Corporate information

Letter from the Chair

Dear shareholders,

A year ago, in this annual letter, I shared with you our conviction that the year would bring us greater opportunities than the challenges that remained. 2023 was indeed a year of significant growth and attractive profitability for BBVA thanks to leading franchises in our main markets, the commitment of the team and our leadership in strategic pillars like innovation and sustainability. By growing profitably, we were able to expand the positive impact we have on society in all countries where we operate, creating opportunities for all of our stakeholders: approximately 72 million customers, over 121,000 employees and all of you, our nearly 800,000 shareholders.

Our loan portfolio grew 7.6 percent from the previous year. This made it possible for 140,000 families to purchase their homes, and 550,000 SMEs and the self-employed, and over 70,000 large companies to boost their businesses, thus contributing to job creation and fostering investment and social well-being. Furthermore, throughout the year we channeled over €15 billion in financing to projects that foster inclusive growth, such as financing for sustainable infrastructure, support for entrepreneurship, financial inclusion and social mortgages.

In 2023, we increased our customer base, adding more than 11 million new customers around the world, a pace that more than doubles the rate from five years ago. This enormous progression is the result of our pioneering, firm commitment to digitization, making it possible for 65 percent of new customers to join the bank on digital channels. Today, over two thirds of our customers interact with us on smartphones and we sell practically 80 percent of all units on digital channels. And even more importantly for us, our customers are more and more satisfied with the service we provide - a service that is essential for them. This is demonstrated by our Net Promoter Score (NPS), which has increased 11 percentage points in the past five years.

From a financial standpoint, 2023 was a very good year for BBVA. We posted our best results ever: €8.02 billion, a 26 percent increase over the net attributable profit in 2022. This progress is even more positive in terms of earnings per share, which rose 32 percent thanks to the share buyback programs that took place during the year. Yet another year, we are one of the top European banks in terms of profitability, with a return on tangible equity (ROTE) of 17 percent. Our ability to combine high profitability with significant growth in business and results is one of the aspects institutional investors found most remarkable following the 2023 earnings presentation. It clearly sets us apart from our European competitors in both aspects.

These excellent results lead us to propose to the Annual General Meeting the approval of a €0.39 cash dividend per share against 2023 earnings. Along with the €0.16 paid in October, it adds up to a total gross dividend per share of €0.55, 28 percent higher than in 2022. Furthermore, we will launch a new share buyback program in the amount of €781 million.

Taking these figures into account, we will have distributed nearly €13.2 billion to our shareholders since 2021. Once the new share buyback program has been executed, we will have redeemed 14 percent of our shares, with the corresponding positive impact on share prices.

Strong business performance also translated into significant value creation for our shareholders in 2023, with a net tangible book value per share plus paid dividends surpassing 20 percent for the year, a truly exceptional figure. Our share performance in 2023 was also very remarkable, with an appreciation in our share price of 57 percent (including dividends received throughout the year) - a figure that more than doubles the average of our competitors in Spain and Europe.

As I mentioned above, our profitable growth has also translated into greater contributions to society, beyond the positive impact on customers and shareholders. This is clearly reflected in the way our income is distributed. We use nearly 60 percent of our yearly income to pay the salaries of the over 121,000 employees that make up BBVA; pay suppliers, boosting the local economy; and for credit provisions to cover possible defaults. Of the remaining 40 percent, which represents the pre- tax profit, we allocate one third (€4 billion) to corporate taxes - a direct contribution by the bank to social well-being; another third (€4 billion) goes to shareholder distributions; and the final third (another €4 billion) is reinvested to boost future growth by lending to our customers.

Finally, in 2023 we also continued to make steady progress in our Community Commitment. This entails allocating €550 million between 2021 and 2025 to social initiatives to reduce inequality, create opportunities through education and support research and culture, together with our foundations. At the end of 2023, we had allocated over €410 million to this program - nearly 75 percent of our total commitment.

Looking ahead, we expect 2024 to be another year of growth for the global economy despite the heightened uncertainty. Tensions in the Middle East and Ukraine persist; it is an election year in several countries; and inflation remains high. In the financial sector, the normalization of interest rates will help banking activity to continue to grow, although it is predicted to do so at a slower rate than last year. In addition, we have confidence in the strength of the markets where BBVA operates. In Spain, we expect GDP to grow close to 2 percent. In Mexico, we are expecting a slightly greater growth, about 2.5 percent, benefiting from its strategic position in the integrated market with the U.S. and Canada (positive impact of nearshoring). The long-term potential of Turkey stands out due to its young population and geopolitical situation, as well as South America for its demographic trends and increased opportunities in access to banking services.

In this context, BBVA is in a strong position to take advantage of the opportunities related to innovation and sustainability - two key pillars of our strategy.

