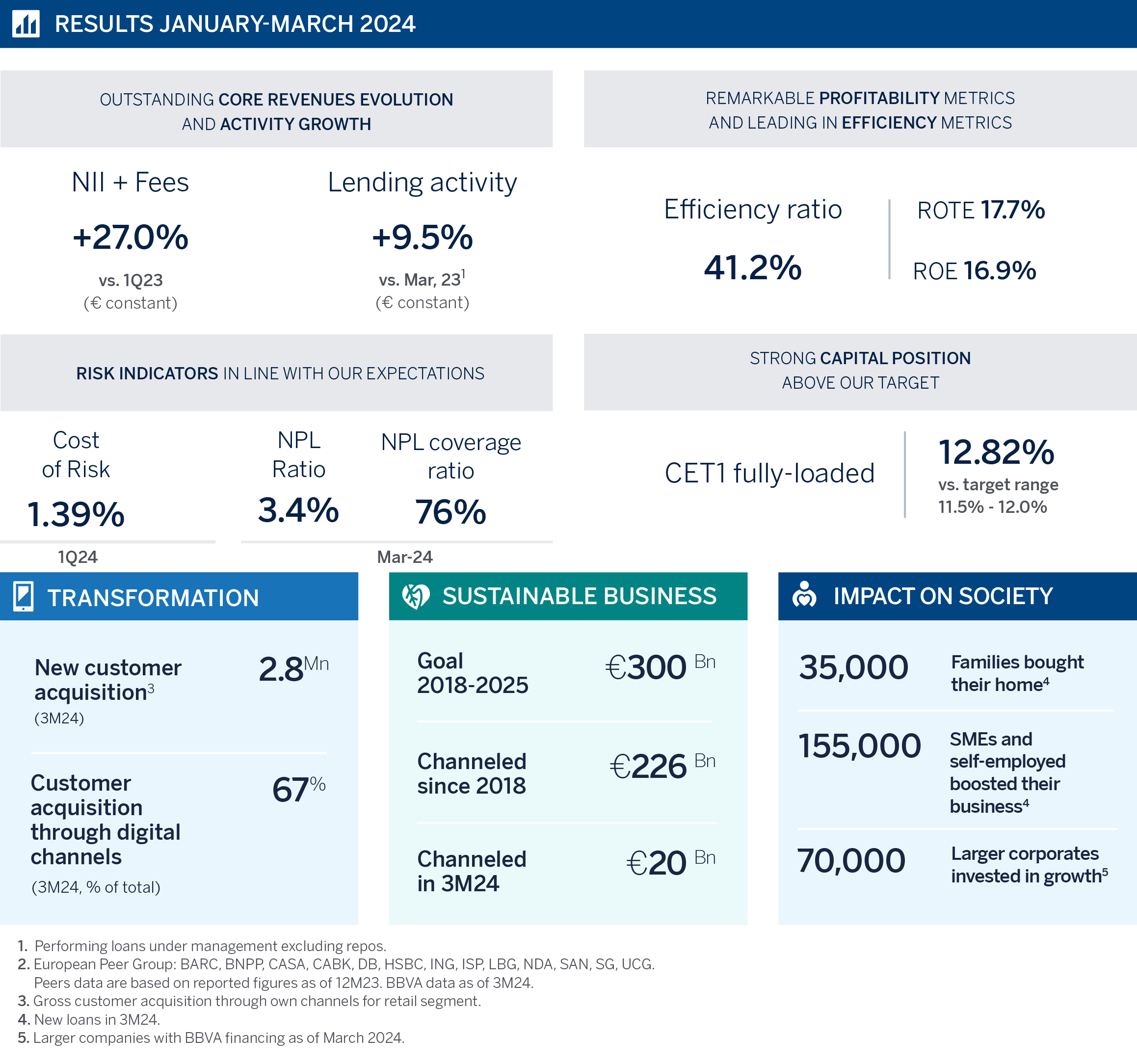

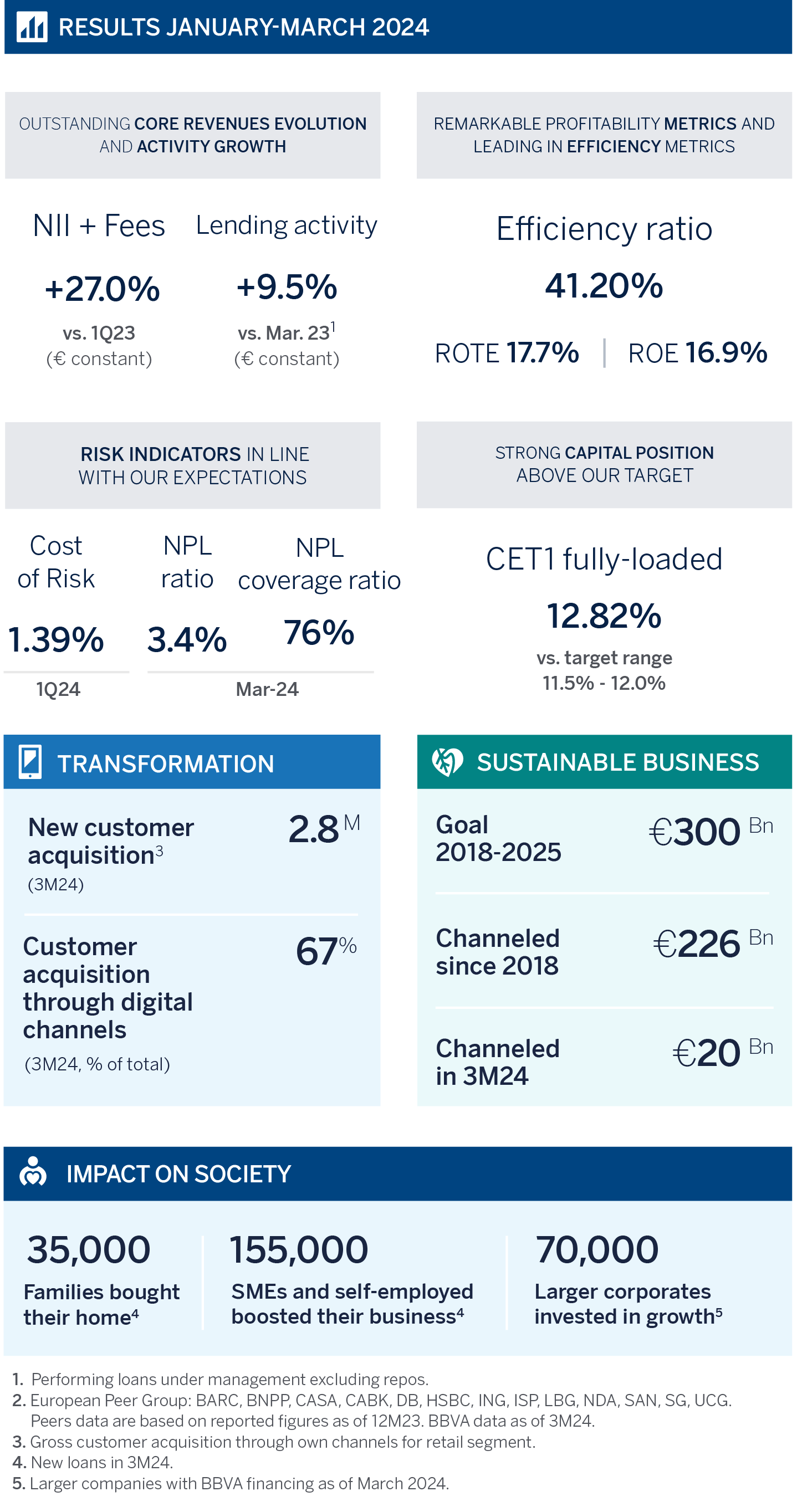

BBVA earns €2.2 billion in first quarter, up 19 percent yoy

The BBVA Group started 2024 with very positive results: Net attributable profit reached €2.2 billion in the first quarter, up 19 percent from a year earlier (+38 percent at constant exchange rates). Earnings per share rose at an even higher pace, 23 percent yoy. These figures are the result of bolstering activity -lending grew 9.5 percent yoy in constant euros- and the outstanding performance of recurring income, which increased 19 percent yoy (+27 percent in constant euros). Additionally, between January and March, BBVA added 2.8 million new customers, 67 percent of them digitally; and channeled €20 billion in sustainable business.

Press kit 1Q2024 Results

“In the first quarter of 2024 we posted excellent results that improve our outlook. We now expect to post double-digit growth in full year profit. The evolution of our earnings is good for society as a whole: Through our activity, there is more lending to our customers, growth in employment, more distributions to our shareholders, and higher tax contributions. All this is reflected in greater social well-being,” BBVA CEO Onur Genç said.

Except where otherwise stated, the evolution of each of the main headings, and changes in the income statement described below refer to constant exchange rates. In other words, they do not take currency fluctuations into account.

