the Paris Agreement.

BBVA publishes intermediate emission reduction targets for the real estate and aluminum sectors

As part of this focus on climate action, BBVA has announced targets for the decarbonization of its loan portfolio in 2030 for CO2 intensive industries. They are intermediate targets with a view to becoming carbon neutral by 2050.

In April 2021 BBVA announced the Net Zero 2050 commitment, which takes both direct and indirect emissions into account, including among the latter those of clients who receive financing from the bank. BBVA wants to accompany its clients in their transition to a more sustainable future, with specific plans and objectives.

On March 5, 2021, BBVA published its commitment to reduce its exposure to coal-related activities to zero, stopping the financing of companies in these activities before 2030 in developed countries and before 2040 in the rest of the countries in which it is present. This decision is in line with the proposal of the Intergovernmental Panel on Climate Change's (IPCC) to limit the increase in temperatures to a maximum of 1.5ºC and with the aim of achieving a carbon neutral economy in 2050.

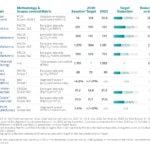

On November 3, 2021, a first exercise to align the bank's lending portfolio with the Paris Agreement was published. It publishes interim 2030 decarbonization targets for the power generation sector as well as for the automotive, steel and cement sectors, implementation timelines and a breakdown of the metrics used to shape this commitment.

On October 5, 2022, BBVA completed this initial exercise with the addition of the oil and gas sector to the bank's portfolio alignment.

On April 12, 2023, the bank published its progress in the decarbonization of several sectors in its first version of a climate transition plan (BBVA’s fourth TCFD report) . In 2022, all sectors with published decarbonization targets reduced the intensity of their emissions.

The alignment indicators were calculated in accordance with the methodologies available today in the market. It is worth noting the limitation for most sectors in terms of accessing sufficient information with the required detail.