Our focus on innovation, which has been a hallmark of the bank for many years now, allows us to continue to identify the trends that are transforming the financial industry. We were pioneers in our commitment to the digitization of our business, thus setting the benchmark in the sector for using new technologies and data to offer better service to our customers. Our outstanding ability to anticipate will continue to be an advantage in fields such as artificial intelligence, which we already use in internal processes (reading documents, contracts and writing code). In 2024, we expect to also use it to advise our customers, including the use of generative artificial intelligence on the bank’s app. In line with this commitment, we created BBVA Technology in 2023, with the aim of further accelerating the Group’s capacity for transformation. We also added 3,800 new professionals to our team in the fields of data and engineering.

The other main pillar of our strategy is sustainability, which is becoming increasingly important. Decarbonization poses the greatest challenge that humanity has ever faced - a challenge that transcends borders and affects all sectors. All companies need to have emission reduction transition plans, so our priority is to support our clients in this transition with advice and financing. This transition will gain momentum with the innovation in cleantech technologies, which also explains why decarbonization is a unique opportunity for innovation and entrepreneurship. Just as we pioneered investments in fintechs to accelerate our digital transformation, we are now investing in cutting-edge cleantech funds to provide better advice to our clients and generate more growth.

Sustainability is proving to be a greater business opportunity than we imagined, and currently represents a fundamental pillar of growth for the Group. In fact, last year we channeled over €70 billion in sustainable business - double the amount from two years ago and over five times the amount from five years ago. Since 2018, we have mobilized nearly €206 billion in sustainable business, exceeding the pace required to reach the target of €300 billion by 2025.

As a founding member of the Net Zero Banking Alliance, the bank also has its own roadmap toward decarbonization with the commitment to be carbon neutral in emissions by 2050, including the emissions financed for our clients. Therefore, we established intermediate decarbonization targets by 2030 for the sectors with the greatest emissions: oil & gas, power generation, the automotive sector, steel, cement and coal and in 2023, we added two more: aviation and shipping.

For the fourth consecutive year, BBVA received the best score in the category of European banks in the Dow Jones Sustainability Index.

As you can see, our winning strategy focused on innovation and sustainability has made our major accomplishments in 2023 possible, and it will ensure that 2024 is another great year for BBVA - a year in which we expect to continue growing with high profitability, and contributing to social and economic development.

All of this was and continues to be possible thanks to the commitment and dedication of our team. I would like to thank them for their hard work day in and day out, and of course, all of you, our shareholders. Your trust and constant support drive us to continue working to make our purpose a reality: “To bring the age of opportunity to everyone”.

Letter from the Chief Executive Officer

Dear shareholders,

In an environment of uncertainty and gradual normalization of inflation, BBVA was able to produce its best results in history, once again demonstrating the strength of its diversified business model and the success of its strategy.

In 2023, BBVA’s net attributable profit rose to €8.02 billion thanks to the excellent performance of recurring revenue. Gross income, or the sum of the main sources of income from the banking business, ended the year with a year-on-year increase of 30 percent at constant exchange rates, i.e. without taking the impact of exchange rates into account.

The Group’s main geographic areas, Spain and Mexico, contributed to this growth with an improvement in customer spreads, benefiting from the high interest rate environment and a strict management of costs, and an increase in lending in Mexico, concentrated in the most profitable segments.

This increase in income, well above the increase in expenses, has made it possible to improve the efficiency ratio by 370 basis points in constant terms from the previous year, reaching 41.7 percent. Therefore, yet another year, BBVA continues to be one of the top banks in efficiency in our group of European peers.

Operating income, or the difference between revenue generated and costs incurred, stood at €17.23 billion, up 39 percent compared to the previous year, not taking currency fluctuations into account.

The NPL ratio remained stable at 3.4 percent while the coverage ratio slipped slightly to 77 percent. Impairment on financial assets rose 34 percent, mainly due to greater provision needs in Mexico and South America, particularly in retail segments. As a result of the latter, the cumulative cost of risk increased to 1.15 percent, in line with our expectations.

Yet another year, BBVA’s profitability metrics are well above the average of our European peers. In 2023, return on tangible equity (ROTE) reached 17 percent, compared to 15.2 percent in 2022, and return on equity was 16.2 percent in 2023, up from 14.4 percent the previous year. Value creation for our shareholders is also reflected in the tangible book value per share plus dividends, which reached €8.93, an increase of 20.2 percent from the previous year. This once again puts us ahead of our competitors.

These strong results helped the bank to reach an excellent capital position, with a fully loaded CET1 ratio of 12.67 percent, above supervisor requirements and the Group’s target range (11.5 percent to 12 percent).

In 2023, we made significant progress toward achieving the objectives established for 2024 at our Investor Day, and we expect to beat them by the end of this year. We will continue to focus on profitable growth and on being a unique bank for our customers, rooted in a value proposition that sets us apart.