The strength of BBVA’s earnings in the first three months of the year benefited mostly from momentum in recurring revenues: net interest income and net fees and commissions reached €8.4 billion (+27 percent yoy).

First, net interest income in 1Q24 stood at €6.51 billion, up 25 percent from the same period a year earlier. A big part of this dynamism came from higher activity. Customer loans rose 9.5 percent, showing the positive impact of the bank’s main activity in society: 35,000 families purchased a home, 155,000 new loans were granted to SMEs and the self-employed, and 70,000 larger companies received financing to invest in their growth.

Furthermore, net fees and commissions posted a 37 percent increase yoy, to €1.89 billion, mostly driven by payment systems and asset management. By business areas, Turkey and Mexico’s contribution stood out.

Net trading income (NTI) rose to €772 million in 1Q24, more than double from a year earlier, supported by the results from the Global Markets unit. The line of ‘other operating income and expenses’ (€-952 million) posted a higher negative impact due to hyperinflation in Argentina and the annual extraordinary tax on banks in Spain, estimated at €285 million.

As a result, gross income rose to €8.22 billion in 1Q24, up 31 percent.

Higher inflation rates in the Group’s footprint (an average of 19.7 percent in the past 12 months) drove up operating expenses by 19.5 percent yoy, to €3.38 billion. The strength of gross margin, however, secured positive jaws and a remarkable improvement in the efficiency ratio, which eased 398 bps vs a year earlier, to 41.2 percent.

Operating income stood at a record €4.84 billion in 1Q24, up 41 percent from a year ago, and considerably higher than the quarterly average of this line in the past two years, about €4 billion.

The impairment on financial assets saw an increase of 41 percent yoy due to higher provisioning needs related to growth in the most profitable segments, in line with the Group’s strategy. Consequently, the accumulated cost of risk for the Group stood at 1.39 percent, as expected. The rest of risk indicators remained stable vs 4Q23. The coverage ratio stood at 76 percent and the NPL ratio was 3.4 percent.

As a result of all the above, the BBVA Group posted a net attributable profit of €2.2 billion in 1Q24, up 38 percent from a year earlier. In current euros, growth was 19 percent, while the earnings per share rose even higher, above 23 percent -in current euros- thanks to the buyback programs executed in recent months.

These earnings helped to propel the bank’s profitability metrics, with BBVA remaining as one of the most profitable banks among European peers. ROTE stood at 17.7 percent in 1Q24, and ROE at 16.9 percent.

BBVA’s strategic focus on innovation and sustainability contributed decisively to 1Q24 earnings. Between January and March, the Group added 2.8 million new customers, of which 67 percent joined through digital channels.

