Results: BBVA earns €2.8 billion in first nine months (+64%)

-Income: Positive trends in recurring revenues (NII plus fees and commissions) continued between January and September, boosting gross income to €18.43 billion (+5.1% y-o-y)

-Risks: The Group's NPL ratio remained stable and stood at 5.1% at the end of September, the same level as in December 2012, while the coverage ratio was 72%

-Capital: BBVA achieved its 2017 capital goal ahead of schedule. The fully-loaded CET1 ratio stood at 11%, with a capital generation of 29 basis points in the quarter

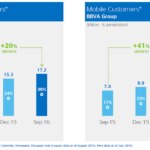

-Transformation: BBVA’s digital customer base stood at 17.2 million (+20% in the past year). Of these, 11 million are mobile customers (+41%)

The BBVA Group earned €2.8 billion between January and September 2016, up 64.3% from the same period a year earlier. Stripping out the impact of corporate operations and currency fluctuations, growth reached 15.0%. Net attributable profit rose to €965 million in the third quarter.

“It has been a good quarter, with solid growth in recurring revenues, cost control, and stability in risk indicators. Furthermore, we have already achieved the capital goal we had set for 2017,” said BBVA CEO Carlos Torres Vila.

All figures mentioned hereinbelow include two impacts: the change in the scope of consolidation following the incorporation of Catalunya Banc on April 24th, 2015, and the acquisition of an additional 14.89% stake in Turkey’s Garanti, which has been incorporated into the Group’s financial statements using the full integration method since Q3-15. Furthermore, the impact of the depreciation in exchange rates softened in the third quarter, although it is still relevant for the first nine months.

Net interest income reached €12.67 billion between January and September, up 5.5% from the same period a year earlier (+18.1% at constant exchange rates). This growth was bolstered by buoyant activity in emerging markets and the Group’s ability to generate income in an environment of historically low interest rates in developed markets. On the other hand, commissions and fees grew 3.3% y-o-y (+12.5% stripping out currency effect) over the same period.

Gross income stood at €18.43 billion, up 5.1% y-o-y (+16.2% at constant exchange rates). On top of resilient recurring revenues (NII plus fees and commissions), the Group benefited from a positive evolution of NTI. This item includes €75 million from the sale of a 0.75% stake in China Citic Bank (CNCB).

Operating expenses declined 2.7% during the third quarter, thanks to the Group’s cost-containment efforts. This trend helped to curb the cumulative cost growth rate for the year to date, which now stands at 5.8% y-o-y (+14.8% at constant exchange rates). Once again, this increase is linked to both the currency effect and high inflation in some countries, together with the incorporation of Catalunya Banc’s expenses all through the year in 2016 (in 2015 it applies from April 24th). As of the end of September, the efficiency ratio remained at June levels (51.8%).

In order to gain efficiency, BBVA set aside an additional €94 million in the quarter, included in the line of provisions, for cost-related initiatives.

In this context, operating income for the year-to-date came to €8.88 billion (+4.4% y-o-y, +17.7% at constant exchange rates).

-

1

13Q16 BBVA Results Presentation

The BBVA Group earned €2.8 billion between January and September 2016, up 64.3% from the same period a year earlier. Stripping out the impact of corporate operations and currency fluctuations, growth reached 15.0%. Net attributable profit rose to €965 million in the third quarter.

-

2

23Q16 BBVA Results Presentation

At the end of September 2016, customers engaging with the bank through digital channels topped 17.2 million (20% more than in September 2015). Of these, 11 million were mobile customers, up 41%.

-

3

33Q16 BBVA Results Presentation

“We have added new key functionalities to digital and remote channels, adapting the relationship model with our clients,” said Carlos Torres Vila. “Digital sales are growing robustly, as well as customer satisfaction and the number of users in our digital and remote channels.”

-

4

43Q16 BBVA Results Presentation

“It has been a good quarter, with solid growth in recurring revenues, cost control, and stability in risk indicators. Furthermore, we have already achieved the capital goal we had set for 2017,” said BBVA CEO Carlos Torres Vila.

The bank’s risk indicators remained stable compared to previous quarters. The NPL ratio ended the quarter at 5.1%, in line with the previous quarter and similar to December 2012 figures. Coverage ratio slipped slightly between July and September compared to June and stood at 72%.

As for capital adequacy, the generation of 29 basis points in the third quarter, which includes the impact from Moody's downgrade of the Turkish sovereign rating (-15 bp), allowed BBVA to achieve the 11% fully-loaded CET1 ratio goal it had set for 2017. BBVA’s fully-loaded leverage ratio at the end of September stood at 6.6%, securing first place among European peers.

Regarding the bank’s activity, at the end of September, gross lending declined slightly compared to the previous year, and stood at €422.84 billion. Customer deposits declined slightly from the previous year, coming to €385.35 billion.