Regarding the main business areas, I would like to underscore the following:

- Spain has benefited from GDP growth of 2.5 percent. This has made it possible to grow our loan portfolio in the most profitable segments: private companies and consumer loans. Profit for the area rose to €2.76 billion, up 47.5 percent from the previous year, excluding non-recurring impacts from 2022, thanks to a strong performance of revenue from the banking business.

- The situation in Mexico, with GDP growth of 3.2 percent for the year, helped to boost activity in all business segments, with total loan portfolio growth reaching 10.9 percent, not taking currency fluctuations into account. This greater momentum in business translated into very significant growth in recurring revenue, which more than offsets the increase in costs in a high inflation environment. BBVA obtained a net attributable profit of €5.34 billion in Mexico, 17 percent more than the previous year, not taking currency fluctuations into account.

- Turkey posted a net attributable profit of €528 million in 2023, 5 percent more than the previous year. This result was possible thanks to growth in commissions and fees and NTI, which helped to compensate for pressure on net interest income, as well as lower provisions. This result demonstrates the strength of our franchise in the country in a macroenvironment that continues to be complex despite the start of monetary policy normalization.

- In South America, lending rose 8.1 percent over the year, boosted by the retail portfolio, mainly due to the positive evolution of consumer loans and cards. The net attributable profit for the area was €613 million, 16.9 percent less than the previous year, impacted by the devaluation of the Argentine peso at the end of the year and the macroeconomic decline in Colombia and Peru.

In conclusion, BBVA’s significant strengths have allowed us to produce excellent results. First, our franchises are leaders in their respective countries, with market shares that position them among the largest banks in each case. Second, our results reap the benefits of our successful strategy. In fact, digitization has allowed us to grow in customers and to provide them with a better service. And being pioneers in sustainability has given us a great business opportunity, which we are already starting to benefit from. Furthermore, it is very important to stress that these achievements are only possible thanks to the best team, BBVA’s team. I would like to thank them for their hard work, dedication and commitment.

Finally, I would like to reiterate again this year my appreciation for all of you, our shareholders. Your support is fundamental for us to continue to lead the banking sector, and it encourages us to do our best each and every day.

History of BBVA

The history of BBVA is the history of many different people; people who have been a part of the more than one hundred financial institutions that have joined our corporate journey since it first began in the mid-19th century. Today at BBVA, we work to to bring the age of opportunity to everyone.