Furthermore, BBVA channeled €20 billion in sustainable business in the first three months of the year, for a total of €226 billion since 2018. This way the bank moves closer to its goal of reaching €300 billion between 2018 and 2025.

BBVA also continued to create value for its shareholders: The tangible book value per share plus dividends stood at €9.17, which represents a 20 percent increase over the past 12 months.

As for capital, the fully-loaded CET1 ratio ended the quarter at 12.82 percent, 15 bps above the level at the end of 2023. BBVA continues to keep a large management buffer above the CET1 requirement in consolidated terms (currently at 9.10 percent), and also above the Group’s target management range set at 11.5-12.0 percent.

Business areas

In Spain, the loan portfolio increased (+0.8 percent yoy) on the back of momentum from the most profitable business segments and a slower pace of mortgage cancellations. Customer resources increased by 4 percent thanks to time deposits and mutual funds. In the P&L account, the favorable performance of net interest income is noteworthy -(+35 percent yoy), following higher activity and the positive evolution of customer spreads-, and NTI contribution (+72 percent yoy), driven by portfolio management. In addition, the efficiency ratio improved significantly (-658 bps in the past 12 months). Net attributable profit reached €725 million, up 37 percent yoy, including the annual impact of the extraordinary tax on banks (€-285 million). Risk indicators remained stable: the NPL ratio was 4.11 percent, with coverage ratio standing at 55 percent. The cost of risk was 0.38 percent.

Lending activity in Mexico grew 8.8 percent yoy, mostly thanks to the segments of consumer, cards and SMEs. Customer resources also increased strongly, 12.5 percent, driven particularly by mutual funds. Growth in recurring income is particularly remarkable on the back of higher activity. Mexico posted a record net attributable profit of €1.44 billion (+3.6 percent yoy). The cost of risk increased to 3.27 percent, in line with expectations, in a context of higher activity in the most profitable segments. The NPL and the coverage ratios ended the quarter at 119 percent and 2.68 percent, respectively.

In Turkey, lending activity increased mostly thanks to loan growth in Turkish lira (+62 percent yoy), in line with inflation. As for resources, growth in deposits in Turkish lira stood out (+55 percent in the past 12 months). In the P&L account improvement in recurring income was remarkable, on the back of momentum of net fees and commissions (+146 percent yoy in current terms) and NTI (+41 percent also in current terms). Net attributable profit was €144 million, down 48 percent yoy (in current euros), impacted by the strong depreciation of the Turkish lira against the euro. The cost of risk performed in line with expectations (0.77 percent as of March 2024), standing at more normalized levels than last year. The NPL ratio eased to 3.43 percent, while the coverage ratio stood at 96 percent.

Growth in activity stood out in South America (+8.4 percent yoy). Net attributable profit was €119 million, down 34 percent from a year earlier (in current euros). In the breakdown by country, Peru contributed €42 million, where recurring income stood out, supported by activity and the stabilization of the cost of risk vs the end of 2023. Argentina contributed €34 million despite the uncertainty and a higher adjustment for hyperinflation. In Colombia net attributable profit stood at €20 million, driven by growth in net interest income. The cost of risk of the area grew to 3.11 percent, while the NPL and coverage ratios stood at 5 percent and 86 percent, respectively.

About BBVA

BBVA is a global financial services group founded in 1857. The bank is present in more than 25 countries, has a strong leadership position in the Spanish market, is the largest financial institution in Mexico and it has leading franchises in South America and Turkey. BBVA contributes with its activity to the progress and welfare of all its stakeholders: shareholders, clients, employees, providers and society in general. In this regard, BBVA supports families, entrepreneurs and companies in their plans, and helps them to take advantage of the opportunities provided by innovation and technology. Likewise, BBVA offers its customers a unique value proposition, leveraged on technology and data, helping them improve their financial health with personalized information on financial decision-making.