BBVA earns €636 million in second quarter, doubling the underlying profit from first quarter

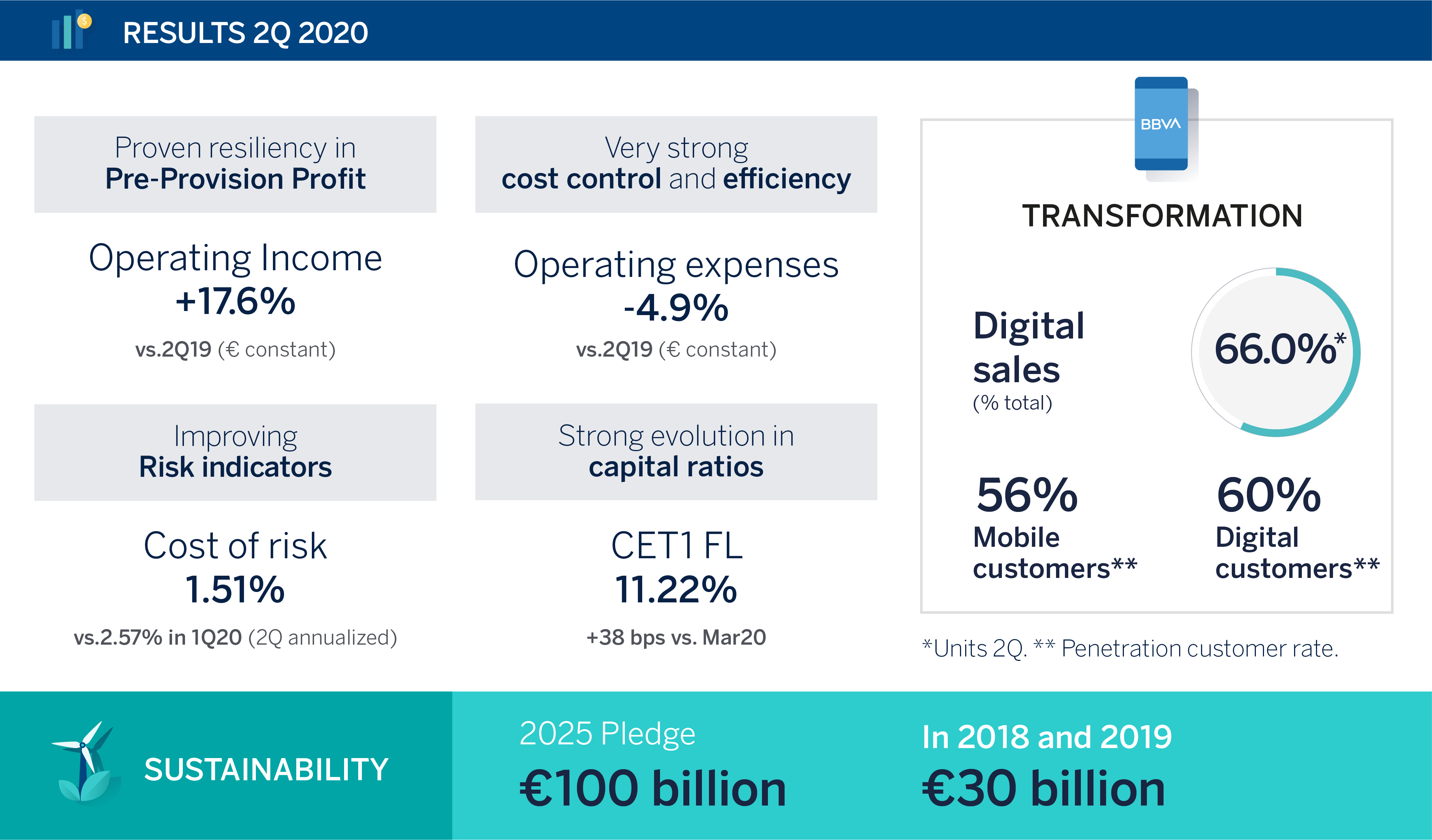

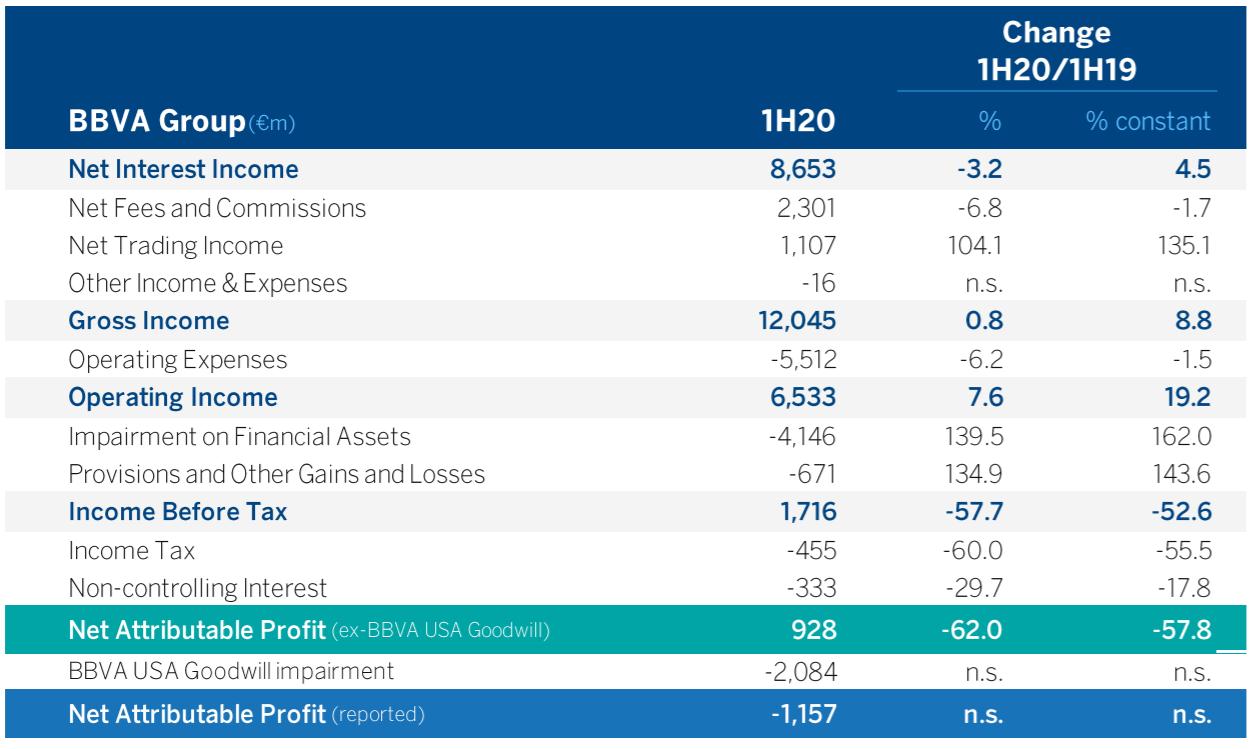

Thanks to the bank’s efforts to anticipate impairments related to the COVID-19 in 1Q20, BBVA earned €636 million in the second quarter, doubling the underlying profit from the first quarter. This quarterly figure is on top of extraordinary provisions of €644 million due to the pandemic. In a complex environment, BBVA has once again demonstrated the strength of its operating income, which grew 17.6 percent at constant exchange rates, and its outstanding ability to generate capital. In the first half of the year, net attributable profit excluding one-offs was €928 million (-57.8 percent yoy in constant euros). Including the U.S. goodwill adjustment –recorded in 1Q20– the bank swung to a €-1.16 billion loss between January and June.

Press kit Results 2Q20

- Statements from Onur Genç (YouTube)

- 2Q20 Quarterly Report

- Statement on BBVA 2Q20 earnings from BBVA CEO (Text)

- 2Q20 Results Presentation Analysts (PDF)

- Statements from Onur Genç - Radio

- 2Q20 Results Presentation - Press (PDF)

- Statements from Onur Genç - TV

- 'La Vela', main building in the 'Ciudad BBVA' (JPG)

- Onur Genç, BBVA’s CEO (JPG)

“In this unprecedented environment, we continued to post solid results before provisions. We are facing this crisis from a position of strength, thanks to the resilience of our revenues, our diversified business model and our digital capabilities. Likewise, our solid capital generation stood out during the quarter,” BBVA CEO Onur Genç said.

BBVA’s results between January and June 2020 reflect the strength of its income before provisions i.e. operating income, which allowed the bank to make provisions and other impairments to face the pandemic’s impact. Reining in operating expenses also contributed to improving the efficiency ratio in 1H20 by 3.89 percentage points.