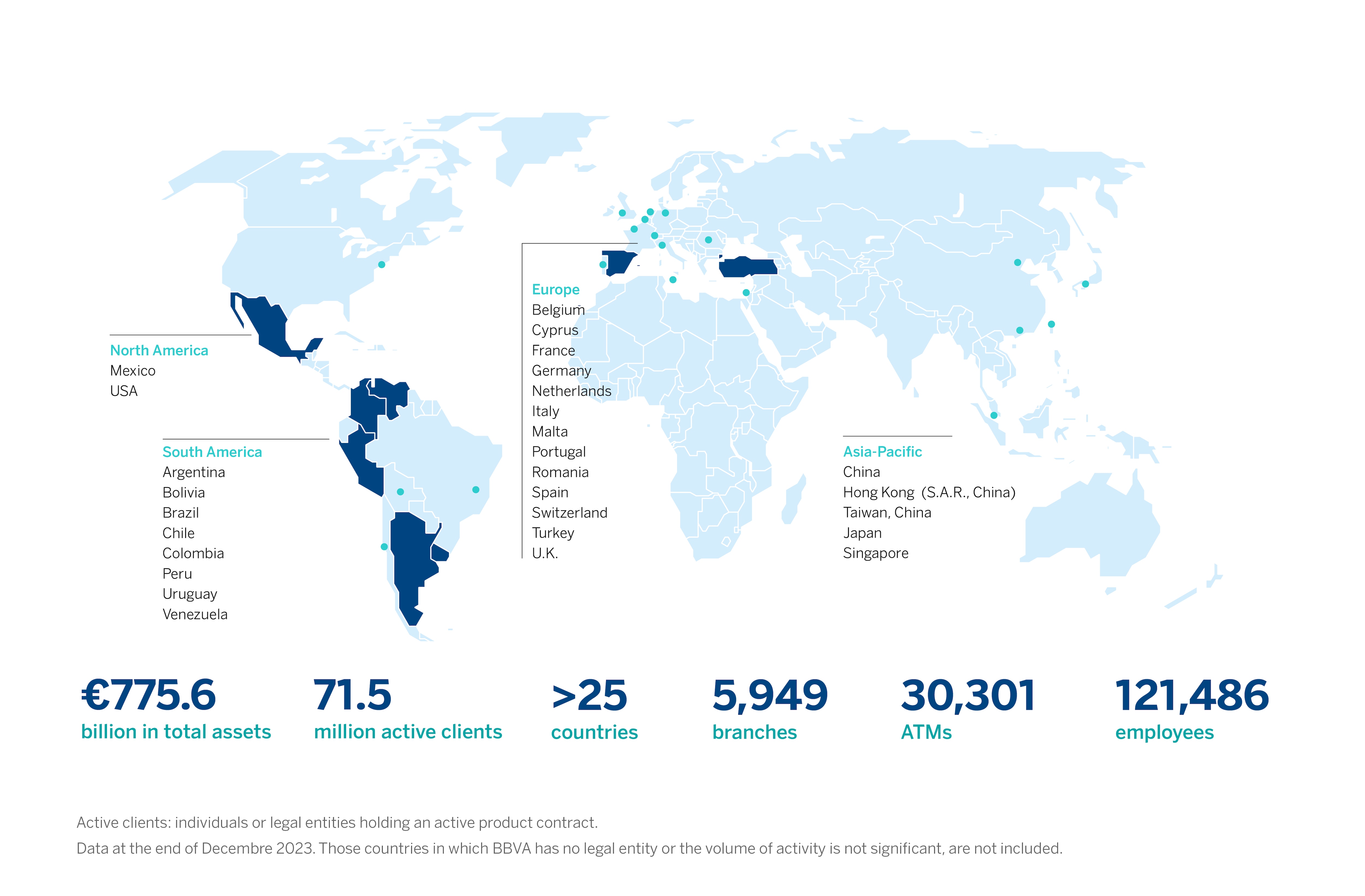

BBVA in the world

BBVA is a global financial services group founded in 1857. The bank is present in more than 25 countries, has a strong leadership position in the Spanish market, is the largest financial institution in Mexico and it has leading franchises in South America and Turkey.

BBVA contributes with its activity to the progress and welfare of all its stakeholders: shareholders, clients, employees, providers and society in general. In this regard, BBVA supports families, entrepreneurs and companies in their plans, and helps them to take advantage of the opportunities provided by innovation and technology. Likewise, BBVA offers its customers a unique value proposition, leveraged on technology and data, helping them improve their financial health with personalized information on financial decision-making.

