Get to know what the new BBVA brand identity means to you

Why a change now? When will I receive a card with the new logo? Will my local branch change? What new services will be offered in my country? Will I see changes in the mobile banking app? If you don't want to miss out on what the new BBVA brand offers you, keep reading.

BBVA is making a debut. From Istanbul to Dallas, from Puebla to Montevideo, customers across three continents are beginning to witness the new BBVA brand.

Why now?

BBVA has been thinking about establishing a unified global brand for quite a while, and the best time was now. The digital transformation in which the Group has been immersed represents the ideal opportunity to simplify the brand worldwide and update the logo in increasingly digital channels. It is yet another milestone in the bank’s being able to offer customers a consistent experience in their interaction with BBVA, regardless of where they are in the world.

Where will I start to see the change?

During this first week of the new brand’s launch, customers in Mexico, Colombia, Spain, and Argentina can now see the the new value proposition in the mobile app. Anyone using Internet banking will discover the bank's new look and feel in its transactional web pages; additionally, all the Group’s digital platforms will be modified to integrate the new logo. The physical locations will also see changes; at any one of almost 1,000 offices in Mexico, the United States, Paraguay, Argentina, Spain, Peru, and Colombia customers can now see the new logo unveiled.

Do I have to do anything?

From an operational standpoint, the rebranding changes will be completely transparent. The new corporate identity is focused on simplifying the way customers interact with the bank. The customer relationship with the Group will be the same as always; nothing needs to be done, no documentation signed.

Do my cards need to be changed?

Customers can continue using their current credit and debit cards; they do not need to be replaced. As the cards expire, new updated cards will be issued.

New and faster services?

The bank's rebranding builds on BBVA's goal to provide a unified value proposition and a consistent user experience, regardless of location. As a result of the bank’s single development process, the solutions it offers will be increasingly global in nature. Thus, a feature developed in Turkey will reach Asunción more quickly than if it had to be built from scratch in each market.

Some concrete examples: the mobile application in Spain, recently recognized as Europe’s best for a third year in a row, will “travel” to different countries, allowing different markets to take advantage of its features. Thanks to the global development platform (GloMo), Peru and Uruguay are already revving things up with new features for their customers.

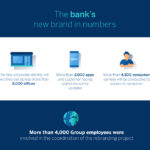

For the next six months, the roll-out of the brand will continue until it has been adopted by more than 3,000 applications and customer-facing platforms – for both consumer and business customers – and in the more than 8,000 offices the Group has worldwide, including branches, corporate headquarters, and other buildings.