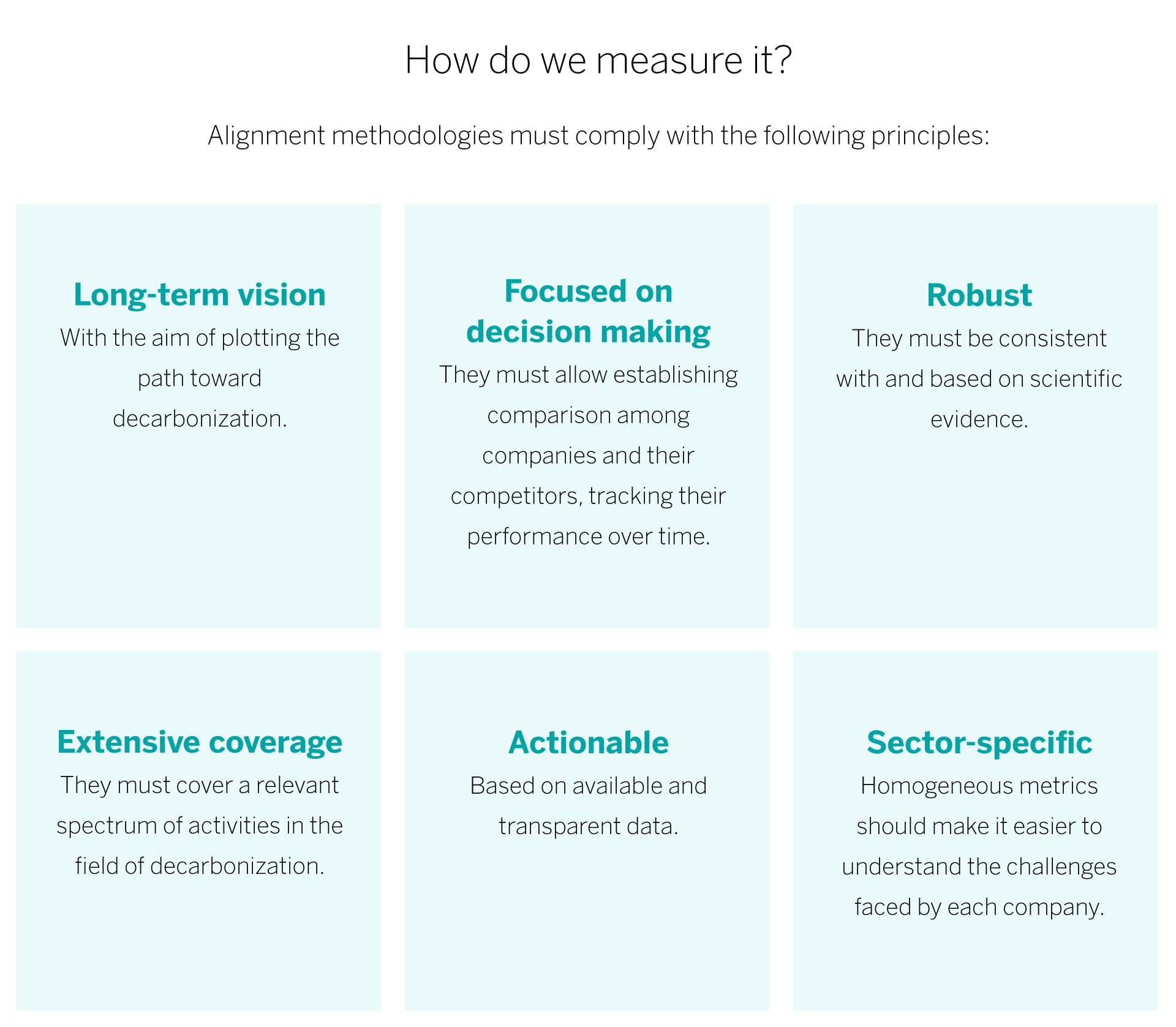

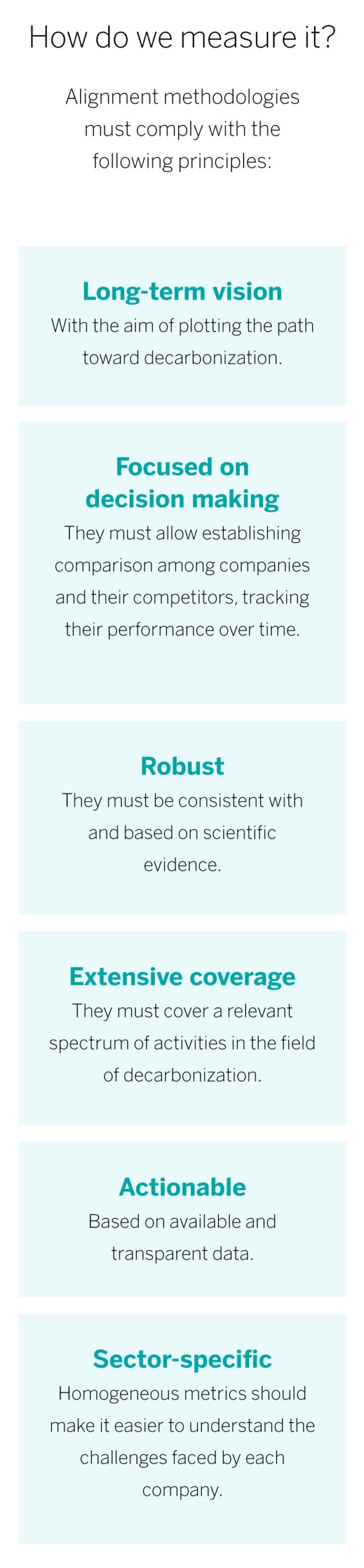

The concept of aligning financing with the Paris Agreement has recently emerged as the new paradigm to operationalize and scale-up climate action within the financial industry.

This concept captures the fact that financial flows must be consistent with a low greenhouse gas emissions trajectory and climate-resilient development to keep the global average temperature from rising above 2°C relative to pre-industrial levels, and as close to 1.5°C as possible.