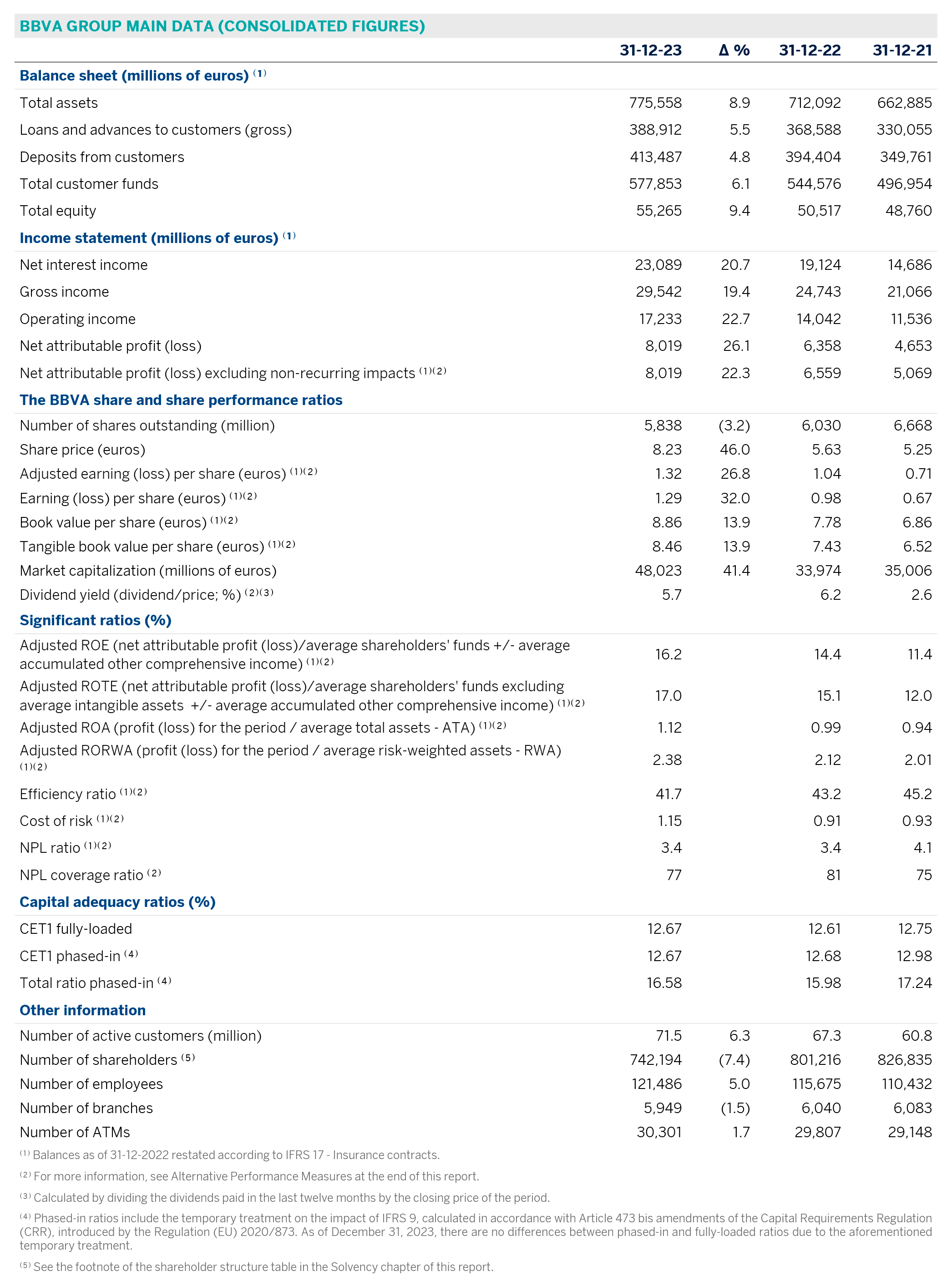

Basic data

Relevant data of the BBVA Group (consolidated figures) at 31-12-2023. This section contains all the updated quarterly figures on the balance sheet and income statement, and other relevant data.

More financial information is available on the Shareholders and Investors website.

-

-

Business Units Business Units

-

Javier Rodríguez Soler Sustainability¹ / Corporate & Investment Banking

-

David Puente Client Solutions

-

Jorge Sáenz de Azcúnaga Country Monitoring²

-

Peio Belausteguigoitia Country Manager Spain

-

Eduardo Osuna Country Manager Mexico

-

Recep Bastug Country Manager Türkiye

-

-

Global Functions Global Functions

-

Luisa Gómez Bravo Finance

-

Jaime Sáenz de Tejada Global Risk Management

-

-

-

-

Transformation Transformation

-

José Luis Elechiguerra Engineering

-

Carlos Casas Talent & Culture

-

-

Strategy Strategy

-

Victoria del Castillo Strategy & M&A

-

Paul G. Tobin Communications

-

Juan Asúa Senior Advisor to the Chair

-

-

Legal and Control Legal and Control

-

María Jesús Arribas Legal

-

Domingo Armengol General Secretariat

-

Ana Fernández Manrique Regulation & Internal Control³

-

Joaquín Gortari Internal Audit³

-

-

Organizational chart

BBVA Organizational chart

Organizational structure

BBVA’s organizational structure meets the objective of continuing to promote the transformation and businesses of the Group, while advancing in the delimitation of executive functions.

The Chair is responsible for the management and proper functioning of the Board of Directors, the supervision of the Group’s management, institutional representation, and leading the Group’s strategy and transformation process. Meanwhile the Chief Executive Officer (CEO) is in charge of the daily management of the Group’s businesses, reporting directly to BBVA’s Board of Directors.

Additionally, certain control areas (Internal Audit and Regulation & Internal Control) report directly to the Board of Directors through its corresponding committees.

Strategy

BBVA’s strategy is based on three global trends with a critical role in the transformation of the economy: digitization, innovation and decarbonization.

- Firstly, digitization. People's behavior continues to move not only to digital and mobile channels, but also to large value ecosystems offered by the main technology companies with a differentiated customer experience.

- Secondly, innovation. The role of new technologies continues to play a critical function in the transformation of the economy, with a great impact on growth and productivity. A true era of opportunities thanks to the new possibilities offered by new technologies such as artificial intelligence, quantum computing, cloud processing, blockchain technology, etc.

- Lastly, decarbonization is clearly a differential trend in the current environment and the greatest disruption in history due to its strong impact on the competitive dynamics of many sectors. Innovation plays a key role in the decarbonization process, a challenge that requires strong investments in new carbon-neutral technologies in all sectors, beyond energy. This challenge is of great importance today in a context that has shown that high energy dependence can be a strong vulnerability. Energy independence has become a priority beyond the fight against climate change.

Purpose and values

BBVA’s strategy revolves around a single Purpose: “To bring the age of opportunity to everyone”. Thanks to innovation and technology, BBVA seeks to have a positive impact on the lives of people and on the businesses of companies, providing access to products, advice and solutions that allow its customers to make better decisions about their finances and achieve their vital and business purposes.

Likewise, the Group is based on solid values: customer comes first, we think big and we are one team. These values and their associated behaviors are the guide for action in all decisions made by all the people who are part of the BBVA Group and help them make the Purpose come true:

The customer comes first

BBVA places customers at the center of its activity, before anything else. The Bank aspires to take a holistic customer vision, not just financial. This means working in a way which is empathetic, agile and with integrity, among other things.

- We are empathetic: we take the customer’s viewpoint into account from the outset, putting ourselves in their shoes to better understand their needs.

