Low costs: one of the keys of the success of robo-advisors

In the United States, there are already $20 billion under management by robot advisors and for the moment, the numbers testify to the success. Improving their knowledge of the investor could turn robo-advisors into a financial tool of the first order.

Four years ago, the assets managed by robo-avisors in the United States stood at $2.3 billion. In 2017, the figure has already reached $20 billion. There’s no doubt the robo-advisors have arrived and are no longer a buzzword in the world of fintech.

The concept is already well-known: robo-advisors are computer solutions that manage investment portfolios automatically, through algorithms and modeling. Because there’s no manager alongside them, their costs are much lower. As a result, they have opened the market of professional financial consulting to segments of the population that previously could not afford it.

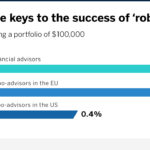

According to a recent report by Deutsche Bank Research, the low cost of robo-advisors has been their commercial hook, and many fintech firms have followed this business model.

In recent years, market conditions have been so peculiar, especially with respect to monetary policy, that it´s advisable not to reach categorical conclusions. Even so, the data gathered by Deutsche Bank from 2006 to the first quarter of 2017 shows there´s not a great deal of difference between the results of active management and automated management. According to the bank`s report, “higher fees do not imply higher returns on investment and in fact some robo-advisors have been able to achieve greater returns with lower fees.”

The robo-advisors have also shown strength during times of market volatility, such as that which followed the June 2016 referendum on Brexit. Their policy, in general, is one of extreme prudence, in order to avoid the potential overreaction of their algorithms to strong market movements. The majority of the robo-advisors don´t start operating until one half hour after the markets open and they stop one half hour before trading closes. Some of them even suspend operations for several hours while awaiting important announcements from central banks.

Human co-operation

How can the robo-advisors be improved? According to Orçun Kaya, economist and author of the Deutsche Bank report, the key to the optimization of their performance is an exhaustive knowledge of their client, the investor – something, of course, which applies equally to a flesh-and-blood advisor.

To better their performance, Kaya recommends developing a hybrid onboarding service for the clients of robo-advisors. It´s not enough for them to spend 15 minutes filling out an online formula with his/her data and preferences, as happens now. At that time, he says, a financial advisor should take part in the process, eliminating some of the risks in filling out an online questionnaire, such as the user´s loss of concentration.

Looking forward, the consulting firm BI Intelligence estimates that robo-advisors will manage $4.6 trillion globally in 2022. They predict this growth will accelerate sharply at the end of the period, due partly to the increase of business in Asia

Geographically, the United States clearly dominates the market today. In Europe, according to Deutsche Bank´s calculations – there is no 100% reliable and up-to-date information – the assets managed by robo-advisors will be about 5% to 6% of what is managed on the other side of the Atlantic. And almost the European market will be almost entirely dominated by the United Kingdom (75% of the assets) and Germany (17%). Both BI Intelligence and Deutsche Bank agree that market conditions are becoming complicated for the fintech companies. They predict a wave of agreements and acquisitions in the sector, led by the traditional asset management firms and by the banks.