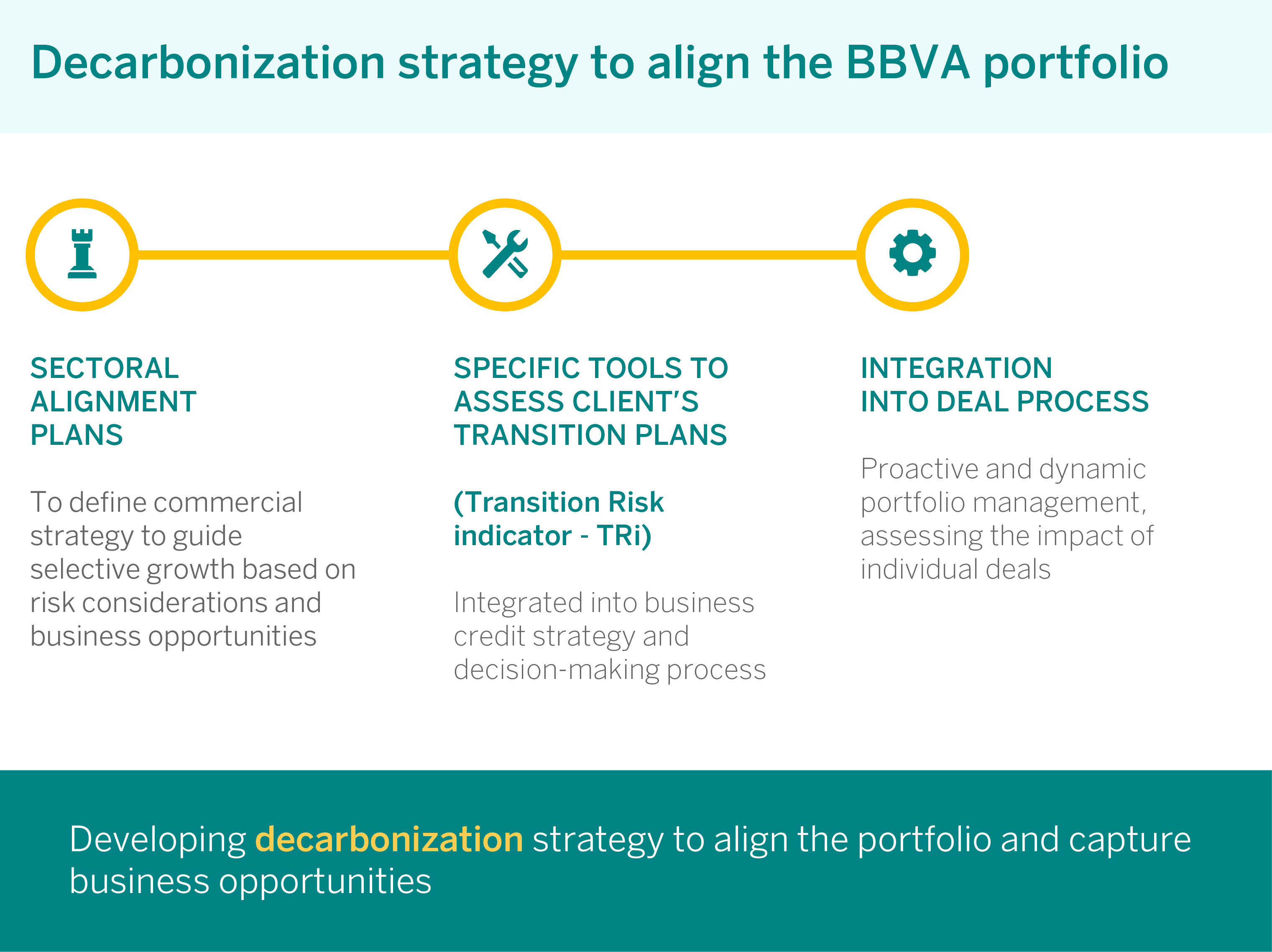

Alignment methodologies help to explain how financial flows contribute to decarbonization, assigning an environmental performance indicator to the loan portfolio. This metric is compared against the benchmark offered by climate change scenarios, and in combination with these, emission reduction targets are set that are included in clients’ sales strategies.

BBVA, in a joint effort with the group known as the Katowice banks (for making their commitment after the Climate Summit, held in this Polish city in 2018) and the 2dii think tank, has implemented the Paris Agreement Capital Transition Assessment (PACTA) methodology to measure the alignment of its loan book with the Paris objectives, covering the coal, power generation, automotive, steel, cement and aviation industries.

Furthermore, BBVA wanted to extend its commitment to the rest of sectors with a relevant impact on the generation of greenhouse gas, such as the oil and gas sector, starting October 5 ,2022, It uses the methodology of the Partnership for Carbon Accounting Financials (PCAF) and establishes an absolute emission reduction target for oil exploration and production.

On December 21, 2023, BBVA announced the expansion of its interim emission reduction targets for 2030 to two relevant sectors: aviation and shipping.

In 2024, BBVA will continue working to extend coverage to other sectors with intense CO2 emissions, such as aluminum, real estate and agriculture.

BBVA has decided to adopt the 1.5ºC scenarios as a reference, specifically, the NET Zero 2050 scenarios of the International Energy Agency (IEA) for the oil and gas, power generation, automotive and aviation sectors. For the steel and cement sectors, it is using the scenario established by the Institute for Sustainable Futures Sectoral Pathways to Net Zero Emissions (ISF NZ). In 2023, the International Energy Agency published an update to its net zero scenario for 2050.

Breakdown by sectors:

1. Oil and gas

The oil and gas industry plays a fundamental role in the transition of the energy sector. Emissions from oil and gas operations (scope 1 and 2) are largely concentrated in activities related to the exploration, drilling and extraction of oil and gas, mainly due to methane leaks from the sector. There are currently strategic initiatives available to reduce the emissions from these scopes, primarily related to managing fugitive emissions. However, the bulk of the sector’s emissions are scope 3, associated with oil and gas consumption by end users.

These emissions account for approximately 80 percent of the sector’s emissions and their reduction requires a decline in the consumption of oil and gas and greater consumption of other low carbon forms of energy. Many groups in the sector are transitioning toward models with multiple sources of energy in order to adapt to this transition.