Net interest income (NII) grew 2 percent yoy in 2Q20 at constant exchange rates (-9.8 percent at current rates) to €4.1 billion. For the first half of the year NII stood at €8.65 billion, up 4.5 percent at constant exchange rates, compared to the same period a year earlier (-3.2 percent at current exchange rates). Net fees and commissions were impacted by subdued activity in retail banking, mainly cards, due to lockdown measures. BBVA Group earned €1.04 billion in net fees and commissions in 2Q20, down 9.5 percent in constant terms (-16.9 percent at current exchange rates). From January to June net fees and commissions reached €2.3 billion (-1.7 percent at constant rates, -6.8 percent at current rates.)

Net trading income (NTI) saw a remarkably good performance, with a 135.1 percent growth yoy in 1H20 at constant exchange rates (+104.1 percent in current euros), mainly due to foreign-exchange rate hedging gains and higher results in virtually all business units.

Gross income reached €5.56 billion in 2Q20, increasing 6.1 percent yoy at constant exchange rates (-5.7 percent at current rates). Over the six-month period, this item grew 8.8 percent at constant exchange rates (+0.8 percent at current rates) to €12.05 billion.

Operating expenses dropped sharply in 2Q20 to €2.59 billion, -4.9 percent at constant exchange rates (-12.1 percent at current rates), compared to a year earlier. In the first half of 2020, operating expenses fell 1.5 percent in constant euros (-6.2 percent at current rates), to €5.51 billion, compared to an average inflation of 4.7 percent in the past 12 months. This containment in operating expenses and the positive performance of recurring revenue allowed for operating jaws to remain in positive territory.

Operating income reached €2.97 billion in 2Q20, which represents a 17.6 percent increase yoy at constant exchange rates (+0.7 percent at current rates.) From January through June, operating income was €6.53 billion (+19.2 percent at constant euros, +7.6 percent at current rates).This growth was driven by a good performance of NII and NTI, as well as a decline in operating expenses.

