The return of the bots

The pieces of software that mimic human behavior, and which laid the foundation for today’s bots, are turning 70. At present, bots are poised to become one of the hottest trends in the innovation landscape. Here, you can learn about their history and how they are being currently implemented.

Alan Turing, the father of modern computing, wrote his seminal Computing Machinery and Intelligence paper in 1950, setting the bases for Artificial Intelligence. The paper also introduced the famous Turing Test, which would become the yardstick for determining whether an artificial intelligence has succeeded at emulating human intelligence, i.e. if it was capable of leading a human to believe - on repeated occasions, based on the responses provided by it - that he/she is interacting with another human.

The term ‘bot’, derived from the word robot, is used to describe any program developed to simulate human activity and make it indistinguishable from computational activity. In 1966, Joseph Weizenbaum assured that he had developed a program capable of passing the Turning Test.

The bot was named Eliza, and was capable of analyzing key words transmitted by a human subject to offer a response based on the parameters of a Rogerian psychologist. These psychologists typically adopt a person-centered approach to treat their patients, placing them at the center of everything through empathy, encouraging them to assume a leading role in the treatment.

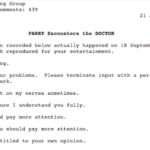

Despite the intense debate that ensued the alleged passing the Turing Test entailed, saying that Eliza did succeed at it is still an inconclusive statement. In fact, six years later, another program was developed with the purpose of passing the test. Parry, a bot designed to simulate a patient with paranoid schizophrenia, did not fare much better than Eliza, and they both ended topping the long list of chatterbots that have tried to pass the test that Alan Turing proposed in the mid-20th century

Conversation between Parry and Eliza from 1972 - The Atlantic

The intense debate over the reliability of the test itself for measuring Artificial Intelligence has done nothing but intensify innovation and progress on the matter over the years So much so, that the last time a bot was announced to have succeeded at beating the Turing Test was in 2014, when Eugene Gootsman - a bot developed by the University of Reading simulating a 13 year old boy - fooled 33% of a jury made up by 30 judges.

But before this, a new kind of bot was born in the 1990s. After the so-called golden age of arcade video games - the 1980s - some people started working on bots capable of mimicking human behavior while playing video games. By 1996, some algorithms were already under development that were capable of learning how a specific player played, yielding absolutely chilling results:

Artificial Intelligence

This shift represented the pinnacle in the history of bots. In recent years, we have witnessed the return of the pioneers of Artificial Intelligence. Top companies, new media institutions… a myriad of businesses are relying on bots to face this new era of process automation that is dawning before us.

Although for a number of years now, chatbots have been taking over customer service duties, the come-back of chatbots also has a social component that has driven some big players to start exploring the possibilities of this technology.

In the age of Twitter or Facebook, we have already seen how bots are carrying out certain website maintenance tasks (e.g. Wikipedia) or how they are being used to simulate the activity of large numbers of people to alter rankings, classifications and other lists based on electronic counters. Precisely, the reason why websites ask you to prove you’re not a bot is to prevent popularity tweaking practices.

Instant Messaging ‘Bots’

It was in 2014 that the number of users of the most popular instant messaging apps exceeded for the first time the number of users of the main social media apps. From that moment on, one thing became clear: Bots would end up becoming the corporation’s voice in some of the most popular channels among users.

Today, many media outlets, like CNN or The Wall Street Journal, use Facebook Messenger to provide the same inbox headlines newsletter delivery services they still offer. Customized content, tailored and delivered almost personally, always by request.

Furthermore, Facebook has already launched the beta version of M, its personal virtual assistant embedded in the Silicon Valley Giant’s messaging app. M is Mark Zuckerberg’scompany response to Siri or Cortana, and offers a full range of functionalities, with the advantage of being platform and device agnostic.

Kik, the Canadian instant messaging company, whose user base includes nearly 50% of U.S. teenagers, opened in 2016 its own bot shop. Telegram, the most popular alternative to WhatsApp in the Western World, is also home to a broad number of bots, created just for fun or to offer a service.

Foursquare, the U.S. company that popularized the check-in concept, has understood that messaging apps are becoming the new platform, but uses its own support to achieve this, just like so many other companies do. In May 2016, the company launched Marsbot, to help users make plans through short and effective conversations.

But, what about the financial sector?

With so much going on, it was obvious that some people would start wondering about the financial sector’s potential to adapt this type of technologies to its own area of influence.

A recent study by Bain and Company found that the banking sector is one of the verticals with higher potential for process automation through the use of bots.

Currently, only 14% of loans in the sector are applied for through digital channels, and, in general, banks can handle just 7% of products digitally from end to end. According to some estimates, the implementation of task automation technologies could save up to 50% of the time workers devote to them.

The three areas showing greater potential for the implementation of these processes are account opening and customer service, regulatory compliance and mortgage management.

In the first category, the benefits of streamlining and improving processes have already been demonstrated, especially considering that bots can browse through different databases and information systems at the same time.

Regarding the automation of regulatory compliance processes, bots could dramatically save the time spent managing judicial notices and enabling a fast and simple way to gather and compare documents, relieving workers from these time consuming, tedious and recurring tasks, so prone to error.

Finally, mortgage management represents the most intensive process in terms of both documentary effort and workload. The digitization of the process allows banks to focus on customer experience, without having to worry about the errors that could hinder the process.