2. Power generation

The decarbonization trend in the power industry is clear. Boosting investments in renewable energies could lead to the decarbonization of the sector in advanced economies between 2030 and 2040 and in emerging markets after 2040. The sector’s most important groups are committing to increase their renewable generation capacity, mainly wind and solar, phasing out coal from their generation portfolios over the next decade and slightly curtailing the weight of gas in Europe, while maintaining or slightly increasing it in emerging economies.

3. Automotive

Electrification is leading to a profound overhaul of the automotive industry and its business models. Regulation to curb emissions from vehicle use has become the main driver behind this transformation. As a result, automakers have been announcing aggressive investments in technology and electric batteries in recent years, and pledging to phase out the production of internal combustion motor vehicles within the next 15 years. Globally, electric vehicle sales are expected to reach 10.7 million by 2025 and 28.2 million by 2030, with emissions at about 121 g CO2/km.

4. Steel

The decarbonization of the steel industry requires very significant investments in the coming years for the development of appropriate technologies. Emission intensity is therefore expected to reach 860 kg CO2 per ton of steel by 2030. After that, it should begin to decline more rapidly, with the advent of new renewable energy sources - especially green hydrogen - and carbon capture technologies. Through 2030, the actions of the industry’s largest players will focus on prioritizing lower-emission manufacturing routes or the use of scrap in the metal mix in order to meet their emission reduction targets.

5. Cement

The cement industry relies on traditional levers to curb emissions, such as reducing the clinker factor, using alternative fuels to replace fossil fuels and replacing a portion of the limestone they use with alternative raw materials. Although the decarbonization scenarios consider carbon capture, use and storage (CCUS) technology as one of the levers in reducing CO2 emissions, it will not be relevant until the next decade due to the lack of technological maturity at the moment. As a result, CO2 emission reductions will be more aggressive after 2030 once CCUS technology becomes available on a large scale.

6. Coal

The energy sector has the highest CO2 emissions. According to the Intergovernmental Panel on Climate Change (IPCC), power generation from coal should fall to nearly zero in order to have a net zero economy by 2050. Achieving net zero emissions requires a change in energy model to renewable energy. Accompanying clients moving forward in this energy transition is essential in order to transform the weight of power generation from coal toward models based on sustainable energy sources.

7. Aviation

The aviation sector is one of the most complex when it comes to decarbonization, as the volume of global air traffic is expected to grow in the coming decades. If the emissions are not mitigated, aviation could go from representing 3 percent of all greenhouse gas emissions to 22 percent in 2050, according to the European Commission. Disruptive technologies will be needed, such as sustainable aviation fuels, the electrification and/or use of hydrogen in propulsion systems, mainly for short- and medium haul flights. The combined efforts of airports, airlines and service providers will be key to the decarbonization of this sector.

8. Shipping

In 2023, the International Maritime Organization announced its goa of reaching net zero emissions by 2050. The reality is that if emissions are not mitigated, this sector could go from representing 3 percent of all greenhouse gas emissions to 13 percent in 2050, according to the European Commission. Reducing emissions from shipping is no easy task due to the long useful life of the assets, high energy dependence and limited drivers available to shipping companies. The sector is taking an initiative and leaders in the industry are establishing ambitious plans that include renewing the current fleet to have zero emission vessels by 2050.

9. Aluminum

The aluminum industry, responsible for a notable 2% of global greenhouse gas emissions, stands as a significant contributor to environmental degradation owing to its energy-intensive production processes. This vital metal, integral to myriad industrial applications, is poised for a substantial surge in demand—projected to rise by 40% by 2030. This escalation is propelled by the burgeoning energy transition, the proliferation of electric vehicles, and an uptick in construction activities. The International Aluminium Institute (IAI) warns that without intervention, the surge in primary production to satisfy rising demand could result in a 30% increase in the sector's carbon emissions. Decarbonizing the aluminum industry necessitates substantial investment in greening its electricity supply. This includes financing production facilities tied to low-carbon grids and prioritizing power purchase agreements for renewable energy, with a particular emphasis on solar and especially hydroelectric power.

10. Real estate

The real estate sector is responsible for roughly 37% of global greenhouse gas emissions. These emissions stem from two primary sources: operational emissions, which constitute 27% and result from the energy consumption and purchases by building users, and embodied emissions, which make up about 10% and are linked to the emissions generated during construction and the production of building materials. Efforts to reduce emissions concentrate on operational emissions, which can be mitigated throughout a building's life cycle. Emissions intensity (kgCO2e/m2/year) is calculated by considering the building type, its estimated energy consumption based on Energy Efficiency Certificates, and the average emission factors of the energy source specific to each building typology.