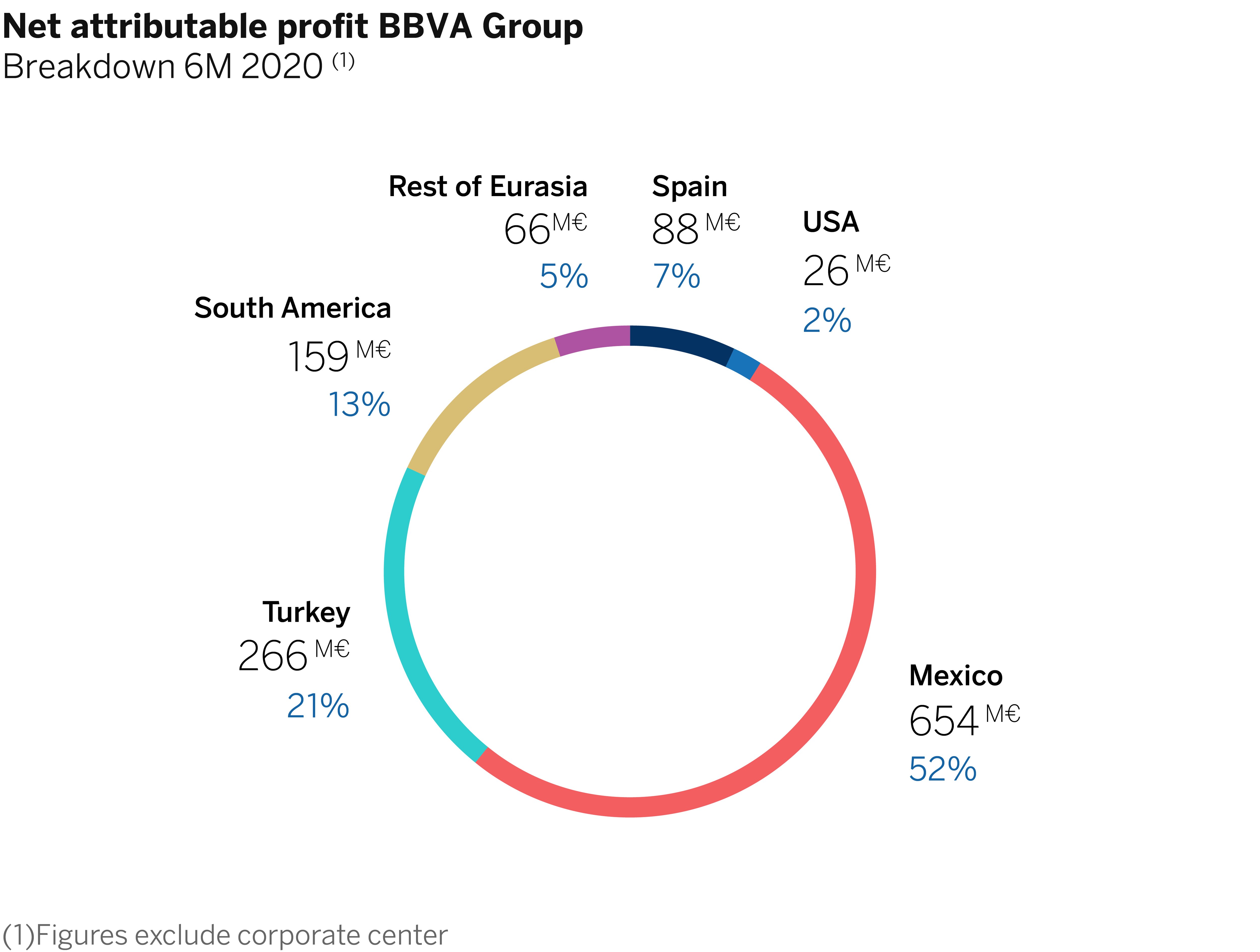

Net attributable profit in 2Q20 came at €636 million, down 40.5 percent yoy at constant exchange rates (-49.5 percent at current), following charges resulting from the pandemic (€644 million: €576 million in impairments and €68 million in provisions). This figure is 118 percent above the net attributable profit for 1Q20, excluding the U.S. goodwill adjustment. In cumulative terms, BBVA's net attributable profit in 1H20 stood at €928 million excluding the U.S. goodwill impairment (-57.8 percent in constant euros, -62 percent in current euros). Including this impact (€2.08 billion) the net attributable result for 1H20 was €-1.16 billion.

The fully-loaded CET1 capital ratio stood at 11.22 percent as of June 30, 2020, which represents a significant capital generation of 38 basis points compared to March 2020 (10.84 percent). This increase is mainly due to a bigger contribution of 2Q20 results and an improvement in financial markets evolution. With 263 basis points above the minimum required, BBVA is in the upper part of the target range – a buffer of 225 to 275 basis points over its fully-loaded CET1 capital ratio requirement (currently at 8.59 percent).

Thanks to front-loaded provisions recorded in 1Q20, the bank has seen a substantial improvement in the cost-of-risk, dropping from 2.57 percent between January and March 2020, to 1.51 percent from April to June. The NPL and the NPL coverage ratios remained in line with the previous quarter at 3.7 percent and 85 percent, respectively.

As for balance sheet and activity, gross loans and advances to customers (€400.76 billion) rose from the end of 2019 (+1.5 percent in current euros, +6.9 percent at constant rates, which represents approximately an additional €26 billion), with increases mainly in the wholesale (CIB) and commercial portfolios. Customer deposits (€402.18 billion) grew 4.7 percent in 1H20, bolstered to a large extent by the positive performance of demand deposits, where customers have deposited their available liquidity to face the pandemic.

Finally, regarding liquidity, the BBVA Group maintained its solid position, with a Liquidity Coverage Ratio (LCR) and a Net Stable Funding Ratio (NSFR) of 159 percent and 124 percent, respectively, as of June 30, 2020, both above the 100 percent regulatory requirement.

