Social networks and the conversation created by the media on the internet provide a reliable source of information to gauge society’s feelings or perceptions on certain topics. In a new report, BBVA Research applies big data and artificial intelligence techniques to analyze the reach, the topics, the key players and the perception of the fintech phenomenon based on the information published on Twitter and traditional media.

Fintech related terms are becoming increasingly ubiquitous in social and traditional media. Media coverage of this phenomenon has been on the rise since 2015. Also, the tone of fintech-related reports has been, and is, more positive, compared to overall Financial Services. Also, the perception of fintech services is more positive than that of the traditional financial system in general. This could be because, according to the authors of the report, “fintech is a topic that raises high expectations and is considered to go beyond the financial system.”

These are some of the takeaways of ‘Fintech Universe through the Eyes of Media and Social Networks,’ a report prepared by BBVA Research data scientists by applying Big Data techniques to information from the media (GDELT) and social networks (Twitter) from 2015 to 2018. Specifically, the report uses natural language processing and sentiment analysis techniques to determine the intensity and the “sentiment of the dialogue” when it comes to fintech in the mass and social media. The authors also identify the main trends, topics, events and technologies associated with the finTech phenomenon. “We also use these data sources to identify countries, organizations and firms that play an important role in the fintech universe," explain the authors.

Fintech perception and coverage in the media

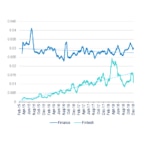

Based on the analyzed data, the term has become increasingly prevalent in the past three years, and is inching closer to the level of media coverage of the traditional financial system.

Fintech and finance media coverage over time 2015-2018.

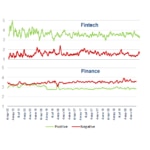

Also, the analysis of the “intensity and tone” of fintech coverage compared to finance in general reveals that the sentiment associated to fintech is very “positive," much more than the feeling linked to finance in general (negative and in decreasing.)

Fintech and finance media sentiment over time 2015-2018.

“The reasons may be the fact that Financial Services are already widely available for the public, who already has a formed opinion of them,” explains the report. Conversely, users are less familiar with fintech solutions and perceptions are based more on expectations than facts, “since fintech solutions are usually considered as easing access to cheaper and more convenient finance.”

Proportion of positive and negative words in the media over time.

Also, on a closer look, the term fintech is often linked to topics such as innovation, science, information and communication technologies, research or labor market that, in general, “have positive connotation,” while finance is associated with the traditional core parties of the financial system such as Central banks, institutions, capital markets, stock markets, which are a key part of the economy, and “which might trigger stronger and more tainted opinions,” say the authors.

Most related topics with FinTech and finance in the media in 2018.

Considering Twitter data in the analyses, the report concludes that a similar positive trend emerges for fintech. But also, the analysis of this data source shows that Twitter reacts faster and more intensely to certain news and vice versa. For example, data show a peak in the media and in Twitter in mid April 2018, coinciding with the Facebook–Cambridge Analytica scandal; or in November 2018, following IMF president Christine Lagarde’s optimistic statements about the possibility that central banks may issue cryptocurrencies in the future.

Which countries are talking more about fintech?

Generally speaking, media coverage of fintech related news has increased across the world since 2015. The U.S., Singapore and Hong Kong are the countries where the debate has intensified more. Media coverage has also increased significantly in some Eastern European Countries such as Hungary and Estonia.

In contrast, the media coverage of fintech has remained virtually stable in Algeria, Israel and Nepal. In the case of Israel, where the fintech ecosystem has great traction, the dialogue was already very active before 2015 (and had begun much earlier than in other countries), and its growth has stabilized in the last two years.

Media coverage of fintech-related news has substantially increased for South American countries as of 2018. A “plausible explanation” for this might be the high number of venture capital deals secured by South American companies in 2018.

In Spain, data show that it was in mid-2016 when media coverage of fintech started increasing notably. In parallel to this increased coverage, a quite heterogeneous fintech ecosystem has spawned in Spain, and established institutions have remained very active in this field, announcing noteworthy collaboration and investment initiatives, like those made by BBVA globally. Also, in 2018 media coverage surrounding fintech solutions grew substantially, following the entry into force of the new European payments service directive (PSD2), establishing a harmonized framework for the competition between traditional institutions and new entrants, mainly in the field of digital payments.

