Francisco González: "The years ahead are going to be incredible for BBVA"

BBVA’s Board of Directors is in San Francisco to work first hand with experts and companies at the cutting-edge of change and transformation. Some of these companies are already working in close collaboration with BBVA, or are part of its ecosystem. BBVA Global Executive Chairman Francisco González analyzed the current status of the bank and the impact of technology on the financial sector, the economy and society.

- Question: Why is the Board meeting in San Francisco?

-Francisco González: San Francisco is the most important innovation hub in the world. We opened our office here back in 2011 and then we had two people, and now we have 90, and the number will keep growing over time. Our people here do an outstanding job and provide the Group with all the information needed regarding the innovation that is taking place. It is only natural that BBVA, which is leading the transformation of banking at a global level, holds its Board meeting here. The Board is going to work for four days, not only with the BBVA ecosystem, but also with outside startups, professors, and experts, that will enrich the transformation experience that the bank is going through. The week began with a meeting of the Board’s Technology and Cybersecurity Committee, which helps to define, supervise and monitor the Group’s technology strategy and technological risks - especially cybersecurity. It’s a busy week focused on transformation, our main priority.

- Q.: Where is the bank in its transformation process?

- A.: We are at a great moment. We have worked for 10 years on the strategy, on the platforms, and now we are on the delivery phase. We are providing our customers with loads of new functionalities, numerous apps. This is a journey that never ends. Transformation is always underway, the world keeps changing. We are also at an interesting time, combining the best banking talent with the best digital talent, creating a new breed of professionals that from BBVA will transform banking at a global level. All the work that has been done can now be implemented, at a time when customers are asking for innovative solutions and increasingly want to use their smartphones to engage with their bank.

- Q.: How does the transformation benefit customers?

- A.: Our top priority is user experience. Today, we have thousands of people across the bank using new ways of working to improve our apps and customer experience every quarter. There are many different things, like being able to activate and deactivate your cards on your cell phone, digitally sign a contract, knowing how much a house costs to negotiate better, thanks to big data; and more than 230 similar initiatives in one year. They’re little things that add up to a major improvement in user experience. That’s what we call in Spain the “revolution of little things.” And they’re available to anyone. Today, you can become a BBVA customer in Spain with a selfie. And the developments are going to be global. Our mobile payment app, BBVA Wallet, has been downloaded more than five million times. The response from customers has been spectacular, both in terms of growth and in use of channels. We have 17.2 million digital customers – 20% more than a year ago – 11 million of them use their smartphones for their transactions, an increase of 41%. In the U.S., 19.5% of sales take place on digital channels, compared to 9.3% in 2015. In Spain, this percentage has reached 16.5%, in Mexico it’s 15.4%, 15% in South America and 25.2% in Turkey.

"We have 17.2 million digital customers – 20% more than a year ago – 11 million of them use their smartphones for their transactions, an increase of 41%

- Q.: The bank has purchased some startups. How do these acquisitions fit in the bank’s strategy?

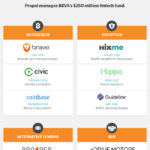

- A.: The transformation affects the entire Group. Part of this strategy means being actively involved in the fintech ecosystem. We collaborate with, invest in and acquire companies that complement our strategy and accelerate our transformation. These investments are relevant because of the opportunities they offer: entering in new markets, attracting talent and developing new business models. For example, in Europe, we bought Holvi and invested in Atom - the U.K.’s first mobile-only bank. In the U.S., we bought Simple, which has a user experience that sets it apart and has changed how people engage with their bank and their money. CEO Josh Reich has been working with the Board this week and Simple’s plans are very promising. Here in San Francisco we bought a design company, Spring Studio, and in Spain we incorporated Madiva, which focuses on big data. Design and big data are fundamental capacities to compete in the new environment.

- Q.: Do you plan to buy more startups?

- A.: For sure. In 2011 we started to buy startups and small stakes in digital companies. Those purchases and investments are now part of our ecosystem. At the end of the day, those investments are options that provide us with knowledge and experience, and we also help those companies. Change is accelerating everywhere and we gain more knowledge as time goes by, so of course we will continue to be very active in the startup world. Not only with fintechs, but also with companies that can cater to our customers’ needs.

- Q.: Which exponential technology could have the greatest impact on banking?

- A.: Big data, artificial intelligence, biometrics, blockchain – they will all impact banking. One technology that is really causing a paradigm shift is the cloud, as it multiplies processing capacity exponentially without having to spend a lot on physical assets that are often underused. Banking infrastructure will eventually be cloud-based. And it’s necessary because operational growth is exponential in the digital era. For example, BBVA currently manages up to 542 million transactions every day. In 2006, it was 90 million. We already have developments in a private cloud and we will continue to move ahead as supervisors adapt to new technological standards. Being in the cloud allows us to fully take advantage of all that data has to offer and the information data can produce for the benefit of people, their projects and their ideas. It allows us to be more agile, flexible, and efficient. And, of course, all this is done with the highest standards in security.

- Q.: What will the banking industry look like a decade from now? What role will BBVA have?

- A.: It will be very different. A new league of competitors is being formed and this new league will include some banks, startups that have managed to consolidate and online giants. New ecosystems will form and we will be at the center of one of them, helping people access the best products and services that exist. And the range of products and services will go far beyond financial products. We’re talking about eliminating complexity so that people can develop their projects and maximize their resources without having to be an expert in many different subjects. Customers will be the biggest winner in all this - that’s the era of transparency. It will be much more than just dominating exponential technologies. It’s about believing in transparency and working transparently, with no conflicts of interest because whoever fails to earn customers’ trust will not have a place in the new environment. We have been working on this for a decade now and the years ahead are going to be incredible for BBVA. Our mission is to bring the age of opportunity to everyone and that’s the path we’re going to follow.

- Q.: Technology can bring improvements, but there is growing debate over the impact the so-called fourth industrial revolution could have on employment. Is society ready for this change?

- A.: We are entering the fourth revolution and that means that we are going through very disruptive times, just as it happened with past revolutions. In the early stages a lot of disruption takes place, a lot of tension is created, and there are winners and losers in this process. Right now we are in a transition period, when more jobs are being destroyed than created. It is very important for the public sector to understand this transition period, and to the make the right decisions. And that means not impeding progress. There's no use in locking the stable door once the horse has bolted. Actions are required to protect those least favored in this process through this period, because clearly this revolution is going to lead to a better quality of life for humankind. Exponential technologies multiply the possibilities of what is possible at a much lower cost, making access more affordable for everyone. That’s why I think technology will help us create a better society. It’s very important that this process be grounded in values. Progress cannot be sustainable without values.