BBVA's strategy in 2020, a year marked by the pandemic that changed our lives

BBVA unveiled its new strategic priorities in early 2020, with a focus on accelerating and deepening the Group’s transformation. At the time, nothing seemed to indicate that the world would be struggling under a pandemic of this magnitude this year. These long term priorities were not changed, but rather reinforced by the COVID-19 outbreak. In the short term, BBVA has also focused on two lines of action: Safeguarding the health and safety of its customers and employees, and guaranteeing the operational continuity of the business.

In this context, BBVA took a step forward to help its clients and customers, and society as a whole, to cope with the crisis. In this sense, the bank rolled out initiatives across all countries where it has a presence to alleviate the financial burden of clients struggling the most under the impact pandemic and to support the economic recovery with financing.

BBVA also doubled down on its efforts to support society’s fight against the pandemic and made an initial donation of €35 million. Concurrently, it launched an employee giving initiative which raised two million euros. Finally, it launched several campaigns to encourage customer participation which raised a total of €9.3 million. The proceeds were used to purchase of medical equipment, especially ventilators, and also to support the most vulnerable social groups and scientific research on this disease.

As for corporate operations, the key milestone in 2020 for BBVA was the sale of its U.S. franchise to PNC. This operation will generate about 300 basis points of capital (about €8.5 billion), and will boost BBVA’s flexibility to invest profitably in its core markets and boost shareholder remuneration¹.

Once the pertinent regulatory authorizations have been obtained, BBVA Allianz Seguros – Allianz and BBVA’s new bancassurance joint venture has begun to operate in Spain. BBVA Seguros has contributed around 1.18 million insurance policies to the new company, representing approximately €300 million in premiums issued by the end of 2019.

Also, BBVA has been involved in supporting a lasting and more inclusive recovery, with sustainability as a fundamental pillar. This commitment is affirmed in the Group's strategy to support the transition to a low-carbon economy. In fact, just two and a half years after it announced its Pledge 2025, BBVA has already mobilized €40 billion euros in sustainable financing (40 percent of the total amount pledged). The bank has also showcased its commitment in Latin America, where it has built a market-leading sustainable product portfolio for its clients and customers. On the other hand, the bank’s strategy to fight climate change contributes to the achievement of the UN Sustainable Development Goals (ODS) and to add momentum to the Paris Agreement.

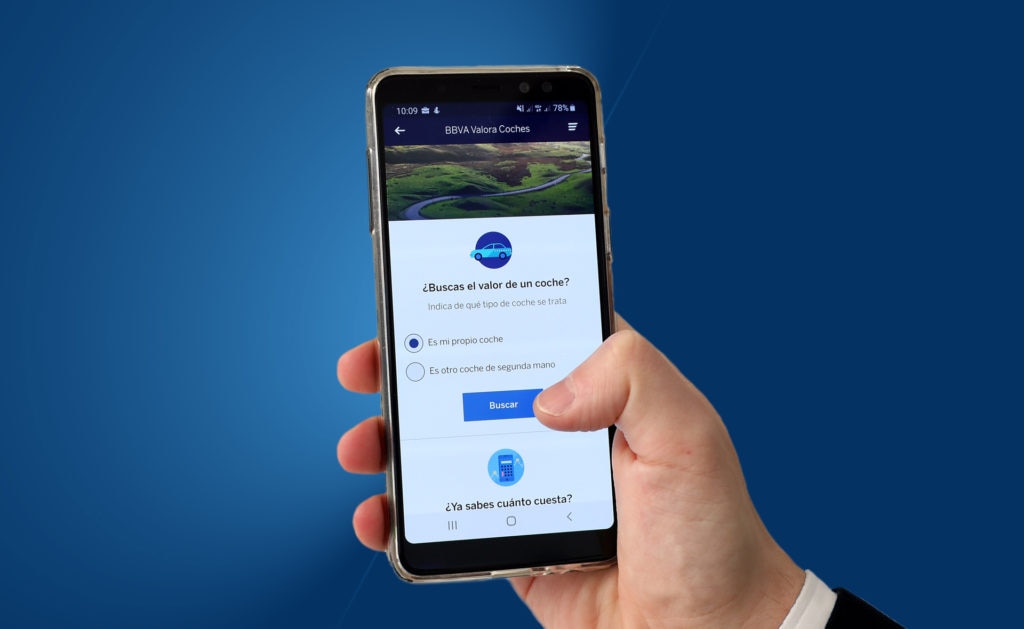

The pandemic has also expedited the digitization of financial services, an area where BBVA was already a pioneer. In 2020, BBVA consolidated its digital leadership: As of September, 62 percent of used digital channels to do their banking, and 57 percent used their smartphones to interact with the bank. Interactions through BBVA’s mobile apps increased by a factor of five compared to the previous year.

¹Any potential repurchase would never occur before the closing of the transaction, estimated in mid-2021. Any repurchase proposal: (i) would take into consideration the share prices, among other factors, and (ii) would require approval by the Shareholders and the Supervisor.

''We face 2021 with an unparalleled position of strength to invest in growth and to increase shareholder distributions''

BBVA Allianz Seguros, Spain’s new non-life insurance company

What does BBVA do for the sustainability of the planet?