BBVA’s priorities during the COVID-19 crisis

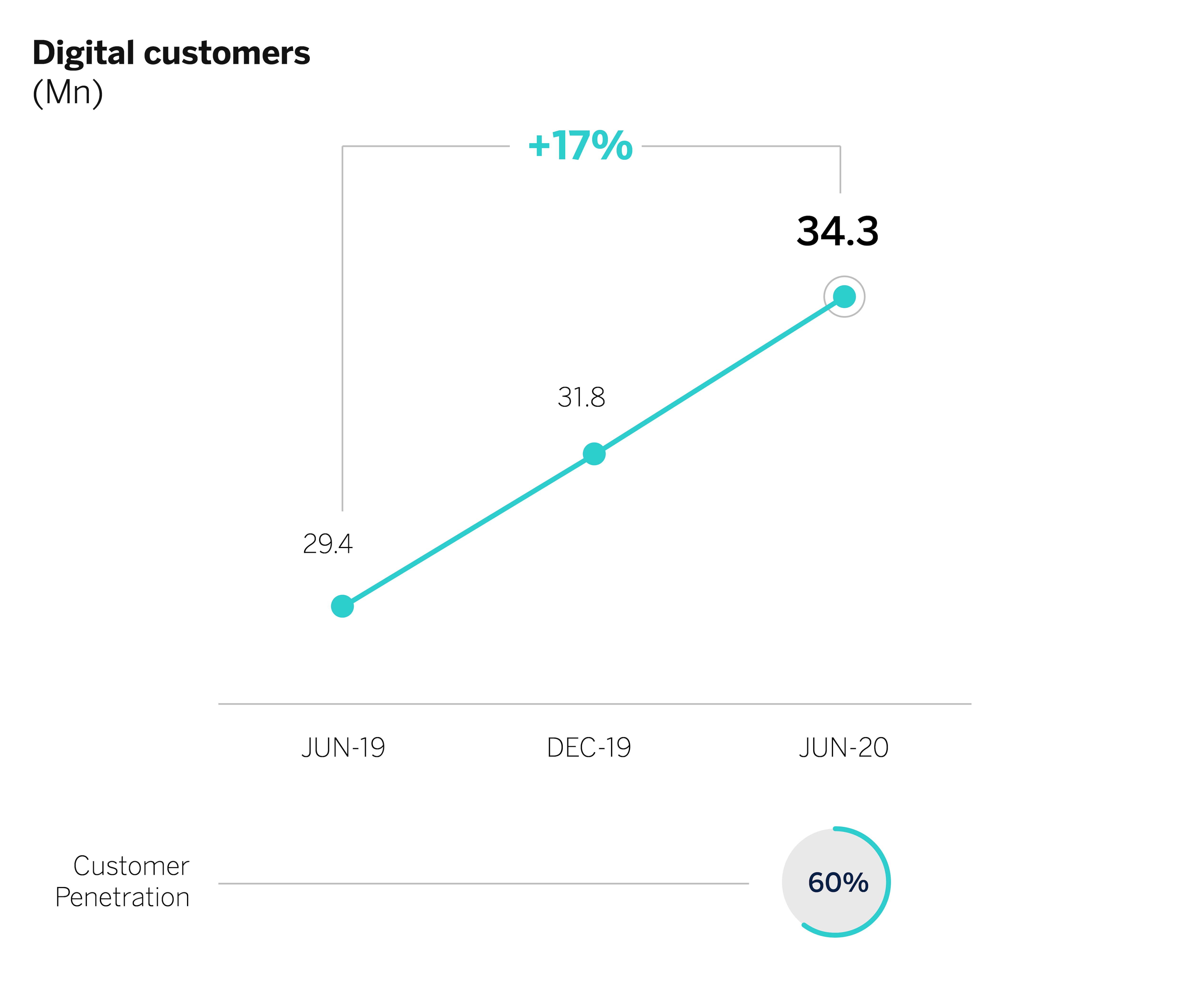

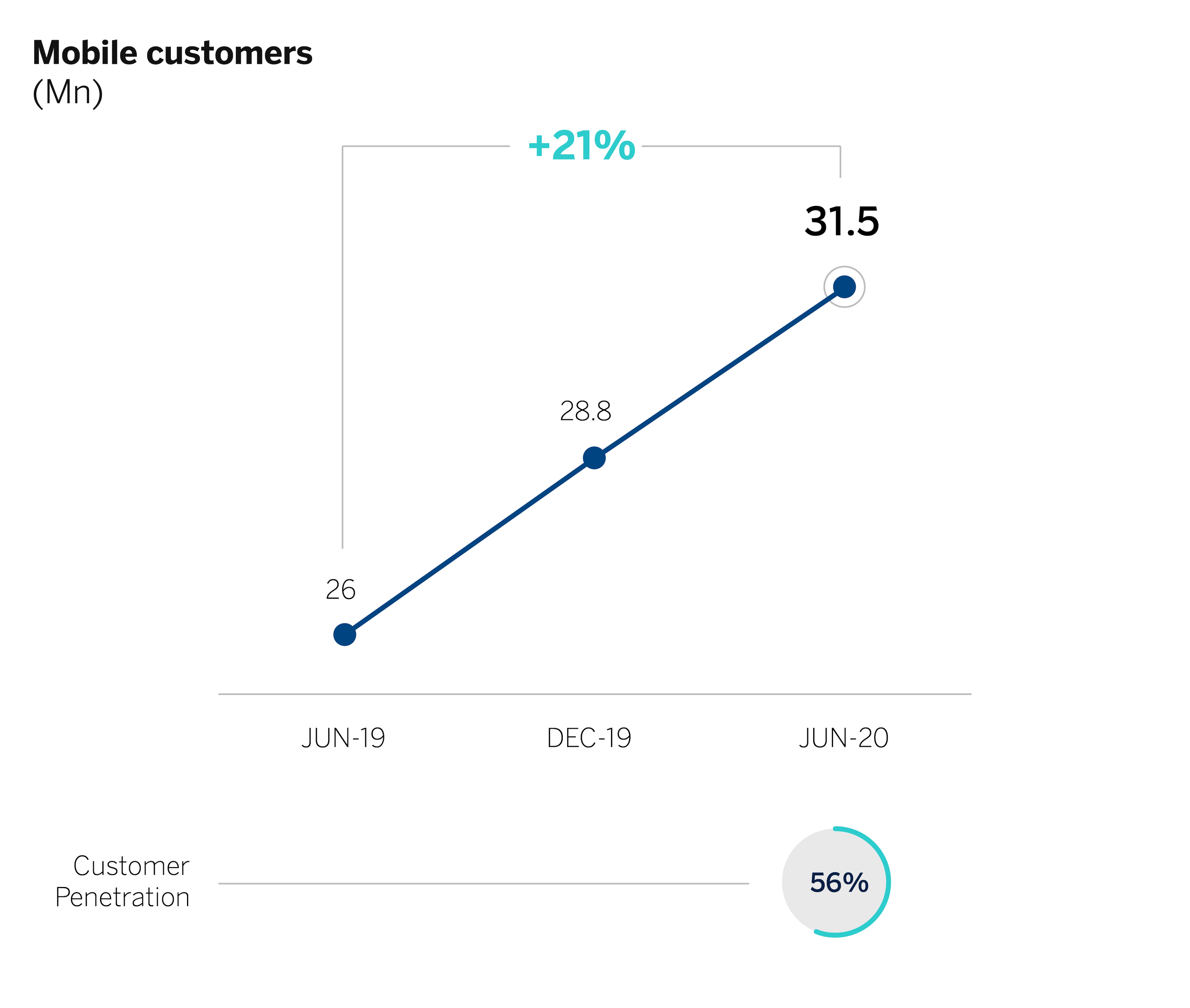

The BBVA Group maintains the priorities it established at the outset of the COVID-19 crisis: protecting the health and safety of its employees, customers, and society as a whole; delivering a service deemed essential in the countries where it operates; and offering financial support to its customers. BBVA employees have gradually and carefully begun to return to their places of work (chiefly in Spain and Turkey) following a data-driven crisis management plan. The pandemic and its different stages in other countries are being assessed using the same set of healthcare and business continuity processes. At the end of June, 87 percent of branches were open, even though customers are being encouraged to use remote and digital channels while the virus remains active. Digitization continued accelerating in 2Q20. Digital customers now account for 60 percent of the total customer base, with mobile customers representing 56 percent. And digital sales, in units, represented 66.0% of the total in 2Q20.

In order to help customers and clients navigate through the crisis related to the pandemic, the bank approved moratoriums and payment flexibility options on 4 million loans, 9 percent of its total loan portfolio. Additionally, the Group has granted credit lines worth €20 billion covered by public guarantee schemes.

Sustainable finance

Among other milestones, BBVA issued in 2Q20 the first COVID-19 social bond by a private financial institution in Europe and the world’s first green CoCo (contingent convertible bond) by a financial institution. The bank also published its second green bond tracking report. According to this report, the projects financed with green bonds issued by BBVA in 2018 and 2019 saved a total of 724,000 tons in CO2 emissions, almost three times the amount vs. a year earlier.

Business Areas

Below you may find the key aspects of activity and the P&L account for the different business areas.