Below you may find the y-o-y rates of change corresponding to the main items on the income statement, considering the Garanti stake in homogeneous terms (as if it had been incorporated by the full integration method since January 1st, 2015). In this context, net interest income dropped 4.6% y-o-y between January and September (+7.0% stripping out currency impact), while gross income fell 3.3% (+7.1% at constant exchange rates). On the other hand, operating income slipped 5.3% compared to the same period a year earlier (+6.9% excluding currency fluctuation).

Transformation of the bank

At the end of September 2016, customers engaging with the bank through digital channels topped 17.2 million (20% more than in September 2015). Of these, 11 million were mobile customers, up 41%.

“We have added new key functionalities to digital and remote channels, adapting the relationship model with our clients,” said Carlos Torres Vila. “Digital sales are growing robustly, as well as customer satisfaction and the number of users in our digital and remote channels.”

One of the bank’s goals is to boost digital sales across all franchises. United States is the region where this trend is more evident: 19.5% of all transactions between January and September were carried out through digital channels, compared to 9.3% in 2015. Digital sales gained momentum across all regions. Through September 2016, digital sales accounted for 16.5% of total sales in Spain, 15% in South America, 15.4% in Mexico, and 25.2% in Turkey, the highest figure.

The main highlights of each business area are detailed below.

Banking activity in Spain showed great resilience in a complex environment with interest rates at all-time lows. Net interest income slipped 2.9% in the first nine months, partly due to lower activity in wholesale businesses and institutional clients. Also, impairment losses on financial assets continued to decline significantly, with a y-o-y drop of 33.2%. NPL ratio continued to improve, reaching 5.9% (vs. 6.0% in June), with coverage of 58%. In the first nine months of 2016, the area earned €936 million, down 5.2% y-o-y.

Real-estate activity in Spain continued to reduce its net exposure to the sector by 13.7% y-o-y, to €11.1 billion at the end of September. Solid market trends contributed to narrow losses to €-315 million between January and September, a 24.4% drop compared to the same period of 2015.

The nine-month result for BBVA Spain -combining banking and real estate activities - came to €621 million (+8.8%).

To better explain the trend in business areas that use a currency other than the euro, the variation rates described below refer to constant exchange rates.

In the United States, operations benefited once again from the solid performance of recurring revenues. In fact, quarterly growth in income from commissions reached 12% y-o-y, bringing

growth for the first nine months to 1.8% y-o-y. This, together with growth in net interest income (+6.1% y-o-y in cumulative terms) allowed gross income to end the period with positive growth (+2.3%). Operating income benefited from cost-containment efforts, growing 1.8%. As for impairment losses on financial assets between July and September, those dedicated to cover the oil and gas portfolio were lower than in the two previous quarters. However, in cumulative terms, they are still higher than the ones corresponding to the same period of 2015. The NPL ratio closed at levels similar to the previous quarter (1.7% in Sept. vs. 1.6% in June) with coverage of 87% vs. 90% in June. Net attributable profit for the U.S. came to €298 million between January and September, down 24.3% y-o-y.

Turkey’s earnings in homogeneous terms (i.e. including the stake as if it had been incorporated by the full integration method since January 1, 2015) reflect the notable strength of recurring revenues. In cumulative terms, net interest income grew 8.9% y-o-y, while income from fees and commissions grew 15.6%. Buoyant activity contributed to achieve a gross income growth of 26.2% between January and September. On the other hand, moderate growth in expenses helped the operating income to grow 43.2%. Regarding credit quality, the NPL ratio deteriorated slightly (2.9% vs. 2.7% in June), but still remained below the sector average. Net attributable profit in Turkey in the first nine months of the year jumped 45.7% y-o-y to €464 million.

Mexico continued to post double-digit growth rates in lending and customer funds. Net interest income and fees and commissions grew 11.8% and 11.4%, respectively in the first nine months. Gross income increased 10.6% to €4.95 billion and operating income rose 12.2% to €3.16 billion. Regarding credit quality, the quarter closed with a stable NPL ratio at 2.5%, with coverage ratio improving slightly to 122%. Between January and September, Mexico earned €1.44 billion, and again grew at double digit rates (+11.4% y-o-y).

Activity in South America continued to grow both in lending and customer funds. In cumulative terms, all income items recorded significant growth, helping gross income to rise 12.7% from the same period a year earlier. Inflation in some countries across the region and exchange rate trends explained again the expenditure growth (+18.7%). This led to a 7.9% increase in operating income. The NPL ratio increased slightly to 2.8%. Net attributable profit grew 2.2% y-o-y, reaching €576 million from January through September.

About BBVA

BBVA is a customer-centric global financial services group founded in 1857. The Group is the largest financial institution in Spain and Mexico and it has leading franchises in South America and the Sunbelt Region of the United States; and it is also the leading shareholder in Garanti, Turkey’s biggest bank for market capitalization. Its diversified business is focused on high-growth markets and it relies on technology as a key sustainable competitive advantage. Corporate responsibility is at the core of its business model. BBVA fosters financial education and inclusion, and supports scientific research and culture. It operates with the highest integrity, a long-term vision and applies the best practices. The Group is present in the main sustainability indexes.