- We have integrity: we always act honestly, in accordance with the law and BBVA’s rules and policies. We do not tolerate inappropriate behavior and always put the customer’s interests first

- We meet their needs: we are swift, agile and responsive in resolving the problems and needs of our customers, overcoming any difficulties we encounter..

We think big

It is not about innovating for its own sake but instead to have a significant impact on the lives of people, enhancing their opportunities. BBVA Group is ambitious, constantly seeking to improve, not settling for doing things reasonably well, but instead seeking excellence as standard.

- We are ambitious: we set ourselves ambitious and aspirational challenges to have a real impact on people’s lives.

- We break the mold: we question everything we do to discover new ways of doing things, innovating and testing new ideas which enables us to learn.

- We amaze our customers: we seek excellence in everything we do in order to amaze our customers, creating unique experiences and solutions which exceed their expectations.

We are one team

People are what matters most to the Group. All employees are owners and share responsibility in this endeavor. We tear down silos and trust in others as we do ourselves. We are BBVA.

- I am committed: I am committed to my role and my objectives and I feel empowered and fully responsible for delivering them, working with passion and enthusiasm.

- I trust others: I trust others from the outset and work generously, collaborating and breaking down silos between areas and hierarchical barriers.

- I am BBVA: I feel ownership of BBVA. The Bank’s objectives are my own and I do everything in my power to achieve them and make our Purpose a reality.

Strategic priorities

Guided by its Purpose and values, BBVA's strategy is structured around six strategic priorities:

1 - Improving our clients’ financial health

BBVA aspires to be its customer's trusted financial partner, helping them to improve their financial health by offering personalized advice based on technology and the use of data.

Money management is one of the greatest concerns for people. BBVA wants to help its customers improve their financial health in two ways:

- On the one hand, by supporting them in the day-to-day management of their finances, helping them understand and be aware of their income and expenses, management of future needs, capacity to save, etc.

- On the other hand, helping clients to make the best financial decisions to achieve their vital and business goals in the medium and long term through personalized advice.

2 - Helping our customers transition toward a sustainable future

Climate change is a challenge that urgently needs to be addressed, but it is also a major business opportunity for the financial sector. The decarbonization of the economy will have an impact on all industries and on the way people move, consume or furnish their homes, requiring significant investments that will last for decades to come.

Additionally, the Bank has an opportunity in the development of inclusive growth. The current environment, with high digitization and use of data, makes it easier to provide an efficient service and with a better understanding of customer behavior. This environment allows the development of new business opportunities that favor inclusive economic development, supporting disadvantaged sectors and inclusive infrastructures, as well as mass banking leveraged on digital channels and new relationship models.

3 - Reaching more customers

Scale is increasingly critical in the banking business. BBVA aims to accelerate profitable growth, supporting itself through its own channels and where the customers are (in third-party channels).

In this sense, BBVA has identified the payments, insurance, asset management and cross-border business activities of companies as key drivers of profitable growth, as well as the value segments of SMEs and private banking.

The key role of innovation in the growth of BBVA implies the Group's firm commitment to new business models such as digital neobanks and the creation of BBVA Spark, that offers a comprehensive proposal of financial services to accompany companies innovative in its different phases of growth.

4 - Driving operational excellence

BBVA is committed to providing the best experience possible and is transforming its model of customer relations to adapt to changes in customer behavior. To do so, it provides access to its products and services through simple processes. The role of the commercial network is increasingly more focused on transactions of greater added value for customers. Interactions of lower added value are redirected to self-service channels, thus reducing unit costs and increasing productivity.

The transformation of the relational model is accompanied by a change in the operational model, focused on process reengineering in the search for greater automation and improved productivity, as well as speedy delivery to the market of new products and functionalities.

This is not forgetting disciplined management of both financial and non-financial risks and optimized use of capital key factors for consistently achieving a return higher than the cost of capital.

5 - The best and most engaged team

The team continues to be a strategic priority for the Group. A diverse and empowered team, with an outstanding culture, guided by the BBVA Purpose and values and driven by a model of talent development which provides growth opportunities for all.

BBVA works to promote the growth and training of the people who make up the Group, who have the necessary skills, knowledge and experience to achieve strategic objectives efficiently and effectively. Also to ensure that employees live the values and behaviors of the Group. People want to be part of companies that are inspired by purpose, with an engaging culture and values that foster diversity, inclusion, equality, social impact, and recognition of work.

6 - Data and technology

Data and technology are obvious accelerators to achieve our strategy. The commitment to developing advanced data analysis capacities, together with secure and reliable technology, allows the creation of outstanding high-quality solutions that help create competitive advantages.

The use of data and new technologies also generates the opportunity for increasingly global processes which can be used in the different geographies and are easily scalable.