In Spain, lending grew 2.7 percent in 1H20 compared to December, driven by corporate banking, retail businesses and SMEs, which were driven by the Spanish Credit Institute ICO credit lines. Customer funds grew 3.3 percent bolstered by the growth in demand deposits. As for the P&L account, gross income grew 4.6 percent yoy through June thanks to recurring revenues and NTI, while operating expenses dropped 6.1 percent. Operating income grew 19.8 percent, to €1.37 billion. The area earned €88 million in 1H20 (-88.1 percent) following impairments on financial assets and loan-loss provisions. Cost of risk improved during 2Q20, from 1.54 percent to 1.00 percent. NPL and coverage ratios stood at 4.26 percent and 65.7 percent, respectively, in line with the previous quarter.

In the United States, lending increased 9.1 percent during 1H20 compared to the end of 2019, thanks to the commercial segment, which benefited from the Paycheck Protection Program guarantee scheme rolled out by the U.S. government. Customer deposits grew 11.7 percent driven by strong growth in demand deposits, which already account for 84 percent of the total. In the P&L account, net interest income for the Jan.-June period declined by 9.2 percent at constant exchange rates (-6.9 percent at current rates), affected by the Fed's interest rate cuts. Operating expenses declined by 2.5 percent in 1H20 yoy in constant terms (they remained stable in current euros), generating an operating income of €648 million. The unit’s attributable profit stood at €26 million, following the provisions to manage the impact of COVID-19. This figure represents a 91.6 percent decline from the previous year, excluding currency fluctuations (similar in current euros). Cost of risk improved from 2.60 percent in 1Q20 to 1.80 percent in 2Q on the back of front-loaded provisions. The NPL ratio stood at 1.14 percent vs. 1.01 percent at the end of March, while the coverage ratio was 133.1 percent.

In Mexico, lending spiked 5.4 percent in the first six months of 2020 compared to 2019 year-end figures, thanks to the wholesale portfolio’s performance, which was driven by businesses and, to a lesser extent, mortgages. Customer deposits grew 8.7 percent on the back of demand deposits. As for the P&L account, net interest income was impacted by interest rate cuts by the central bank. The unit’s operating income stood at €2.35 billion, -0.8 percent in constant euros, and net attributable profit reached €654 million (-43.9 percent at constant exchange rates, -49.1 percent at current rates), following the impact of pandemic-related impairments. Cost of risk however declined significantly in 2Q20, from 5.30 percent to 4.95 percent, while the NPL ratio improved slightly from 2.28 percent to 2.22 percent. The coverage ratio increased to 165.5 percent.

In Turkey, loans in Turkish lira grew 22 percent compared to 2019 year-end figures, driven by commercial clients supported by the Credit Guarantee Fund. This growth was evident in the unit’s net interest income, which grew 27.6 percent at constant exchange rates (+13.4 percent in current euros), also driven by an improvement in customer spreads due to lower cost of deposits. Between January and June, operating income grew 44.8 percent yoy at constant exchange rates (+28.7 percent at current rates), which also benefited from a containment in operating expenses. These grew considerably lower than inflation. Net attributable profit for the six-month period stood at €266 million, +6.3 percent at constant rates (-5.5 percent at current rates). Cost of risk improved thanks to front-loaded provisions in 1Q20, from 3.80 percent to 2.71 percent. The NPL ratio stood at 7.02 percent while coverage ratio was 81.9 percent.

In South America, lending grew 9.1 percent in 1H20, as a result of growth in Argentina, Peru and Colombia. Customer funds grew by 17.7 percent from December 2019. The region posted a net attributable profit of €159 million in the six-month period, which represents a yoy drop of 47.3 percent at constant exchange rates (-60.6 percent at current rates), due to impairments related to the pandemic. As for risk indicators, the NPL ratio stood at 4.5 percent, the coverage ratio reached 108 percent and the cost of risk stood at 3.10 percent.

In the Rest of Eurasia, lending grew during the first half of the year by 14.9 percent due to greater drawdowns of loans by customers to face the situation generated by the pandemic. The area’s attributable profit reached €66 million (+20 percent yoy in current euros). The NPL ratio stood at 0.8 percent, the coverage ratio reached 126 percent and cost of risk was 0.32 percent.

