2023, the year the market recognized BBVA’s strong results

2023 has been a year in which BBVA has exceeded all expectations. It has been a very positive year both in financial and strategic terms, which has translated into a rise in the share price of over 40% so far this year¹. In terms of innovation, it is important to note the creation of a global financial crime prevention unit, as well as the integration of tech companies into BBVA Technology. Furthermore, BBVA Spark, the bank’s unit for innovative businesses, was launched in Mexico, Spain, Colombia and Argentina. BBVA is one of customers’ favorite banks in Mexico, Spain and Italy, and its mobile banking app in Turkey is used the most. From 2018 to September 2018, BBVA has mobilized €185 billion in sustainable business - 62 percent of the €300 billion target for 2025. For the fourth consecutive year, BBVA obtained the best score among European banks in the Dow Jones Sustainability Index (DJSI), the benchmark global index for sustainability. In relation to shareholder remuneration, in 2023 it has concluded two share repurchase programs, one of 422 million euros included in the ordinary remuneration for fiscal year 2022 and another of 1,000 million, as extraordinary remuneration to BBVA's shareholder distribution policy of between 40 and 50 percent of the bank's earnings.¹Statements about historical performance or growth rates must not be construed as suggesting that future performance, share price or results (including earnings per share) will necessarily be the same or higher than in a previous period. Nothing in this press release should be taken as a profit forecast.

DECEMBER 11th

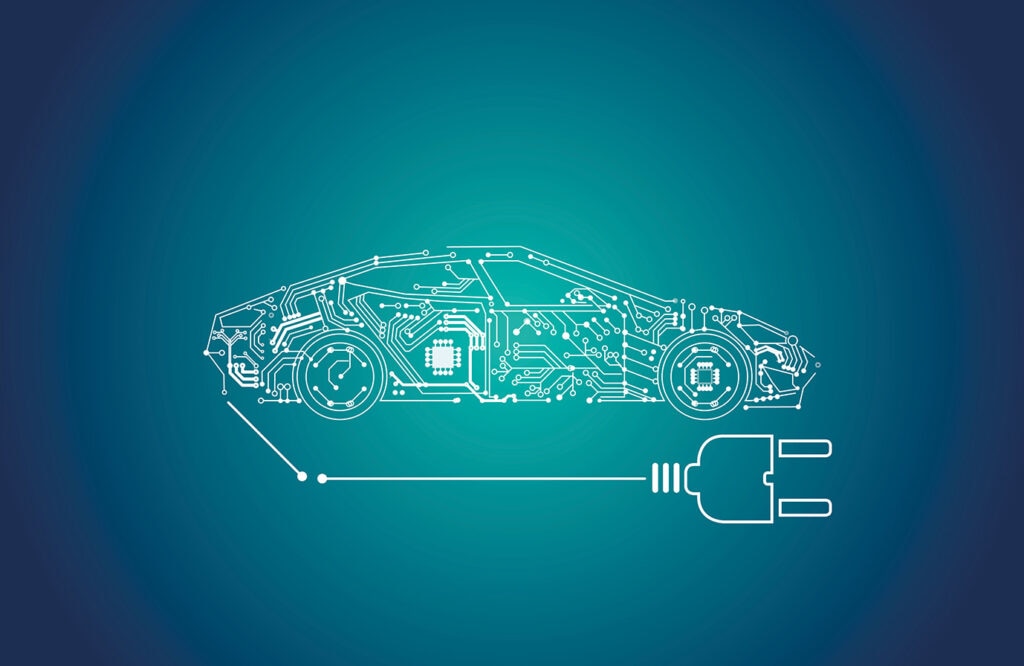

BBVA supports the development of a battery gigafactory in France by providing project finance to AESC

BBVA has led the project finance deal as mandated lead arranger and hedging provider for an electric vehicle battery gigafactory in France. The bank thereby supports AESC in the construction and operation of a gigafactory in Douai, France, adjacent to Renault ElectriCity's production plants. The Net-Zero Banking Alliance acknowledged this transaction in its 2023 Progress Report, unveiled at the COP28 summit.

DECEMBER 9th

BBVA partners with Metaco to enhance its crypto-asset service in Switzerland

BBVA Switzerland has signed a partnership agreement with blockchain company Metaco to host its digital asset custody service--a first in Europe--on the Harmonize™ platform. With this new partnership, the bank inaugurates a new stage in its crypto strategy. The deal also opens the door for BBVA to broaden its range of services in the future to better serve the needs of its institutional clients.

DECEMBER 7th

BBVA, Europe's most sustainable bank for the fourth year in a row, according to the Dow Jones Sustainability Index 2023

For the fourth consecutive year, the Dow Jones Sustainability Index (DJSI)¹ awarded BBVA the best score in the European banking category and, alongside other banks, the second highest rating worldwide. The DJSI is the world's benchmark index for sustainability. A total of 27 banks from around the world won a place in this year’s ranking.

NOVEMBER 29th

BBVA completes its special €1 billion share buyback program

BBVA successfully closed out the share buyback program launched on October 2, which reached €1 billion. Under the program, the bank repurchased a total of 127,532,625 shares at an average price of €7.84. The buyback is treated as a special shareholder distribution. It is in addition to BBVA's shareholder distribution policy of between 40 percent and 50 percent of the bank's earnings.