Sustainable and responsible business model

In 2019, BBVA undertook a strategic rethinking process to further enhance its transformation and adapt to the key trends that are changing the world and the finance industry. Two of the primary trends identified are the fight against climate change and the growing importance of social inclusion. In this context, the strategic plan approved by the bank's Board of Directors in 2019 seeks to accelerate this transformation and the achievement of its purpose. The plan encompasses six strategic priorities, including "helping customers transition to a sustainable future" and "improving the financial health of our customers."

The fight against climate change poses one of the greatest disruptions in history, with unprecedented economic consequences. All actors in our global community (governments, regulators, companies, consumers and society in general) have to adapt to these changes.

The commitment to sustainability, responsible banking and the creation of long-term value for all stakeholders is reflected in the bank's various policies. Specifically, BBVA's Sustainability Policy sets out and establishes the general principles and main objectives and guidelines for the Group's management and control in the area of sustainable development. The policy seeks to achieve a balanced approach to economic development, social development and environmental protection.

BBVA has two key focuses of action in the sustainability domain:

- The fight against climate change and the protection of natural capital as drivers of the joint global effort to accelerate the shift to a net-zero emissions economy by 2050.

- Inclusive growth, where BBVA catalyzes change, thereby enhancing the well-being and economic growth of society, leaving no one behind and bringing the age of opportunities to everyone.

Based on these two focuses of action, BBVA has set three strategic sustainability objectives:

- Boost the growth of the Group's business through sustainability. Identify new opportunities, innovate by developing sustainable products and offer guidance to individuals and enterprises, while embedding sustainability risks in the Group's management processes.

- Achieve greenhouse gas emission neutrality. Reduce the Group's direct emissions and indirect emissions by helping customers to cut their own emissions, thus achieving net zero by 2050 at the latest, in line with the more ambitious goals of the Paris Agreement.

- Promote integrity in our relationship with stakeholders. Ensure a responsible relationship with our customers and suppliers, promote diversity and inclusion in our team, enhance transparency and encourage investment in the community.

The global Sustainability area is responsible for designing and supporting the execution of BBVA's strategic sustainability agenda and the development of business in this area, setting sustainability targets, and driving and coordinating the lines of work in this sphere conducted by the various areas. Therefore, implementing the sustainability strategy is a cross-cutting endeavour. It is the responsibility of all areas to progressively integrate sustainability into their strategic agenda and work dynamics. The area is responsible for raising awareness of BBVA's sustainability principles and aims while advising the executive units in charge of implementing them and ensuring that they are embedded in their activities and internal procedures.

Sustainable finance

Banks play a pivotal role in the fight against climate change and in achieving the United Nations Sustainable Development Goals, thanks to their unique position to mobilize capital through investment, lending, issuance and advisory functions. There are a number of key ways in which we can contribute to this challenge. First, by providing innovative solutions to customers to help them transition to a low-carbon economy and by supporting sustainable finance. Secondly, we systematically mainstream social and environmental risks into our decision-making.

For BBVA, sustainability is already a lever for growth. In November 2022, BBVA again raised its sustainable mobilization target to €300 billion between 2018 and 2025, a threefold increase over the initial target.

Commitment to the community

BBVA's 2021-2025 community commitment focuses on communities or groups in conditions of vulnerability, inequality or lack of protection.

The ultimate goal of the plan is to provide resources, tools and support to improve the lives of disadvantaged people and thus contribute to inclusive growth. We seek to ensure that the benefits of economic growth are distributed fairly across society, thereby creating opportunities for everyone and leaving no one behind.

In the period 2021-2025, BBVA and its foundations will allocate €550 million to social initiatives to support inclusive growth in the countries where it is present. This is the most ambitious social plan launched to date by the bank.

Through a range of initiatives, BBVA will support five million entrepreneurs, help more than three million people receive a quality education and train one million people in financial literacy. In addition, the BBVA Microfinance Foundation will provide more than €7 billion in microloans. In total, these programs are expected to reach 100 million people during this period.

The 2021-2025 plan strives to respond to the key social challenges in each region. BBVA's community commitment is complementary to its pledge to channel €300 billion in sustainable finance over the 2018-2025 period.

The 2025 Community Commitment addresses four areas of action: reducing inequality and promoting entrepreneurship; creating opportunities for everyone through education; supporting research and culture; and encouraging volunteering among employees:

Reducing inequality and promoting entrepreneurship

BBVA undertakes initiatives to reduce social and economic inequality and promote entrepreneurship. The bank also promotes the financial inclusion of unbanked communities, and improves the financial health and resilience of people with limited access to financial services or those who are underserved.

Such activities include: support for low-income entrepreneurs through the BBVA Microfinance Foundation and other programs to support entrepreneurs, training in financial literacy to empower the population, promotion of financial inclusion, employability and digitalization, and social assistance programs for Ukraine war refugees.