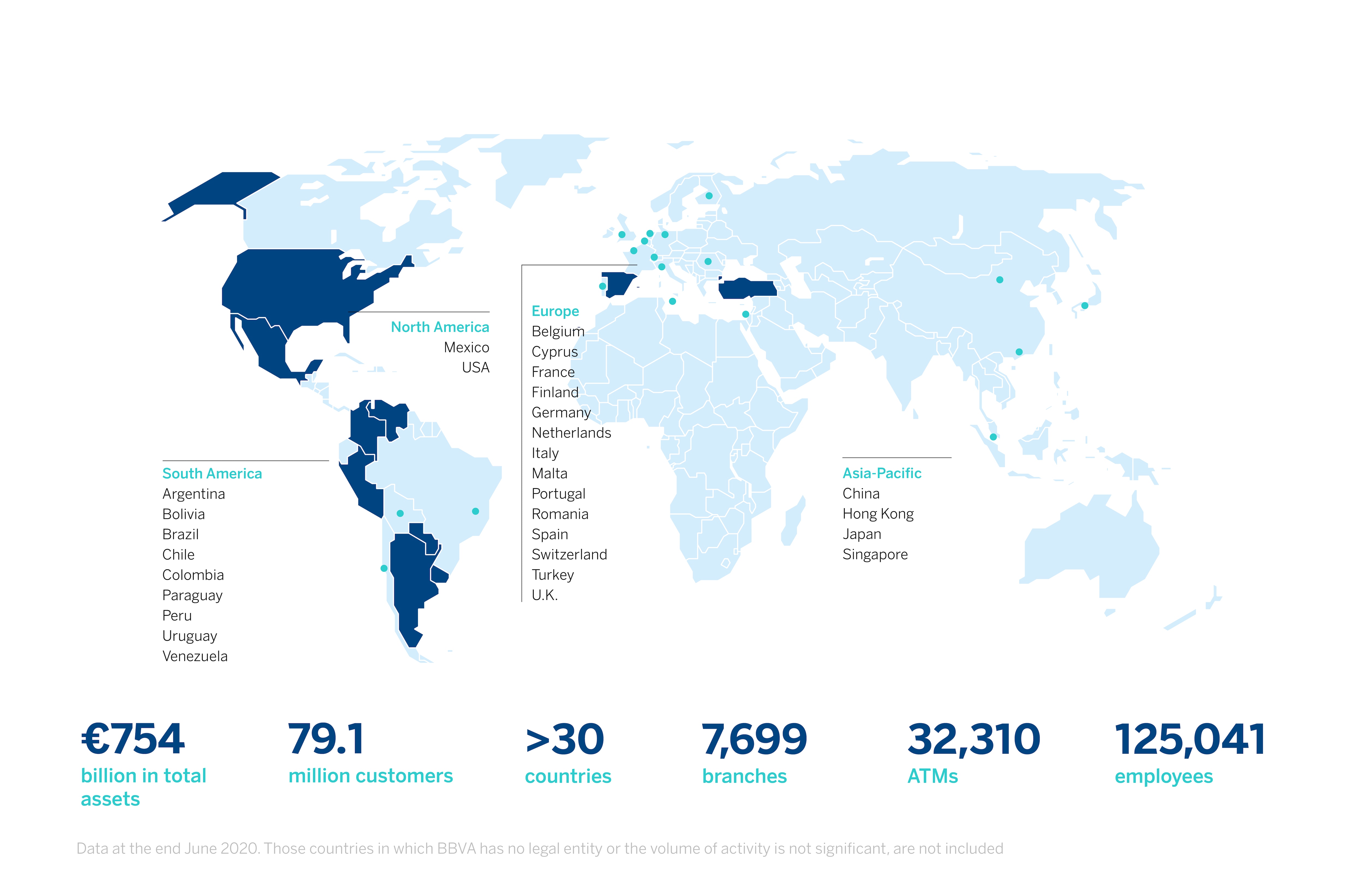

BBVA is a customer-centric global financial services group founded in 1857. The Group has a strong leadership position in the Spanish market, is the largest financial institution in Mexico, it has leading franchises in South America and the Sunbelt Region of the United States. It is also the leading shareholder in Turkey’s Garanti BBVA. Its purpose is to bring the age of opportunities to everyone, based on our customers’ real needs: provide the best solutions, helping them make the best financial decisions, through an easy and convenient experience. The institution rests in solid values: Customer comes first, we think big and we are one team. Its responsible banking model aspires to achieve a more inclusive and sustainable society.