What do we talk about when we talk about fintech?

Analyzing the topics on which the fintech-related dialogue focuses, the report concludes that they are quite varied, and not exclusively technological or financial. Surprisingly, the debates address many other social themes: from employment and new skills, to gender and the environment, a broad variety of terms appear in the media in connection to the “fintech” term.

Most outstanding FinTech-related topics in the media.

The authors interpret this wide range of topics with the “diversity of edges that can encompass the application of new technologies on financial services at a global level.” Also, this can also explain the gap between the sentiment they generate towards traditional Finance and FinTech, as the report found that there is a perception that "fintech is revolutionizing not only the financial system but also other sectors with a high potential for economic growth (real estate, insurance, tourism, the environment, government, etc.).”

Analyzing Twitter conversations in 2018 (in English language), the report found that the most commented topic by far was blockchain, one of the most potentially disruptive technologies of the segment. This points out the great interest among the general public in distributed ledger technologies (DLT). Other prominent topics in 2018 included artificial intelligence, the Internet of Things, big data, machine learning and data science, which were among the year’s most recurrent hashtags. On the other hand, the most frequent terms in tweets have been more business-oriented. Some examples are: Financial, Banking, Payments, Business, Startups, Innovation and Regulation.

Most used hashtags in the fintech universe in Twitter during 2018 (in English).

Also, besides FinTech, a growing range of acronyms are appearing that, according to the report symbolize interconnected networks of various actors that combine to create innovative solutions for different markets Some of these are InsurTech (Technology applied to insurance), HealthTech (Technology & health), MarTech (marketing & Technology) or RegTech (regulation and Technology). By geographies, the areas with more Twitter activity related to FinTech have been Europe (especially London), Singapore and India.

As for the links between terms, the report, again, notes that “fintech activity is dominated by the blockchain technology.” Also, the report underscores that the weaker links among blockchain and terms such as ‘cryptocurrency’ evidence that the interest in the technology has already grown beyond the boundaries of virtual currencies.

Relation between pairs of words (the nodes size represents the connectivity of each term and the edges size represents the frequency of joint appearance).

Links between terms also indicate that “social media users tends to identify fintech companies with startups,” more than with traditional institutions or banks. However, InsurTech and banking are the activities more frequently associated with the fintech activity

Who is who in the fintech ecosystem?

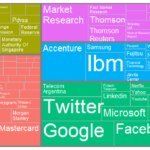

Despite the prevailing perception among social media users about the strong link between fintech and the startup ecosystem, when identifying companies and institutions that are mentioned more frequently in connection with fintech in the media, the author’s analysis concluded that it is large organizations that prevail. The report divides them into five large categories:

- Financial services: big companies such as VISA, NASDAQ and Mastercard, which are investing heavily in FinTech solutions to “keep up the pace of innovation in the banking sector.”

- Authorities and governments such as the U.S. government (the most present) or institutions such as Central Banks, the European Union, the U.S. Federal Reserve, or the Monetary Authority of Singapore.

- Bigtechs such as Google, Facebook, Twitter and Microsoft, which are starting to venture into financial services, especially in the field of payment solutions.

- Traditional technology companies such as IBM, Oracle and Accenture.

- A mixed group of institutions from different sectors, such as Thomson Reuters, specialized in providing information and ancillary services to financial firms.

Most outstanding fintech-related firms and organizations in the media.

Understanding a global phenomenon

With its report, BBVA Research aims to contribute to the understanding of the new financial system framework by “offering an alternative approach based on empirical evidence from media and social media data sources.”

The Fintech phenomenon is “disrupting and transforming banking”, bringing about new challenges and opportunities that will ultimately result in the democratization of finance. In this context, the analysis the information surfacing online and in the media in real time has become a “valuable asset to get timely information to understand the new global shape of the financial sector,” concludes the report.

In fact, data collected from these information sources attest, according to the report, to the scale of the FinTech phenomenon and its increasing relevance, which ripples past the financial system and across other segments of society and of the economic activity. In this context, alternative information sources, such as the ones used in this report, are extremely valuable for researchers, for the industry, for regulators and for anyone trying to understand this “overwhelming global phenomenon that is reshaping the financial system through technology and having an enormous impact on society.”