- BBVA supports vulnerable entrepreneurs through various initiatives. One of the key players in this regard is the BBVA Microfinance Foundation, which closed 2022 cementing its position in the microfinance sector and celebrating 15 years of activity in which it has served more than six million entrepreneurs in five Latin American countries. For the fourth consecutive year, it has been recognized by the Organization for Economic Cooperation and Development (OECD) as the leading foundation in terms of contribution to development in Latin America.

- Financial education and literacy: At BBVA we believe in the potential of financial literacy as a key driver to improve financial health and aid the transition to a more sustainable economy. The 2021-2025 Global Financial Education Plan aims to train two million people and reach 50 million people receiving BBVA content on this subject. The plan, deployed in all countries within BBVA's footprint, has three lines of action in financial education: for society, to support businesses, and to encourage collaboration. In 2008, the bank launched its first Global Financial Education Plan. From then until 2022, BBVA has offered training programs in financial knowledge and skills in all the countries where it is present.

- War in Ukraine: In 2022 BBVA launched a community response plan to Russia's invasion of Ukraine to help alleviate the effects of the humanitarian emergency triggered by the war.

Creating opportunities for everyone through education

BBVA offers a wide range of initiatives to promote access to high-quality education. This includes programs to reduce the digital education gap, scholarships for access to high-quality education, and programs for the development of values and skills and in support of higher education and vocational training.

In addition, the bank partners with public education systems to create free, high-quality content that is distributed through a range of channels.Key initiatives in the field of education included:

- Aprendemos juntos 2030, a project recognized by the United Nations for its contribution to the SDGs. The contents of this initiative are related to a greener and more inclusive future and include the involvement of leading international figures.

- Chavos que Inspiran: The BBVA Mexico Foundation focuses its activities on education through its flagship program “Chavos que Inspiran” (Kids who Inspire). This initiative aims to transform the lives of young people with limited resources through scholarships and mentoring for 10 years. As a result of this project, it is estimated that 8 out of 10 scholarship recipients will be the first in their families to graduate from university, rise above the poverty line and achieve a socio-economic level that would otherwise have been unattainable for four generations.

- Educación Conectada is an initiative launched in 2020 by BBVA and the Fad Juventud Foundation in Spain, which aims to reduce the digital divide in the education system by promoting the digitalization of the entire educational community, from school management and teachers to families and students.

Support for research and culture

BBVA develops, mainly through the BBVA Foundation (“BBVAF”), various initiatives to support researchers and creators in the fields of science, culture and business, cultural reference institutions and scientific dissemination. The direct promotion of scientific research is one of the levers on which the FBBVA relies, along with the recognition of talent through awards such as the BBVA Foundation Frontiers of Knowledge Award.

Volunteering

The bank's corporate volunteering initiatives promote the collaboration of employees to generate a significant social impact, increase pride in belonging, satisfaction and productivity, and position BBVA as a benchmark company in corporate volunteering, increasing its attractiveness to existing and potential employees.

BBVA’s Code of Conduct

The Code of Conduct establishes the behavioral guidelines that, according to the principles of the BBVA Group, ensure that conduct adheres to the internal values of the Organization. To this end, it establishes the duty to respect applicable laws and regulations for all its members in an integral and transparent manner, with the diligence and professionalism that correspond to the social impact of financial activity and to the trust that shareholders and customers have placed in BBVA.

The Code was approved by the BBVA Board of Directors on February 9, 2022.

BBVA's Whistleblower Channel

A fundamental mechanism to guarantee the effective application of the regulations and guidelines of the Code of Conduct is the Whistleblower Channel, through which not only BBVA employees, but also other third parties not belonging to the BBVA Group can can confidentially and, if they wish, anonymously report any conduct that does not adhere to the Code of Conduct or that violates applicable legislation, including human rights-related complaints.

The Compliance area will handle complaints diligently and promptly. The information will be analyzed objectively and impartially and the identity of the whistleblower will be kept confidential. Those who report facts or actions in good faith through the Whistleblower Channel will not be subject to retaliation or suffer adverse consequences for this communication.

This Channel allows you to maintain, if you wish, a dialogue with the Manager of your complaint. For this purpose, we have designed a system (secure mailbox) that will allow you to communicate with BBVA, preserving your anonymity at all times.

The Whistleblower Channel is available 24 hours a day, 365 days a year from any computer or cell phone.

If you observe or someone informs you of an action or situation related to BBVA that may be contrary to the regulations or the values and guidelines of our BBVA Code of Conduct, please report it through:

Submit report on Whistleblowing Channel

The Whistleblower Channel is not the appropriate channel for dealing with customer complaints.

BBVA’s tax strategy

BBVA’s corporate principles for tax issues and fiscal strategy, approved by the Board of Directors.

BBVA Due Diligence

Know more about our regulatory framework, financials reports, Corporate Governance and Corporate Integrity Models.